Electric Vehicle Trends and Challenges for Industrial Real Estate

Industrial real estate investors should understand and prepare for the needs of the electric vehicle (EV) sector as growth sharply accelerates.

Key Takeaways

- Demand for EVs is increasing the need for manufacturing facilities, assembly plants and distribution centers across North America.

- Tax incentives and government grants and subsidies are being offered to encourage the expansion of EV operations and investment in new facilities.

- EV manufacturing facilities require unique specifications, features and geographies.

- Demand for power and specialized technicians is expected to outpace supply, which could constrain the industry’s growth. Meeting corporate decarbonization commitments amid supply chain strain is another challenge.

Introduction

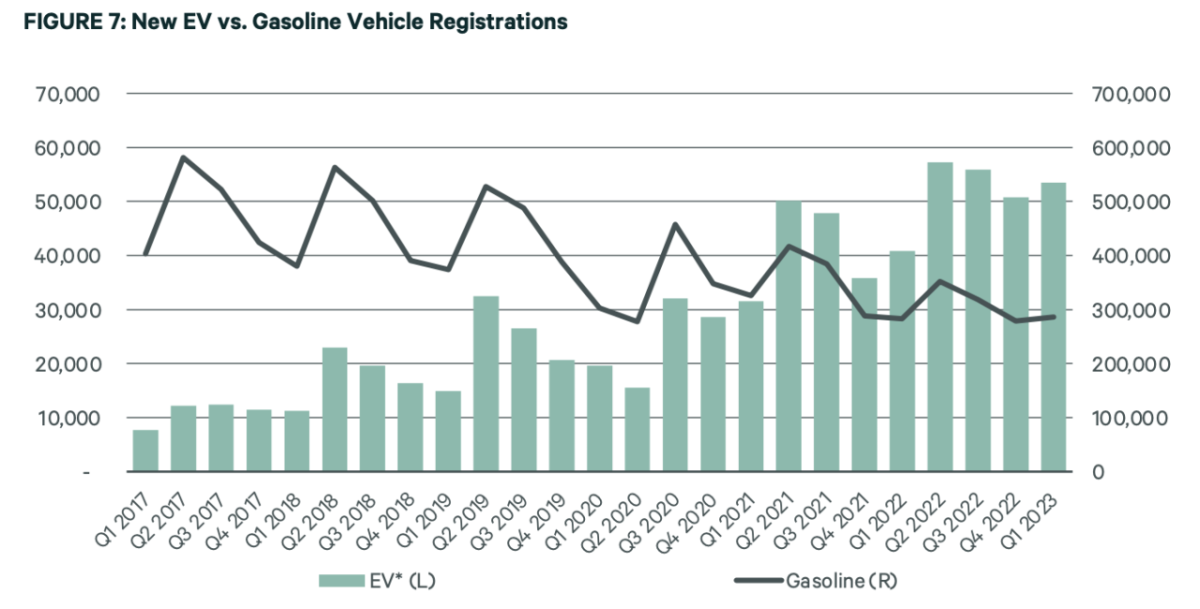

EVs are now more popular than ever, with significant growth still ahead. There are over 3 million EVs on U.S. roads today and 26 million are projected by 2030, according to the Edison Electric Institute (EEI). EVs accounted for 7.2% of U.S. new car sales in Q2 2023, up from 5.7% a year earlier. Domestically, the industry is projected to generate US$77.7 billion in revenue this year and grow 18% per year to approximately US$177.2 billion by 2028, according to Statista Market Insights.

Multiple factors are driving this EV demand surge:

Environmental Benefits:

Pure electric cars do not directly produce carbon dioxide emissions, greatly reducing air pollution. Two-thirds of Americans want to reduce their impact on climate change and nearly three-quarters want to use less gasoline, according to a 2023 survey by the Energy Policy Institute at the University of Chicago.

Availability and Affordability:

