Impact Investing in the Age of Fintech and Big Data

Impact Investing in the Age of Fintech and Big Data

by Reggie Stanley, president and CEO of ImpactUs

New impact investing platform harnesses technology, social networks, and scale to help investors, institutions and their advisors invest with purpose.

The term “impact investing” as it relates to private debt and equity is nearly 10 years old, it has been a rarified concept for rank-and-file investors and even many institutions and advisors. Even those committed to integrating environmental, social and governance (“ESG” or sometimes “SRI”) factors into their portfolios have been finding it easier among publicly traded offerings, yet nearly unmanageable when seeking unique thematic, place-based private alternatives. The new impact investing brokerage platform, ImpactUs Marketplace, seeks to make impact investing more accessible by navigating the cutting edge of parallel trends and movements.

There are larger movements at play right now that have many investors, both new and experienced, seeking purpose-driven investments to help create a social or environmental benefit along with a financial return. Investors are looking at environmental solutions, sustainable agriculture, microfinance, healthcare, affordable housing, and specific domestic and international communities as places where their money can make a difference. This is partly motivated by growing populist interests, emerging business solutions, and increasing numbers of young people among the ranks of the investor class who can find and make such investments due to the growing trends in financial technology and social networks to find and make such investments at scale.

The emerging network of investors building community around and through the ImpactUs Marketplace is greatly empowered by these trends. It’s our mission to use financial technology to bring more people into the impact investing world. We do so by capitalizing on concurrent and related movements that indicate increasing demand and transformative influence over our financial systems.

The Rise of Fintech

Financial technology will play a critical role in attracting more investors to the impact investing sector going forward, particularly when it comes to millennials, institutional investors and those that advise them. These important constituencies expect investment solutions that let them identify, evaluate and transact in one place, at lower costs. Women are also becoming a larger share of the investing population, and women are more likely to seek investments that align with values and make a positive impact.

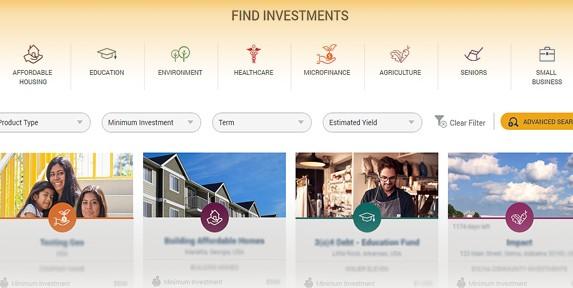

And as disruptive as Fintech is proving to be to the traditional capital markets, it holds even more promise in this space because of the power of personalization and the ability to look at more details faster. A new generation of investors expects to have decision-driving data at its fingertips. ImpactUs has an important role to play in this new landscape. Our investment platform, ImpactUs Marketplace, (www.impactusmarketplace.com) provides the advanced infrastructure, connectivity, and cost-efficiencies that will allow the widest range of advisors, investors, and mission-driven institutions to connect at scale, ultimately driving more capital to mission-driven institutions.

Information, Please

I had the pleasure of appearing on a panel a few months ago at SOCAP16 discussing collaborative data. What I took away from that experience is that the community sees open data and collaboration as a clear way to enable better risk assessment, better impact measurement, and expanded market opportunity. This will empower investors, professionals, and entrepreneurs to make informed and impactful investment decisions.

Personalized investment platforms that allow users to access, select and seek purpose-driven, or values-based opportunities, are going to be what is expected by succeeding generations of users. ImpactUs has been working to grow such a platform organically. We are up and running with a group of early-adopter mission driven institutions. These are, and will increasingly be, institutions whose missions cross a range of critically important impact areas and networks of interest including affordable housing, sustainable agriculture, microfinance, education, women, and minority communities.

Find out more about plans for ImpactUS Marketplace in 2017 and beyond in the rest of Reggie's blof post here - www.greenmoneyjournal.com/december-2016/impact-investing-in-the-age-of-fintech-and-big-data