Climate Tax’n’Cash Could Eliminate All Energy-Related CO2 Emissons by 2035, Study Suggests

Taxing all Greenhouse Gases, re-distributing 50% as cash-back to people and 50% invested in renewables could lead to rapid de-carbonisation

October 5, 2023 /3BL/ - The potential negative impacts of global warming have been known for ages. The heat-absorbing characteristics of CO2 in the atmosphere was first experimentally proven in 1856; the first calculations of how our climate could be affected by continued burning of coal/oil and gas were published in 1907. Famous and respected scientists have warned the World since the 1970s again and again of what is to come. 2023 has seen temperature and climate anomalies on all levels – heat waves, droughts, interrupted by torrential rain and floodings of biblical proportions, all around the globe. Net-Zero by 2050, the stated target of the Paris Agreement that was supposed to keep our planet below 1.5 C warming, is already out-dated – September 2023 locked in at 1.8 C warming. It is only a question of time before harvest of staple foods will be seriously affected.

Yet – on the policy level all there is are “calls”, “pledges”, and “targets” that should be achieved somehow sometime in the future.

There is still no plan, no roadmap, no concept for financing.

Global warming/climate change is a market failure - the true cost of the product is not included in the price. Changing climate change therefore seems best tackled through market instruments: taxes on CO2 and all other GHGs. The problem with this approach is that energy intensive products/services will become less affordable for the lower income segments: there needs to be some kind of a compensation: a cash-back.

