Evaluating Carbon Offsets

Originally published on NRG Energy Insights

Welcome back to the second installment in our carbon offsets series. As a brief refresher, our last blog covered what carbon offsets are, the various types of credits, and why using offsets in support of broader decarbonization efforts is valuable. Next, we will go a step further and dive into how offset projects are evaluated as a credible tool in a company’s ongoing efforts to reduce, avoid, and offset greenhouse gas emissions.

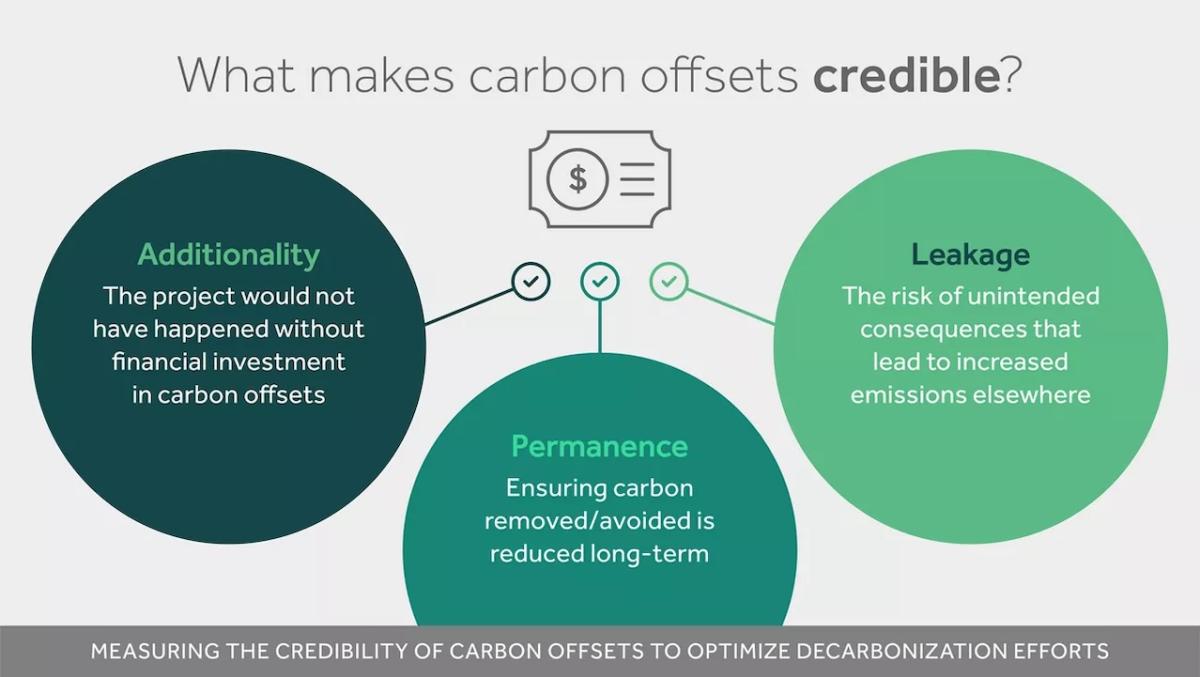

Not all carbon offsets are created equal, and we need to evaluate them for credibility. Some ways to describe the value that high-quality offsets bring include additionality, permanence, and risk of leakage. Let’s describe each factor in more detail.

What is Credibility?

Credibility is all about the trustworthiness and reliability of the project and the organization behind it. There are often concerns about whether or not these projects actually deliver the promised carbon savings, but one way to evaluate for credibility is through independent project registries and industry standards organizations. The Verra registry, and the recently released “Common Core Principles” by the International Council for the Voluntary Carbon Market (ICVCM) are highly regarded examples. This sounds like a mouthful of industry jargon, but these independent organizations describe high-quality projects and bring transparency to tracking and auditing using the latest technologies and techniques. These standards, and tracking and auditing techniques help lay the framework for transparency in describing additionality, permanence, and potential for leakage.

Additionality

Additionality simply put, means the renewable project would not have happened without financial investment in carbon offsets. If the emissions reductions would have happened anyways, despite an investment in the project, then the reductions are not additional. This is measured by looking at whether the project is financially viable without the carbon offset revenue, and whether the emissions reductions would not have occurred otherwise. For example, a landfill gas project that captures and destroys methane emissions that would have otherwise been released into the atmosphere may be additional, as it may not have been financially feasible without the carbon offset revenue.

Permanence

Permanence ensures the carbon removed or avoided by the project will stay out of the atmosphere for a significant period. This is measured by reviewing the project’s plan for ensuring the long-term durability of the emissions reductions or removals achieved. For example, a forestry project might ensure the permanence of the emissions removals by implementing a comprehensive monitoring and enforcement system to prevent illegal logging and land-use change. The project might also bring sustainable jobs to the local community in monitoring and enforcement, a potential “co-benefit” of the project.

Risk of Leakage

Leakage describes the risk of unintended consequences that lead to increased emissions elsewhere. This is measured by assessing and mitigating these risks and ensuring that the project is not causing negative environmental or social impacts in another area or in another way. An example might be a project that involves the installation of efficient cookstoves in a rural community, which may inadvertently lead to increased emissions somewhere else if the community uses the money saved to purchase more polluting goods and services.

Clearly understanding what high-quality means and how to accurately measure a project’s credibility is critical to investing in carbon credits. Ensuring that investment funds are put toward projects that are best positioned to make a real impact in reducing our carbon footprint and helping to address the climate crisis. In our next blog, we will review what to look out for when identifying offset providers, specific projects, and more educational resources.