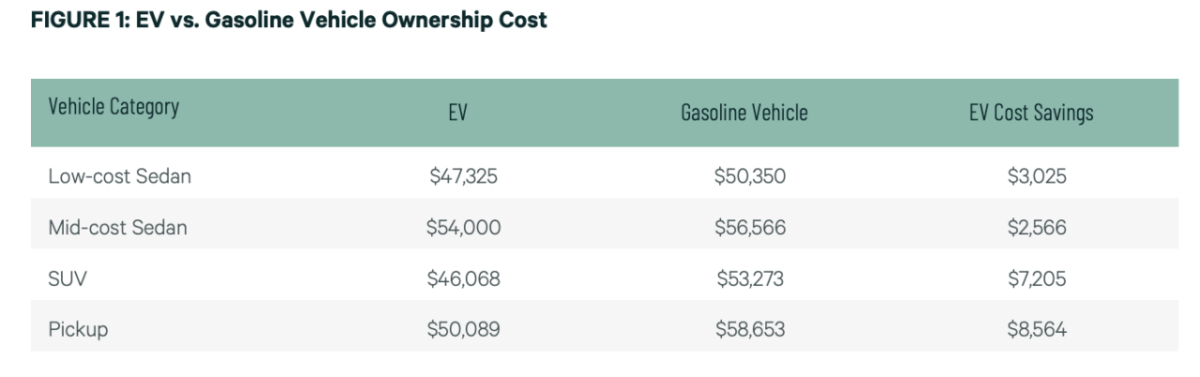

On average, EVs cost less than traditional gasoline vehicles, considering purchase price minus resale price, fuel, insurance, taxes, fees, maintenance and repairs. Federal tax credits for certain vehicle models often provide further cost savings.

U.S. Government Policies and Incentives:

- The federal government set the goal of zero-emissions by 2030 for half of all new vehicles sold domestically.

- The Clean Vehicle Rebate Program offers up to US$7,500 for qualifying EVs. This program began April 2023.

- The 12% federal excise tax on zero-emission trucks has been suspended, as a purchase incentive.

- The State of California’s Advanced Clean Cars II rule mandates that all new cars and light trucks sold in the state will be 100% zero-emission vehicles by 2035. It is the U.S.’s leading state for EV and plug-in hybrid registrations per thousand people.

EV Production Rises to Meet Demand

Automotive Manufacturer Landscape

There were 94 Original Equipment Manufacturer plants producing automobiles and trucks across North America at the end of 2022. There were 55 plants in the U.S., 30 in Mexico and nine in Canada.

