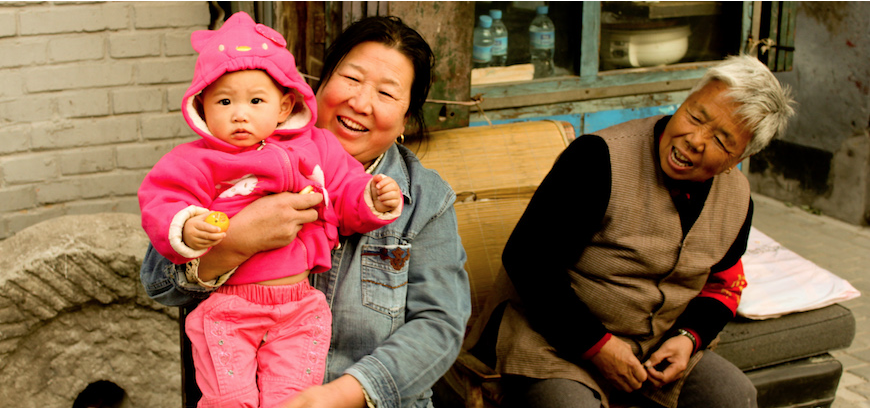

Supplemental Safety Net: An Innovative Model Paves the Way for Inclusive Insurance in China

As originally published on NextBillion.com

Despite rapid economic growth that has benefited many, hundreds of millions of people in China still remain outside the formal financial system without access to safe and affordable financial products. One of the biggest unmet financial needs is insurance. Salaried and wage-earning Chinese workers sometimes have insurance through their jobs, but many employees, especially those in social services, are severely underserved, and casual or self-employed workers are likely to have no coverage at all. China’s government recognizes that its current efforts to build a basic social security safety net can be complemented by private insurance expansion. The challenge—hardly unique to China—is how to make the commercial insurance market work for large numbers of the country’s large population of low- and moderate-income households.

To read the full article, visit NextBillion.com.