Emerging Trends and Early Outcomes Signal Impactful 2024 Proxy Season for Climate-Related Proposals

A record number of shareholder proposals, three noteworthy commitments, an early majority vote, and already 56 withdrawn in return for commitment; 2024 proxy season spotlights the staying power of climate-related proposals and growing investor interest in biodiversity loss, just transition, and increasing transparency in the financial services sector.

A new analysis by the sustainability nonprofit Ceres indicates investor-driven climate action interest in the 2024 proxy season remains strong. With hundreds of climate proposals filed, a noteworthy majority vote recorded earlier than usual, and important commitments from three leading financial institutions, the 2024 season is off to an encouraging start.

To date, shareholders have filed 263 climate-related resolutions, according to tracking by Ceres – a record number of proposals filed for a single proxy season, and more are expected. In 2023, there was a record 259 climate-related resolutions filed.

Early majority vote in 2024 Proxy Season

Among the most notable developments so far is a majority vote of 57% at Jack in the Box Inc. on a resolution asking for scope 1 and 2 greenhouse gas emissions disclosure and target setting filed by The Accountability Board that came in early March – a positive sign that many shareholders support climate action by relevant companies.

"A majority vote at this early stage in the season is one indication of a promising outlook for the 2024 proxy season," said Rob Berridge, senior director of shareholder engagement at Ceres. “It's clear that investors are continuing to rally behind key climate-related shareholder proposals, reflecting the sustained commitment to informed, responsible investment stewardship practices and driving corporate action in the face of the rapidly intensifying climate change and nature loss.”

In the opening stretch of the 2024 proxy season, New York City Employees’ Retirement System (NYCERS) withdrew its resolutions with both JPMorgan Chase and Citigroup, and Investors for Paris Compliance withdrew a similar proposal at National Bank of Canada in return for the banks' commitment to disclose their clean energy financing ratio. This figure reflects the proportion of the institution’s financing of low carbon energy projects compared to fossil fuel financing. The New York City Comptroller’s office filed similar proposals with four additional major banks, making this new type of proposal an important development to monitor.

Already, a total of 56 Ceres-tracked proposals have been withdrawn in return for a commitment, continuing a trend that demonstrates the shared value of dialogue between investors and companies. For comparison, in 2023, 83 proposals were withdrawn due to a commitment, and in 2022, 116 were.

2024 proxy season trends in shareholder-driven climate action

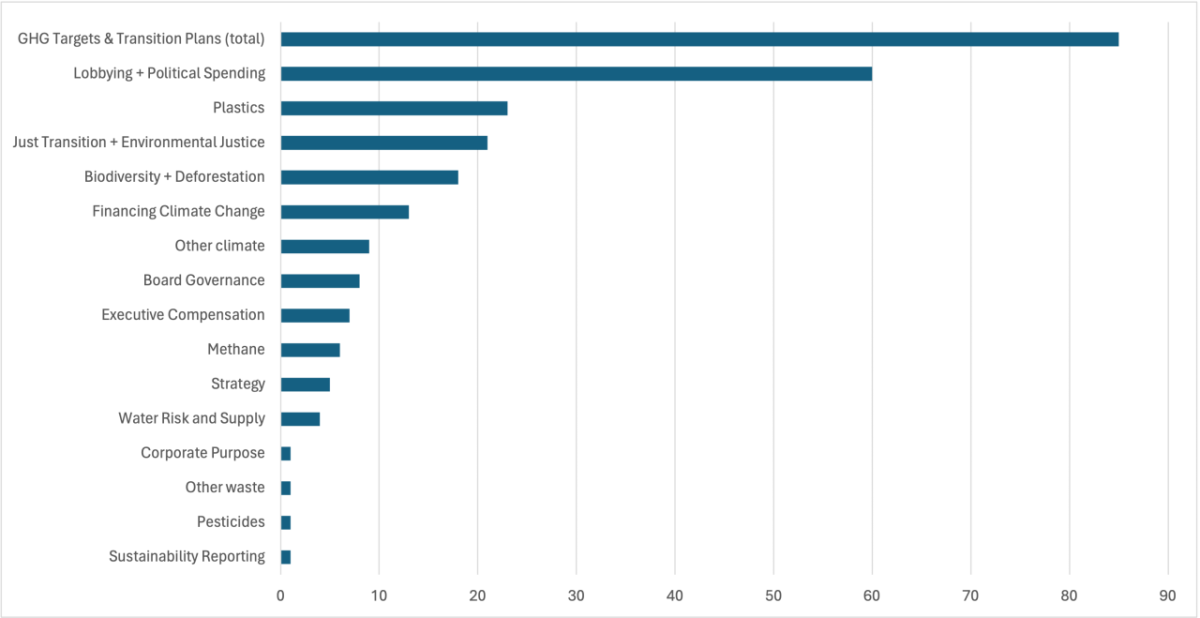

As in recent years, proposals relating to greenhouse gas emission reduction goals and/or climate transition plans are the leading category (when combined) this year, making up 28% of the tracked resolutions. Investors filed 60 proposals concerning lobbying and political spending activities, revealing ongoing concerns about whether a portfolio company’s corporate advocacy aligns with climate objectives.

The burgeoning biodiversity-related proposals category highlights investors’ heightened concerns about the risks of nature and biodiversity loss, further demonstrated by the nearly 200 investors participating in the Nature Action 100 initiative. Engagement efforts are also evident in water-related proposals, citing the Corporate Expectations for Valuing Water from the Valuing Water Finance Initiative to urge companies to evaluate and disclose water risk in their supply chains.

Another emerging trend spotlights investors’ growing interest in addressing the risks related to human rights and robust workforce development within the context of a clean energy transition. These Just Transition and environmental justice proposals grew to 21, from 16 last year.

Climate-related resolutions filed by topic (as of March 25, 2024)

The consumer goods sector saw the highest number (72) of climate-related proposals filed this year, followed by financials (59), industrials (40) and energy (26).

The large number of proposals filed with financial services companies reflects growing momentum on the heels of last year’s proxy season. Shareholder engagement with banks is critical because, as key players in the broader economy, banks face a variety of climate-related impacts and play an important role in reducing systemic financial risks.

Meanwhile, investors continue to engage Climate Action 100+ focus companies through dialogues and, when necessary, shareholder proposals. Launched in 2017, Climate Action 100+ is an investor-led effort to ensure the world’s largest greenhouse gas emitters reduce emissions, improve governance, and strengthen climate-related financial disclosures. Key flagged shareholder votes providing information to the market about company responsiveness to investor engagement and the goals of the initiative are anticipated later this spring.

As the 2024 proxy season unfolds, early analysis demonstrates that responsible investors continue to recognize climate risk is financial risk and that it is in their business interest to engage with companies, including through filing and voting on shareholder proposals.

About Ceres

Ceres is a nonprofit organization working with the most influential capital market leaders to solve the world’s greatest sustainability challenges. Through our powerful networks and global collaborations of investors, companies and nonprofits, we drive action and inspire equitable market-based and policy solutions throughout the economy to build a just and sustainable future. For more information, visit ceres.org and follow @CeresNews.

Media Contact: Vivian Melody, vmelody@ceres.org, 617-247-0700 ext. 353