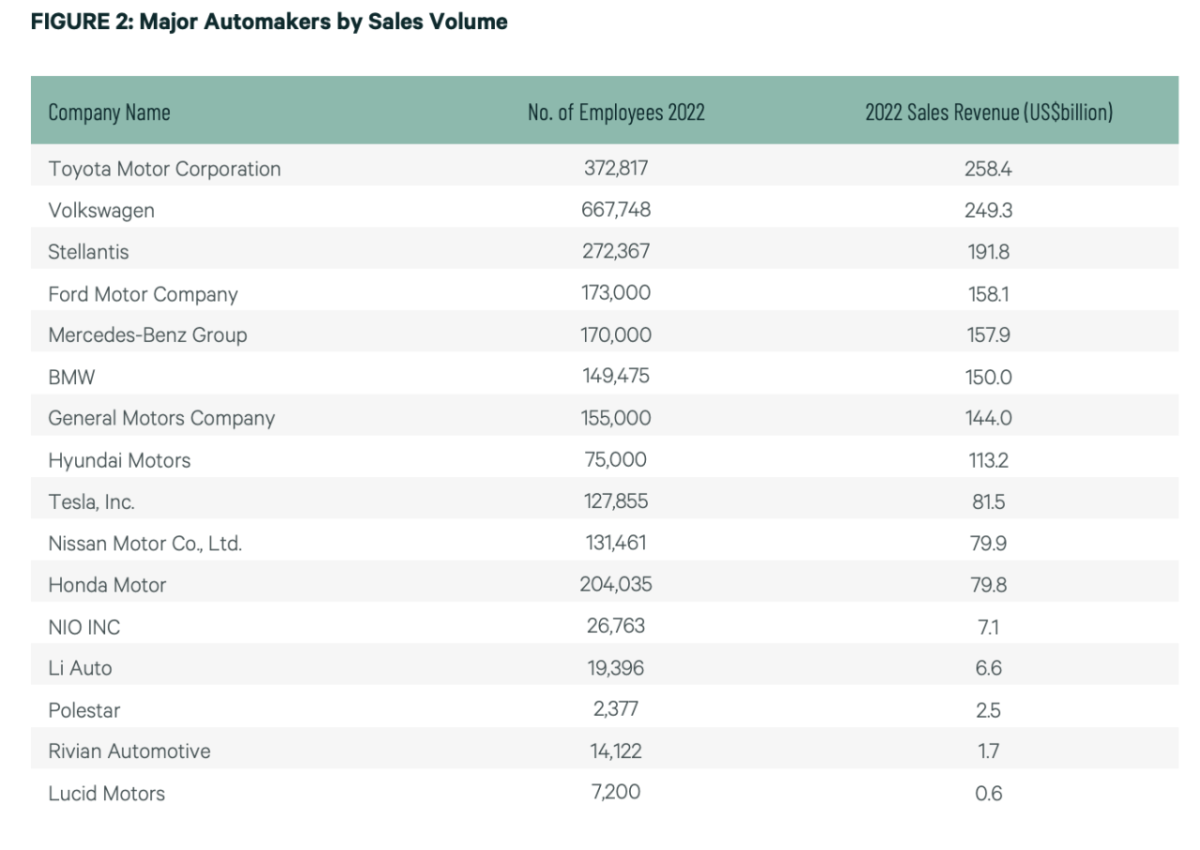

Traditional major automotive manufacturers such as Ford, General Motors and Hyundai are increasing EV production. However, Tesla produces the most EVs in the U.S., having delivered a record of more than 466,000 EVs in Q2 2023.

Other notable EV automakers include the publicly traded California-based firms Rivian and Lucid Motors. Rivian, founded in 2009, recently announced Q2 2023 production volume set a company record, at nearly 13,000 EVs. The company is pacing to produce 50,000 vehicles by year-end. Lucid Motors, a luxury EV manufacturer founded in 2007, plans to build its first overseas manufacturing plant in Saudi Arabia. The Saudi government, an investor, committed to purchase up to 100,000 Lucid automobiles over the next 10 years.

