Electric Vehicle Adoption Moving Utilities to Plan for a Zero-Emissions Future

EVs are speeding ahead, even as questions persist over charging infrastructure

Separated by decades of progress and technology’s endless march, it’s easy to think electric vehicles share little heritage with their internal combustion forebears. But even as they bookend the automotive spectrum, today’s EVs are much like the first automobiles in one important respect: When the first cars were made, they had an outsized dependency on infrastructure. Without a robust system of roads (let alone highways), what was the incentive to buy?

Fast forward to 2018, and the comparison comes into sharper focus. Original equipment manufacturers (OEMs) are speeding their moves toward electric vehicles, even as questions persist over whether charging infrastructure can support wider adoption of EVs by consumers and accommodate corresponding power demands on the grid.

Recent years have seen more utilities in planning mode as they worked to better understand aggregated charging. In 2018, utilities are putting those plans into practice as they launch pilot programs. Hastened by the release of 2018’s crop of EVs (the Chevy Bolt, Tesla’s Model 3, the Nissan Leaf, etc.) and the announcements of a plethora of new EVs planned for 2019, we see a growing sweet spot of customer adoption as more Americans are sold on EVs. Regulatory moves are also part of the equation, as states such as California adopt climate change mandates that encourage EV adoption.

Now comes the difficult work to ensure enough infrastructure — and grid modernization — to support this growing network of vehicles. How are utilities planning for increased load and charging? What steps are they taking to harmonize this need with grid operations?

SOLVING RANGE ANXIETY

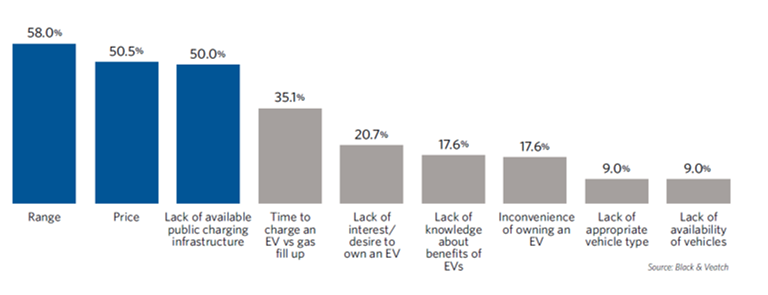

Among the main challenges in hastening broader EV adoption is customer perception of miles traveled, range and reliability. Some vehicle batteries are moving past the 200-mile-percharge barrier, solving one problem. But what about broader availability of EV infrastructure? Range, vehicle price and lack of publicly available charging infrastructure rank as the biggest obstacles to increased EV adoption, survey respondents told us (Figure 1).

These sentiments reflect challenges often cited by customers: Where can I charge my car, and will I have to charge every day? How long does it take to charge with a Level 2 versus a DC charger? Do I have to wait in line? How much will it cost?

A major hurdle was cleared earlier this year when Electrify America detailed its national DC fast-charger network, the nation’s largest public DC fast-charging network (Black & Veatch was one of two companies selected by Electrify America to design and build the charging station sites). This new DC charging network is a strong complement to existing public infrastructure such as the EVGO network, and the ChargePoint, ClipperCreek, Volta and Greenlots stations found in many public and private parking lots.

Electrify America’s ultra-fast EV chargers are the first certified cooled-cable 150- to 350-kilowatt (kW) chargers deployed in North America, capable of delivering enough energy for up to 20 miles of range per minute — seven times faster than today’s 50kW DC chargers. Black & Veatch is currently supporting site development services across the U.S., as well as performing engineering, permitting and construction of DC Fast Charger electric car charging station sites in the Pacific Northwest, Northern California, Southern California, Mountain, Central, Midwest, Southeast Central and Southeast regions. The large number of charging sites will open unprecedented options and raise convenience for motorists.

GRID ANXIETY?

Wider EV adoption rates are raising new questions about the readiness of our grid. Presuming a significant growth rate, the U.S. Department of Energy (DOE) has estimated that there will be 21 million plug-in EVs on the road by 2030. That growth is motivating new planning and solutions among utilities, which must consider where they can reliably predict and control load related to increased charging stations, some of them high-power.

