CSRHub Adds a New Major Source-- Ideal Ratings

As previously seen on CSRHub.com

March 21, 2017 /3BL Media/ CSRHub recently added a major new source to its pantheon of ratings partners—Ideal Ratings. Ideal Ratings seeks to provide ESG data to Socially Responsible Investors (SRIs). This is similar to the target market for our long-time friends at ET Global Indexes, IW Financial, MSCI, RepRisk, Thompson’s Asset4, Trucost and Vigeo EIRIS. However, Ideal Ratings has some features that differentiate it from these other sources:

- 40,000 company coverage. Ideal Ratings includes information on almost all of the 48,000 publicly-traded companies that CSRHub tracks. Only RepRisk (which currently rates more than 80,000 entities!) has broader coverage. Thanks to this new addition to CSRHub’s system, we will be able to continue expanding the number of companies we rate from our current tally of about 17,000 to at least 20,000, over the next few months.

- Comprehensive list of policy and disclosure indicators. We receive more than 300 different indicators from Ideal Ratings. This is comparable to the lists from Asset4, MSCI, and Vigeo EIRIS—although Ideal Ratings is more oriented towards tracking specific policies and disclosures than any of our other sources except Asset4.

- Extra depth on some special issues. Like many other sources, Ideal Ratings assesses how companies perform on issues that are of special interest to particular stakeholder groups. Ideal’s operations are in Egypt, so it is not surprising that it offers strong information on Sharia law issues. Ideal Ratings also tries to estimate the percentage of revenue from issues such as Nuclear Power, involvement in controversial regimes, and “sin” issues such as gambling and alcohol sales. This is similar to work that IW Financial also publishes.

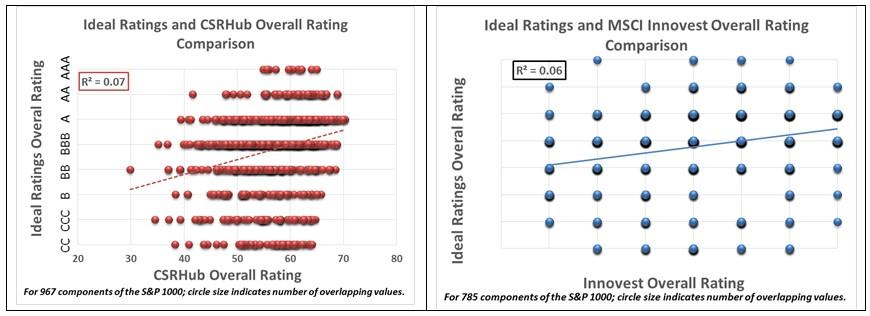

While Ideal Ratings offers “opinions” on the overall sustainability performance of the companies it covers, its views appear to be quite different from those of both other major sources (such as MSCI’s Innovest) and from CSRHub’s sources in the aggregate.

Of course, this different viewpoint does not mean Ideal Ratings is wrong or off track! Each of our sources shows similar differences with the others. We are happy to add the Ideal Ratings’ viewpoint to our system and encourage a company who would like to better understand how they are perceived by this source to reach out directly to Ideal Ratings or contact our team at CSRHub for a review of how their company is rated by all of our sources.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub provides access to the world’s largest corporate social responsibility and sustainability ratings and information. It covers over 17,265+ companies from 135 industries in 133 countries. By aggregating and normalizing the information from 525 data sources, CSRHub has created a broad, consistent rating system and a searchable database that links millions of rating elements back to their source. Managers, researchers and activists use CSRHub to benchmark company performance, learn how stakeholders evaluate company CSR practices, and seek ways to improve corporate sustainability performance.