Investments in EV Manufacturing

Vehicles

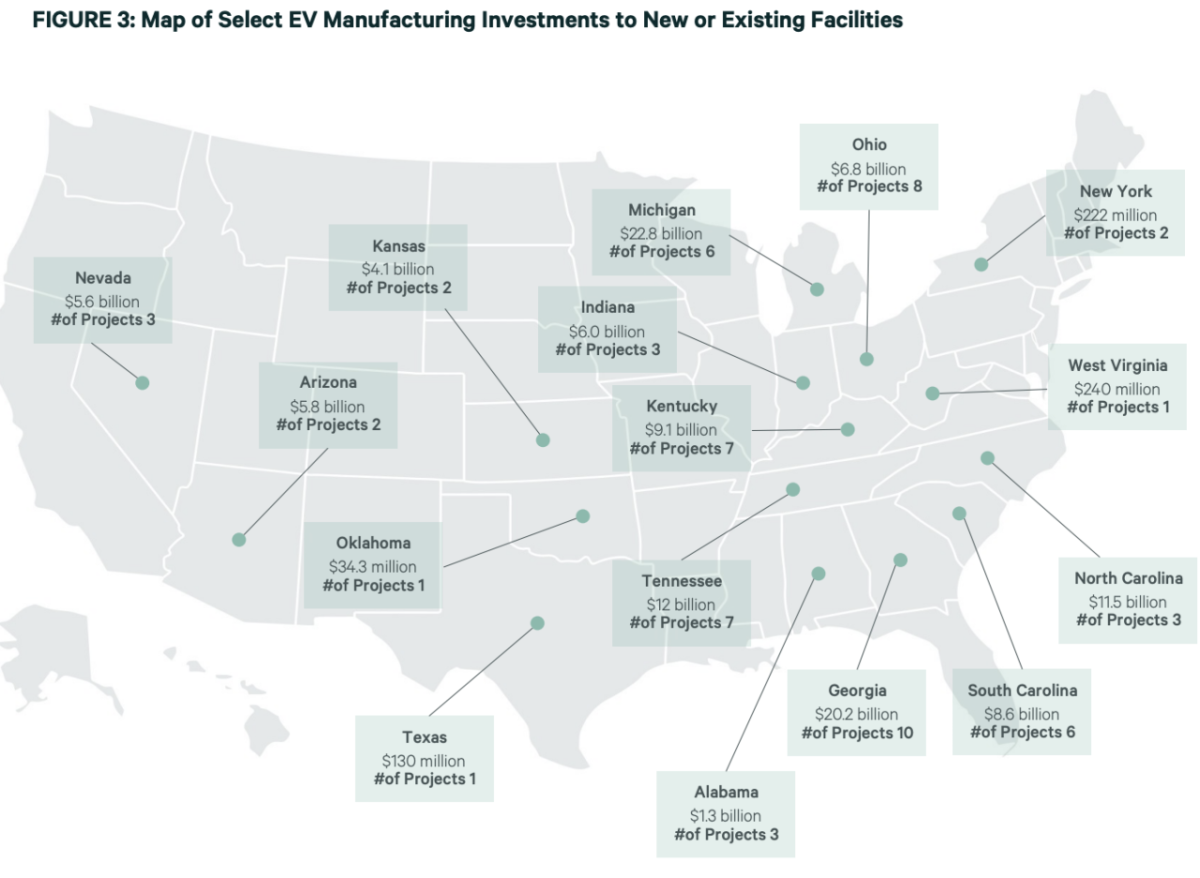

Most major automotive manufacturers are now developing EVs and ramping up production with multi-billion dollar EV facility investments throughout the U.S. As of May 2023, there were nine Ford EV facilities collectively valued at US$18.7 billion and 11 General Motors EV plants collectively valued at US$14.6 billion under construction. Many EV plants are located in the South: Alabama, Georgia, Kentucky, North Carolina, South Carolina and Tennessee are home to over US$64 billion of EV development investments. The Midwest has projects valued at about US$33 billion, under construction in Indiana, Michigan and Ohio. The construction of these plants creates the need for nearby distribution centers to store and distribute automobile components.

Charging stations

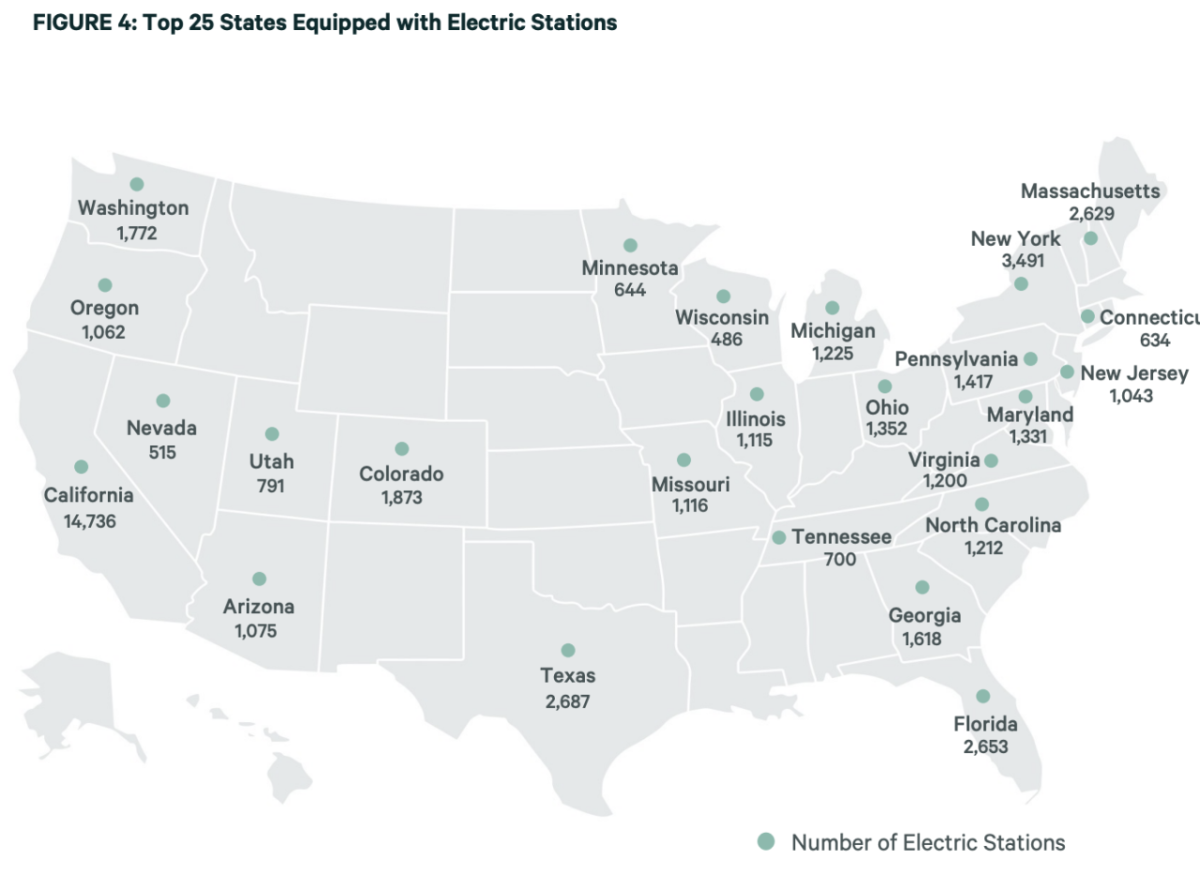

- In Q2 2023, BMW, GM, Hyundai, Kia, Mercedez-Benz and Stellantis announced a joint investment of at least US$1 billion to build nearly 30,000 fast EV chargers on major highways and other areas across the U.S. and Canada over the next few years. Currently, there are about 54,600 charging stations in the U.S. and about 20,900 in Canada.

