Despite Hurdles, Vehicle Electrification in the US Is Likely Here to Stay, Finds Bloomberg Intelligence

Originally published on bloomberg.com

- The BI survey indicates that 42% of buyers likely to opt for EVs for their next purchase

- Charging obstacles and affordability remain the largest hurdles to incremental adoption of battery EVs, albeit temporarily

- BI expects US Battery EV penetration to reach 25% by 2030

NEW YORK, April 18, 2024 /3BL/ - Electric Vehicles (EVs) continue to pick up major traction in the US, with adoption continuing to accelerate even amidst growing challenges with charging infrastructure and overall affordability. A new survey from Bloomberg Intelligence (BI) found that despite these hurdles to growth, US battery electric vehicles (BEV) penetration is likely to reach 25% by the end of the decade.

The survey, conducted with 1,000 prospective auto purchasers, found that 42% of respondents were considering purchasing an electrified vehicle as their next car, with 23% opting for hybrid electric vehicles, in contrast to the current 7% penetration in hybrid electric vehicles. 9% of those surveyed favoring battery EVs, which is higher than the 7% battery EVs penetration last year.

BI’s research shows that prospective auto purchasers who already own an electrified vehicle are incredibly loyal to BEVs, with the report finding that 93% would stick with their current powertrain for their next purchase, compared to 34% of gasoline vehicle owners who are deciding to opt for an electric car. Fuel-type stickiness suggests that EV penetration is unlikely to reverse course as the benefits to an electric vehicle could continue to outweigh costs to current owners; and this continuous preference for EVs is consistent across HEV, PHEV, and BEV owner segments.

Steve Man, Global Lead Director for Auto & Industrial Market Research at Bloomberg Intelligence and the lead author of this report said: “We’re continuing to witness a profound penetration of BEVs in the US auto market, which promises to reach 25% by the end of this decade. Tesla, GM and Stellantis’ slew of affordable EV models, set for debut by 2026, may tap more mass-market buyers. Despite this, the market still has a long way to go to mature, with charging network inadequacy, range anxiety and extended charging wait times topping the list of concerns for all car buyers. China, a country with a 23% BEV penetration, has an average charge point per BEV almost 5 times higher than the U.S., signaling a critical need for charging infrastructure development in the country to bolster the technology’s penetration in the US auto market.”

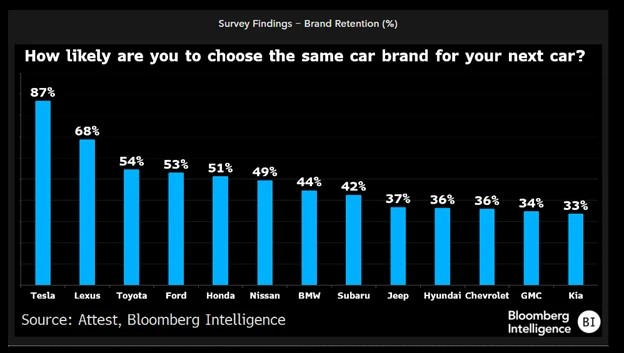

Tesla still maintains an 87% brand retention rate, outperforming two non-electric automakers at 67% with Lexus and 54% at Toyota. 81% of prospective Tesla buyers are new customers switching from competing EV brands compared to 42% of Nissan’s prospective buyers.

Traditional driving preferences and trust in technology is slowing down wide adoption of Advanced Driving Assistance Systems (ADAS). Close to 80% of potential users, who would opt out of autopilot technology, remain skeptical about the reliance and safety of self-driving systems. Consumer preference for the fun of driving and a sense of being in control also rank highly in resistance to ADAS.

BI’s survey on auto-buying intentions in United States was carried out on Mar. 18-25, using the Attest platform. The target audience of 1,000 adults was selected using criteria specified by BI to reflect a nationally representative sample of geography and gender. Respondents qualified if they were planning to buy or lease a brand new car in the next year. The survey’s confidence interval is 99% and margin of error 5%.

The full 2024 US Auto Electrification Survey will be available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Contact

Oktavia Catsaros

Bloomberg Intelligence

ocatsaros@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of over 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and more than 600 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.