T. Rowe Price Finds Financial Stress Is a Predictor of Financial Wellness

Adoption of financial wellness programs can reduce stress, lead to better retirement outcomes

Originally published on T. Rowe Price Newsroom

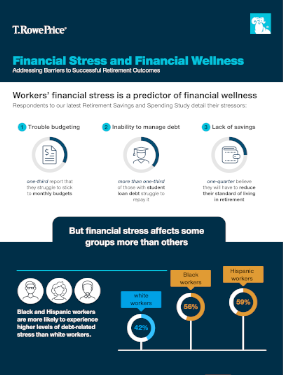

BALTIMORE, August 22, 2022 /3BL Media/ - T. Rowe Price, a global investment management firm and a leader in retirement, published new research which found that financial stress is a predictor of financial wellness. Specifically, retirement plan participants who report being stressed about debt are saving less for retirement than those who are not stressed. These insights are based on T. Rowe Price’s which measures people’s day-to-day financial behaviors, progress made towards the financial goals they set for themselves and how, ultimately, how today’s actions may affect their future retirement.

“The path to a successful retirement is paved by financial wellness,” said Joshua Dietch, head of retirement thought leadership at T. Rowe Price. “Employers, financial professionals, consultants, and recordkeepers are uniquely positioned to encourage the promotion and adoption of financial wellness programs which can reduce financial stress and lead to greater savings and better participant retirement outcomes.”

annual Retirement Savings and Spending study and analysis of its proprietary Retirement Behavior Index™,

The study’s analysis of financial stress included an assessment of factors like stress emanating from debt, budgeting, retirement and nonretirement savings, managing investments and health care costs. Additional findings from the research include:

- Debt, particularly unsecured debt, correlates with financial stress

- Seventy-three percent of younger workers (30 years old and below) reported moderate to high levels of stress related to budgeting compared to 40% of older workers (50 years old and above)

- Women are 26% more likely than men to experience higher levels of financial stress, particularly as it relates to debt, budgeting, nonretirement savings, and health care expenses

- Black and Hispanic workers are 34% and 40% more likely than white workers to experience higher levels of debt-related stress

- Workers who start saving for retirement early in their working years have higher Retirement Behavior Index™ scores, T. Rowe Price’s proprietary financial wellness framework, than those who start saving later in their working years

ABOUT T. ROWE PRICE

Founded in 1937, T. Rowe Price (NASDAQ-GS: TROW) is an independent global asset management company with $1.31 trillion in assets under management as of June 30, 2022. The firm is focused on delivering investment excellence and retirement services for institutional, intermediary, and individual investors. Our strategic investing approach, driven by independent thinking and guided by rigorous research, helps clients feel confident in pursuing financial goals. For more information, visit troweprice.com, Twitter, YouTube, LinkedIn, Instagram, or Facebook.

CONTACT T. ROWE PRICE, PUBLIC RELATIONS

Monique Bosco

410-345-5740

Monique.Bosco@troweprice.com

Kim Francois

410-577-4423

Kim.Francois@troweprice.com

Laura Parsons

443-472-2281

Laura.Parsons@troweprice.com