- Siemens opened its second U.S. EV charging manufacturing hub in Dallas-Ft. Worth this year. The company plans to produce one million EV chargers to support the U.S.

- As of August 2023, the most Alternative Fueling Stations (AFSCs) are in California, at just under 15,000 public stations, according to the U.S. Department of Energy. New York has the second most, with nearly 3,500, and Texas is in third with close to 2,700.

Batteries

- Panasonic is investing approximately US$4 billion in its lithium-ion battery plant under construction in DeSoto, Kansas. Completion is scheduled for early 2025.

- Ford will invest US$3.5 billion in a 2.5 million sq. ft. EV battery manufacturing plant in Marshall, Michigan. The lithium iron phosphate battery plant will employ roughly 2,500 employees and is scheduled to be operational by 2026.

Semiconductors

- Semiconductors are used in many electronic devices, including EVs. They power numerous electric mechanisms in the EV manufacturing process by controlling the flow of electricity and providing conductivity changes based on the environment. Companies such as U.S.-based Micron are investing up to US$100 billion for a new megafab in Clay, New York to build the U.S.’s largest-ever semiconductor fabrication facility. The microchip factory would aid in components for EVs and other chip-related industries.

- Taiwan Semiconductor Manufacturing Company (TSMC) made a substantial investment of US$40 billion to construct two semiconductor fabrication plants in Central Arizona.