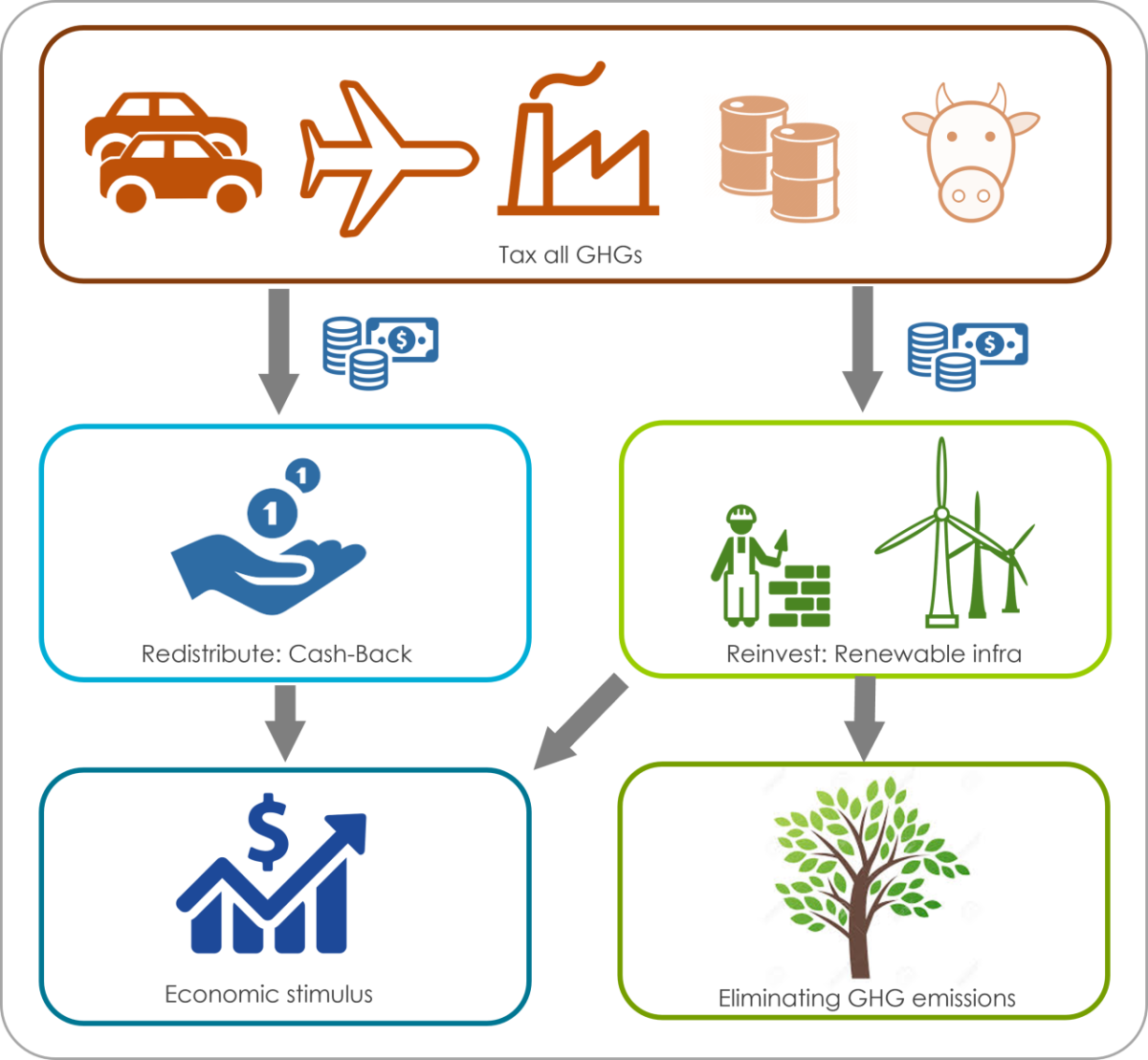

The study, conducted by SolAbility, examines the impacts on energy usage, technology deployment, carbon emissions, and on the economy through a computed simulation under a scheme that would tax CO2 and GHGs, redistribute 50% of the tax revenues in cash to the people, and re-invest the other 50% in building a renewable energy infrastructure - Global Climate Tax'n'Cash

- All GHGs are taxed at the same rate, in every country, at the point of final sale (like a VAT);

- The tax starts at U$ 100 per ton of CO2e, increasing by U$100 every year to give the economy time to adapt.

The global climate tax revenues are used as follows:

