Bloomberg is Investing in Market Infrastructure

Bloomberg is Investing in Market Infrastructure

Originally posted on www.bloomberg.com/bcause.

Bloomberg has always believed that bringing transparency to financial markets through access to information can increase capital flows, produce economic growth and create efficiencies for businesses. This idea revolutionized the bond markets in 1981, and, since then, we have expanded our efforts across asset classes to equities, derivatives, commodities and the broader financial markets.

Under the chairmanship of Mike Bloomberg, both the Sustainability Accounting Standards Board (SASB) and the Financial Stability Board (FSB) Task Force on Climate-related Financial Disclosures (TCFD) aim to bring market quality transparency on material environmental, social and governance (ESG) data to financial market participants.

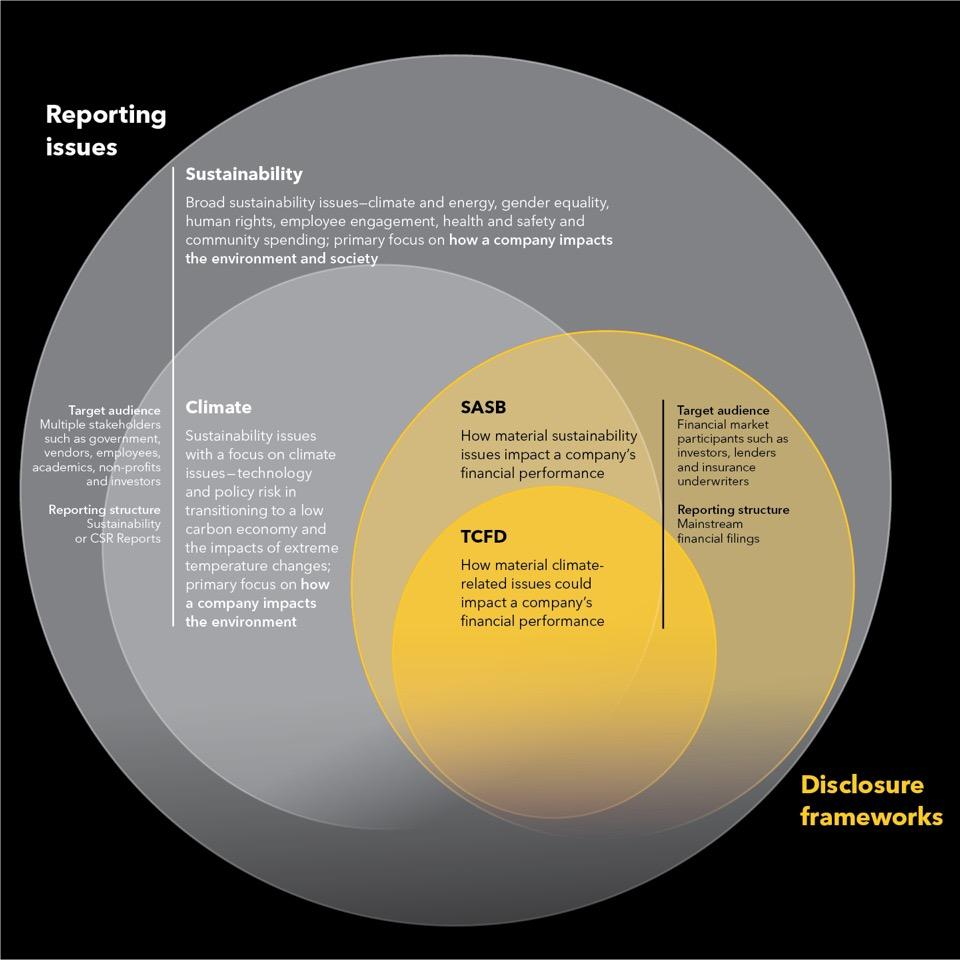

Bloomberg supports a number of different, multi-stakeholder sustainability reporting initiatives that cast a wide light on ESG performance and on an organization’s impacts on the environment and society. SASB and the TCFD are market-driven initiatives, targeting investors as the primary audience by focusing on how ESG factors impact an organization’s financial performance. The frameworks are interconnected; SASB focuses on a range of sustainability issues, whereas the TCFD concentrates specifically on climate-related risks and opportunities. They share the common goal of providing market-relevant, quality, consistent, comparable and forward looking sustainability-related data in mainstream financial filings. The data allows market participants to better assess and price sustainability related risks and opportunities. By leading these two complementary efforts, Bloomberg hopes to accelerate the adoption of ESG factors into mainstream investment decisions.

Bloomberg operates as a neutral intermediary between issuers and the investors who utilize the data to inform their decision-making. From this vantage point, we are uniquely positioned to help align the myriad of reporting frameworks and help address three core challenges:

- Issuer perspective: What can be done to streamline reporting and relieve some reporting fatigue?

- Investor perspective: How can we move towards generating information that is investment-decision useful?

- Market perspective: How can we minimize “market confusion” around different reporting-frameworks?

By aligning the TCFD framework and SASB standards on climate specific disclosure, we are developing a roadmap for further alignment on broader ESG issues and reporting frameworks.

To read Bloomberg's 2016 Impact Report, click here.