U.S. Leasing Activity

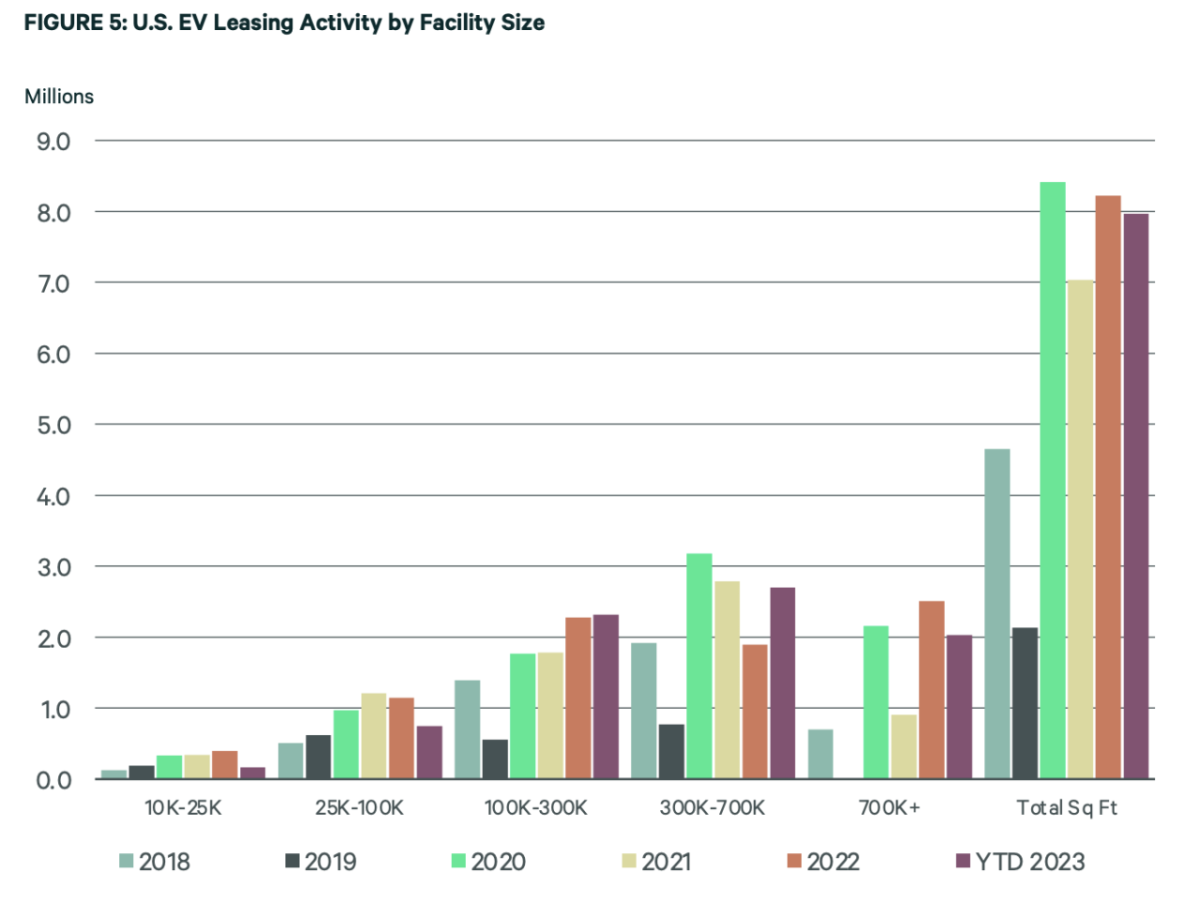

While many EV manufacturing plants are owner-occupied, EV industry growth has resulted in more leasing activity for specialized manufacturing and distribution centers. In the U.S., the leasing has typically been bulk lease transactions (100,000 sq. ft. or more). Bulk lease transactions comprise 7 million sq. ft. of the 7.9 million sq. ft. of EV-occupied space leased in H1 2023, representing 163% year-over-year growth.

There are 15 markets where over one million sq. ft. of industrial space was leased to EV occupiers in the last five years. These deals total 28 million sq. ft., representing 73% of all EV leasing deals over this time period. The top five markets were Chicago (3.6 million sq. ft.), Detroit (3.1 million sq. ft.), Central Valley (2.5 million sq. ft.), Silicon Valley (2.4 million sq. ft.) and Memphis (2.3 million sq. ft.).

Mexico and Canada Nearshoring

Mexico

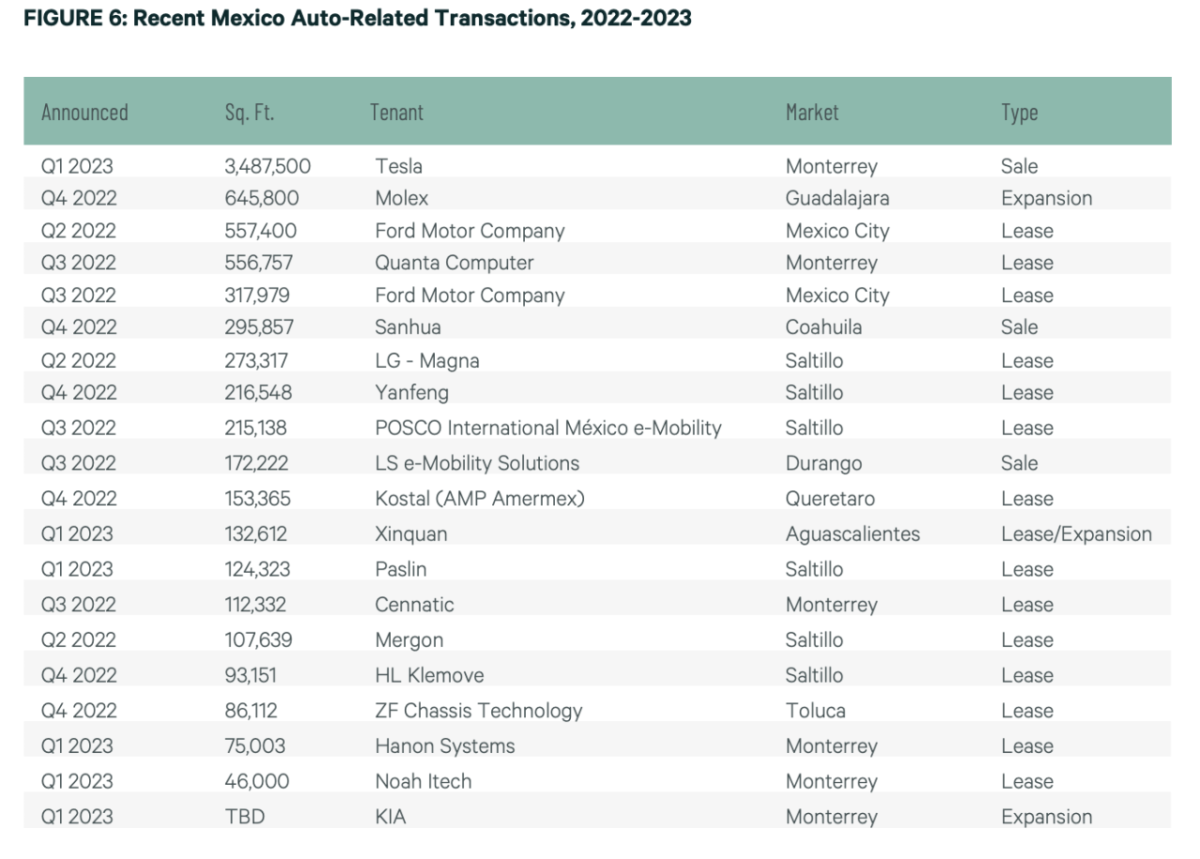

Mexico’s manufacturing and logistics facility construction and leasing activity is significantly growing due to the nearshoring of automotive manufacturing to the country. There is 40 million sq. ft. of industrial space under construction, representing 22% growth over the past year. A record-high 27.2 million sq. ft. was leased during H1 2023, with 3.1 million sq. ft. (17%) leased to automotive companies. CBRE forecasts that, as of Q2 2023, industrial tenants are seeking to lease 16.85 million sq. ft. of space, with automotive companies comprising 43.1% of this demand.