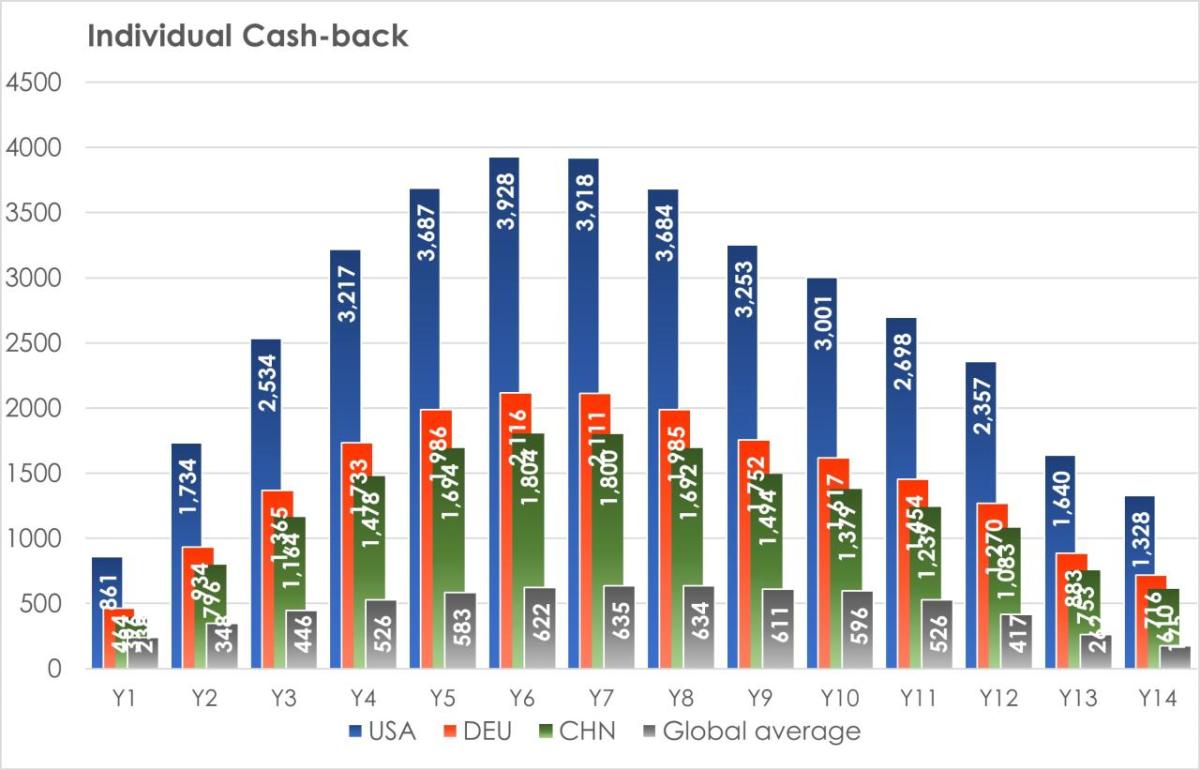

- 50% of the climate tax revenues are directly re-distributed to the people, equally per person (including children);

- 40% of climate tax revenues invested in the renewable infrastructure – electricity generation, grids, storage, public transport, and the replacement of fossil-fuelled equipment;

- 7% for reforestation, mitigation, and adaption;

- 3% in a global fund in support of the lesser developed and most affected countries.