Without adequate planning and investment, charging stations could tax the grid and bring about unplanned distribution grid investments to deal with transformer upgrades, brownouts or costly repairs. In addition, the traditional business model of utilities as the sole power generator is being upended by the emergence of end-customer and private company-owned renewable technology generation, like solar and wind, as well as other DER and energy management solutions.

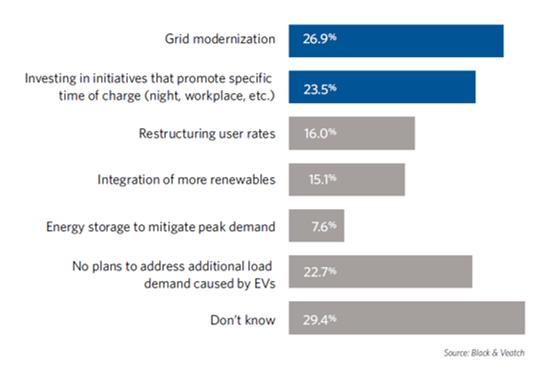

However, utilities are recognizing that with proper planning, these disruptive technologies can be turned into new streams of revenue. Many utilities have begun the planning process, with survey respondents saying grid modernization and programs that encourage customer charging during specific times will be important to managing additional load demand brought on by EVs (Figure 2).

A thoughtful approach to grid modernization can help utilities meet growing energy needs, balance supply and demand, and integrate renewable energy generation. It also can provide grid services and help fund new grid and charging infrastructure by providing additional revenue.

While the DOE’s 2030 timeframe seems like a long way off, these capital-intensive upgrades require careful coordination and have long lead times for approvals, engineering, permitting and construction. As more EVs hit the streets, utilities should move now to plan for their impacts on their systems, along with the market deregulation brought by state-level public utility commissions (PUCs).

GRID MOD THROUGH UNIQUE PRICING STRUCTURES

We increasingly see that as the EV market matures, utilities are understanding the need for more renewable energy. If they want to avoid the problems associated with peak demand, it follows that solar produced during the day can deliver the excess supply needed for daytime charging.

In California, one challenge is the mismatch between peak production from solar energy — which occurs between 11 a.m. and 3 p.m. — and peak EV charging time, which is typically overnight. This has produced a midday energy surplus that EV cannot take advantage of. To remedy this, charging network providers could install charging stations at workplaces and business parks, and adjust rates to encourage midday charging. Such actions would directly impact and shape consumer behavior and charging patterns. Investor-owned utilities (IOUs) in California have been exploring such rate adjustments.

Various other types of grid modernization can help mitigate impacts. One such method is managed charging — often referred to as “smart charging” — that occurs when the utility signals the network to reduce charging levels if a high-load event is occurring on the grid. Or, in situations where there is a surplus of energy, utilities can signal the network that charging load can be increased. Battery storage is also a key strategy, as it drastically reduces the amount of power consumed from the electrical grid during peak times, while freeing up capacity for other uses.

Pricing signals also can influence charging behavior and balance energy supply from renewable energy resources. In addition, other types of distributed generation powered by conventional fuels, such as micro-turbines, fuel cells, combined heat/power systems and energy storage can be integrated with EV charging at a local level.

THE ROAD AHEAD

Henry Ford’s Model T changed the fate of passenger vehicles through a revolutionary production strategy that put the car within reach of buyers. That, in turn, helped spur the build-out of roads — and later, highways — that would fulfill the promise of the

automotive industry.

In much the same way, widespread EV charging infrastructure will be foundational to fulfill the promise of zero-emissions transportation. So, too, will be the moves we make to accommodate the added demand of expansive, high-power charging and DER grid impacts, which will happen concurrently.

To prepare for and realize the benefits of a zero-emissions future, stakeholders such as cities, utilities and private enterprises like

automakers and medium- to heavy-duty vehicle OEMs must work together on planning, designing and building systems to accommodate their corresponding power demands. Standards must also be deployed and implemented to maximize equipment

utilization. Much great work is underway, and there is more to come.