Even more automotive companies are expanding or coming to Mexico due to affordable labor availability, proximity to the U.S. border and a broad supplier base.

Select Mexico major projects:

- Tesla announced it will build its sixth Gigafactory in Nuevo León (Monterrey), a key port for commercial trade between northeastern Mexico and the U.S. The 3.5 million sq. ft. facility will be Tesla’s first location in Mexico.

- Toyota plans to invest US$328 million in its Guanajuato production plant to begin manufacturing hybrid Tacoma trucks. The company’s total investment in this facility will increase to US$1.2 billion. The Japanese automaker has operated in Mexico for over 20 years.

- Markets such as Saltillo, Mexico are also greatly benefiting from the new construction activity, as more automotive industry occupiers enter its region.

- Other major companies expanding in Mexico include Molex in Guadalajara and Ford in Mexico City.

Canada

The Canadian government has shown its commitment to the Canadian EV industry with record capital contributions and subsidies. The country aims to achieve 20% zero-emission light-duty vehicle sales by 2026, 60% by 2030 and 100% by 2035. Many existing Canadian auto manufacturing plants are being revamped for EV production. Canada has direct access to most of the critical natural resources required for EV battery manufacturing, making its location even more desirable. New EV registrations increased by 396% over the last five years across Canada’s seven main provinces, while gasoline-powered vehicles declined by 36%.

As highlighted in CBRE’s report on Southwestern Ontario, the market has a long legacy as an automotive manufacturing and supply chain hub. Its regional industry growth continues with investments in EVs.

Select Canada major projects:

- Stellantis and LG Energy Solution are constructing a C$5 billion (US$3.8 billion) EV battery plant manufacturing facility in Ontario, set to produce over 45 gigawatt hours (GWh) of battery capacity each year. The project is scheduled to deliver in 2024.

- Windsor, Ontario is home to two Ford engine plants. The company plans to invest C$1.8 billion (US$1.3 billion) towards retooling its Oakville Assembly Complex to build EVs by 2025.

- Volkswagen pledged C$7 billion (US$5.2 billion) to build a 370-acre EV battery plant in St. Thomas, Ontario, with government capital contributions totaling C$1.2 billion (US$897,300) and subsidies totaling up to C$13 billion (US$9.7 billion) over the next decade.

- The first all-EV manufacturing facility in Ontario was developed in late 2022 for General Motors.

Charging Ahead: Four EV Challenges to Consider

1. Adequate Power Availability

Modern EV vehicle and battery manufacturing is extremely power-intensive. EV manufacturing facilities have unique infrastructure requirements, including high-voltage power supply, battery assembly lines, charging foundation installation capabilities and advanced robotics and automation systems. All of these elements rely on stabilized energy flow and accessibility to power, which is key to the sector’s continued robust growth.