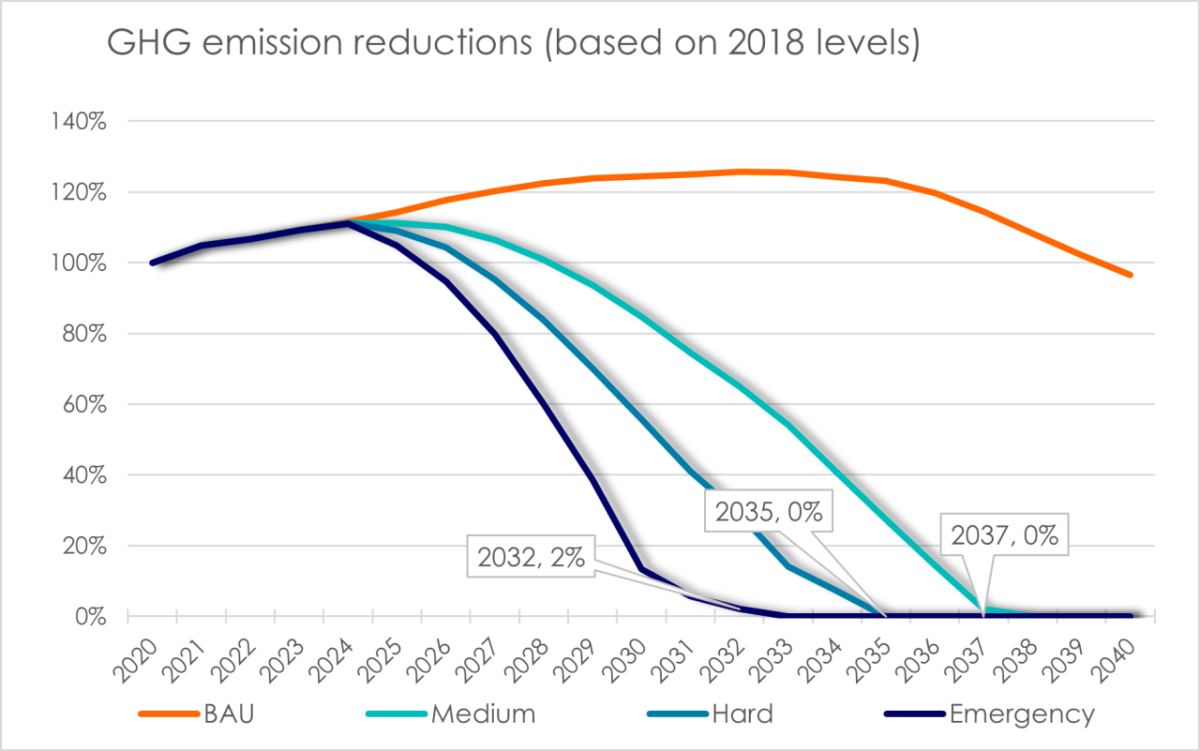

The simulation of a global climate tax shows that

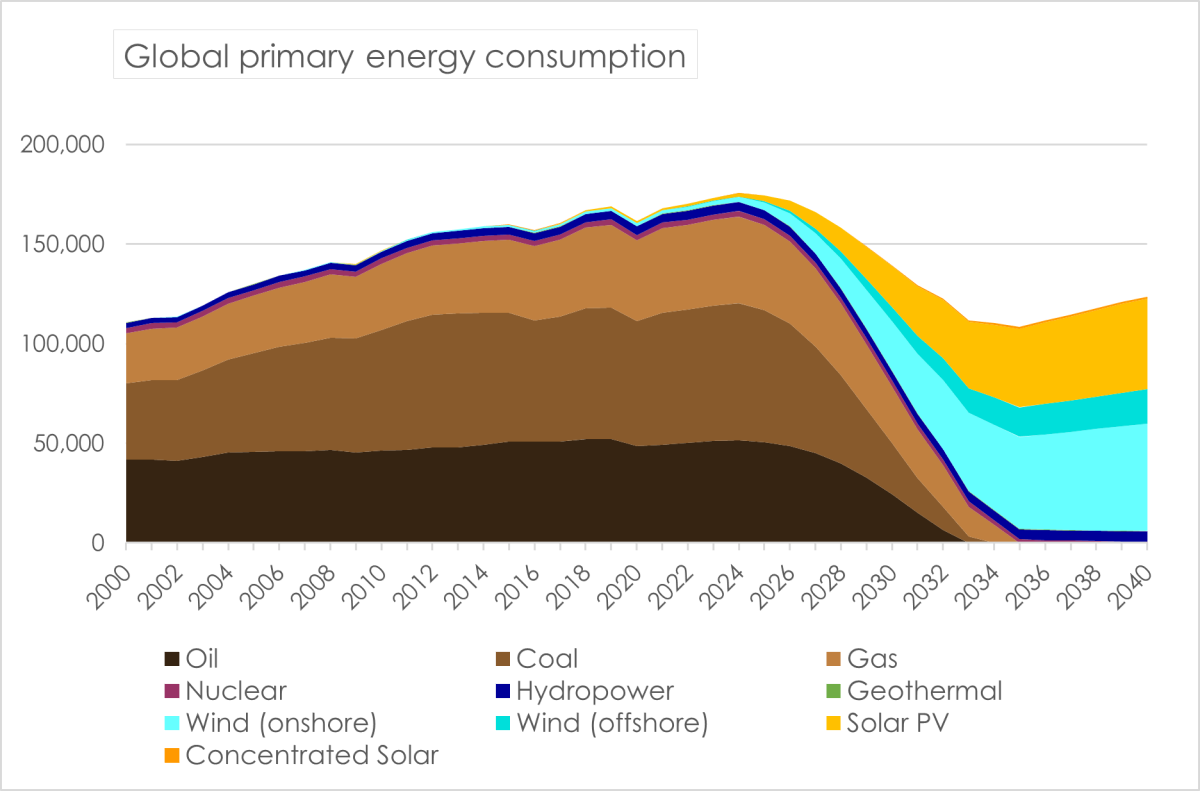

- There will be more than enough renewables installed to replace all fossil energy by 2035 – not Net-Zero, but Real-Zero;