2. Labor Force & EV Training

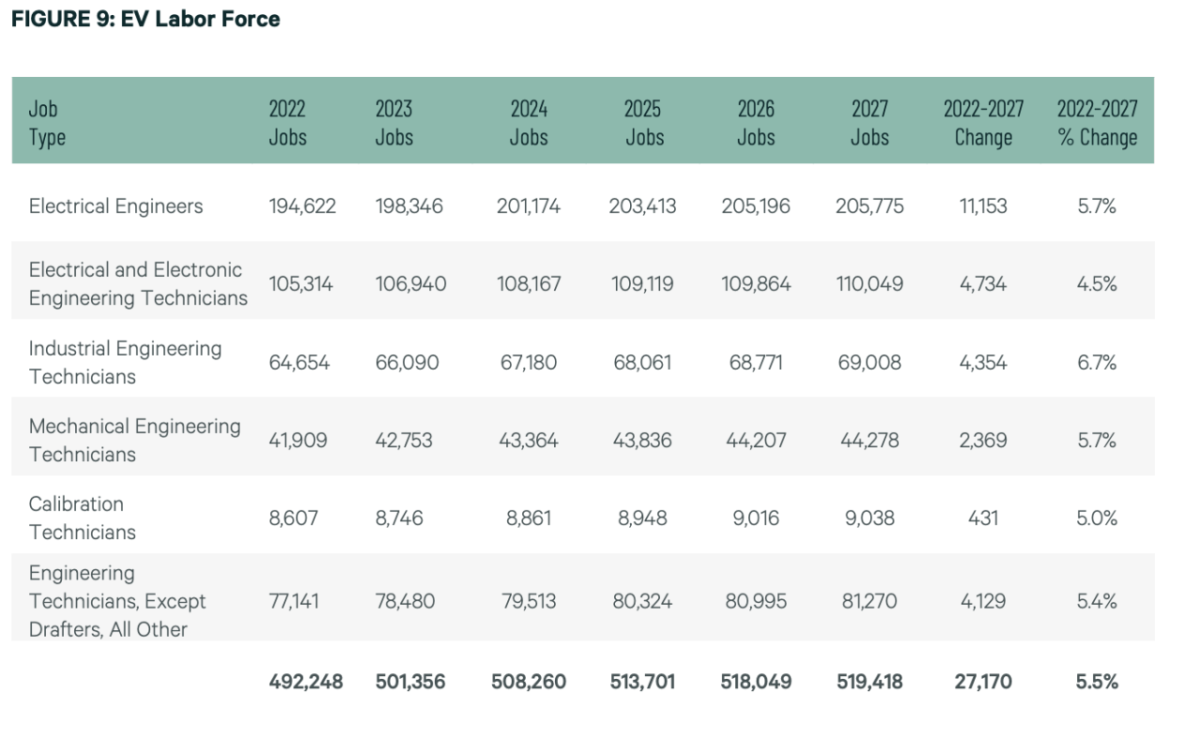

Growing EV demand is fueling the need for more electrical engineers and technicians with EV-specialized training. These talents are essential for designing, developing and manufacturing EVs and their components such as motors and batteries. Today, there are approximately 194,000 EV-specialized engineers but 200,000 will be needed by 2027. This is the industry’s most in-demand job. The total industry labor force is expected to grow by over 27,000 by 2027.

Meeting this labor demand may be challenged by demographics. Many aging workers may not be able to adapt to the new skills and requirements of EV manufacturing. Robust training and education initiatives will be critical to address this headwind.

3. The Need to Retool Infrastructure

The passage of the Inflation Reduction Act and the CHIPS Act increased the country’s investment in domestic energy production and manufacturing, to meet the federal mandate of reducing carbon emissions by roughly 40% by 2030. Corporations have announced new plans to locate manufacturing facilities across the country. A typical project can take three to five years from planning to being fully operational, with the bulk of construction time spent on utility installation.

Facility design may need to be retooled in order to accommodate the unique requirements of EV-related operations, as seen in many Canadian facilities. This can include considerations such as adequate space for charging infrastructure, battery storage, maintenance as well as accommodating increased electrical capacity and energy demands.

4. Supply Chain Pressures

Manufacturing EVs requires a fluid supply chain for sourcing key raw materials such as lithium, cobalt and rare earth metals. Half of the world’s cobalt originates from the Democratic Republic of Congo. Bolivia, Chile and Argentina contain three-fourths of the world’s lithium, according to Energyx. Two-thirds of this raw material is processed in China. According to Statista, revenue in the EV market is projected to reach US$70 billion in 2023 and is expected to grow 18% annually, resulting in a projected market volume of US$162 billion by 2028. This expanded goal will add pressure to mine, transport and refine these materials faster than ever before, further straining the supply chain.

Outlook

EVs will become mainstream as their affordability and environmental benefits win over more consumers, with an assist from improved infrastructure and government incentives. Rising demand for EV vehicles, batteries, other components and charging stations will require strategically located distribution centers, manufacturing space equipped with advanced machinery, fast-charging station compatibility and proximity to renewable energy sources. Industrial real estate demand trends will be more concentrated in the U.S.’s Midwest and Southeast regions due to logistical, economic and labor market advantages. California will see solid demand, given its close relationship with top EV companies. Texas is also well-positioned in the EV industry due to its proximity to the U.S.-Mexico border and hosting Tesla’s headquarters in Austin. These regions will enjoy more economic and employment opportunities related to charging infrastructure deployment, battery development and software engineering. These factors will shape the industrial landscape and influence occupier and investor decision-making for the foreseeable future.

About CBRE EV Solutions:

CBRE’s new global service line advises clients on establishing their EV charging infrastructure, including EV-charging strategy, identifying locations for charging sites, planning and installation of EV-charging infrastructure and providing overall program management and ongoing maintenance.