- Global energy costs are reduced by 50% due to lower cost of renewable electricity and higher efficiency of electric appliances;

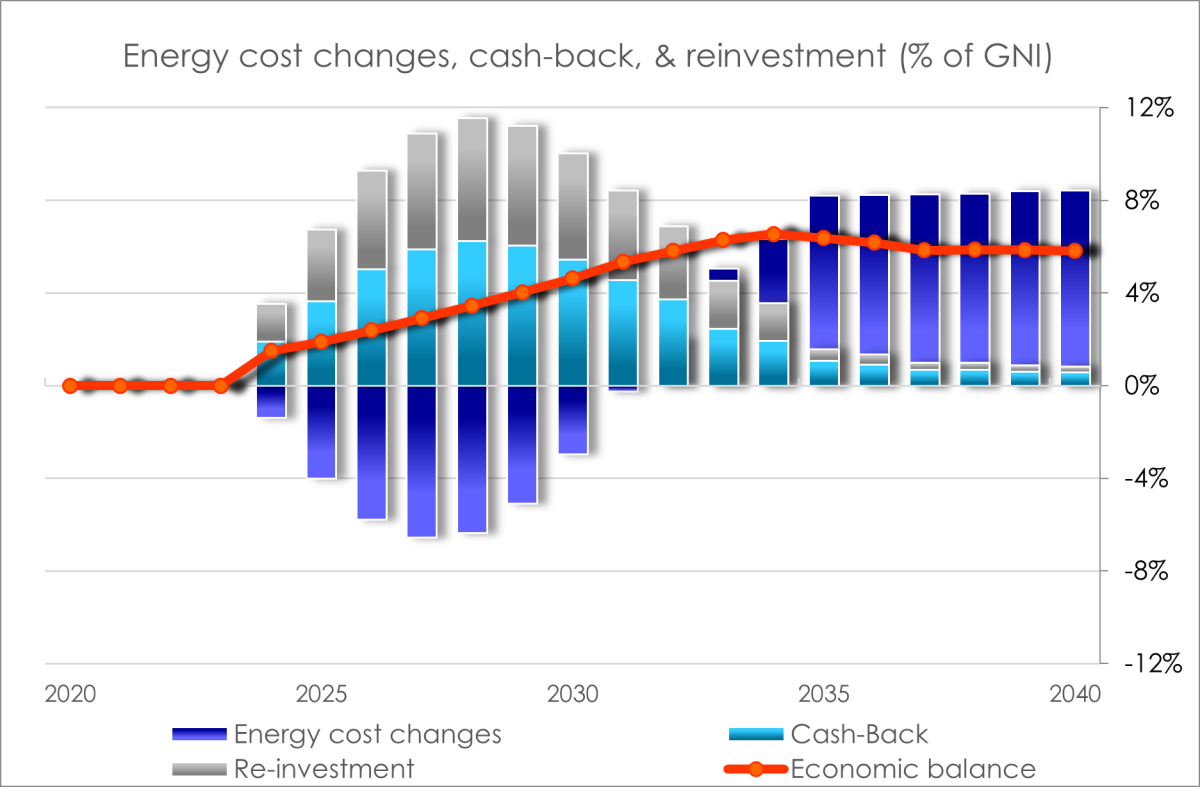

- Thanks to the cash-back, between 50% and 70% of the population will have more cash in their hands (even accounting for rising costs), boosting local businesses and the economy

- Due to the cash-back and the re-investment of the tax revenues, global climate tax'n'cashwould have net-positive impacts on the global economy right from the start, and save the global economy betweeen 2-3% of GDP in energy cost.

We already have the technology needed for an energy transition. The new technologies are more efficient, and cheaper. Unfortunately, there is no political vision and courage to start financing the transition. For reasons that are somewhat difficult to comprehend, a global climate tax seems as politically illusionary as it is economically viable.

For more information, please visit www.climatax.org