Wealth for African-Americans and Latinos Continues to Decline Since Recession While the Wealth of White Families Recovers

Lower Rates of Financial and Business Assets Seen as a Cause for Racial Wealth Gap

Chicago, November 6, 2015 /3BL Media/ - Micro- and small- business development strategies can help tackle the growing racial wealth gap in the United States, according to a new funder’s brief released by the Asset Funders Network (AFN). Lower levels of business and financial assets held by African-American and Latino households are one of the key reasons for the racial wealth gap, suggesting that business ownership may be an important means to narrow the gap

Written by Joyce Klein of FIELD at the Aspen Institute, with support from Capital One, the funder’s brief, Narrowing the Racial Wealth Gap through Business Ownership, examines the available research on business ownership, and the connection between business ownership and wealth creation for diverse populations. The brief also identifies proven tools and strategies investors can employ to strengthen access to and effectiveness of business ownership as a means to build wealth and reduce the racial and ethnic wealth gap.

“Microenterprise is a proven yet underutilized strategy for increasing household wealth as well as worker income,” said Joe Antolin, AFN Director. “Through this guide, grantmakers wanting to tackle inequality and invigorate opportunity in our nation are provided a collection of strategies leveraging business ownership to focus on narrowing the wealth gap for Blacks and Latinos.”

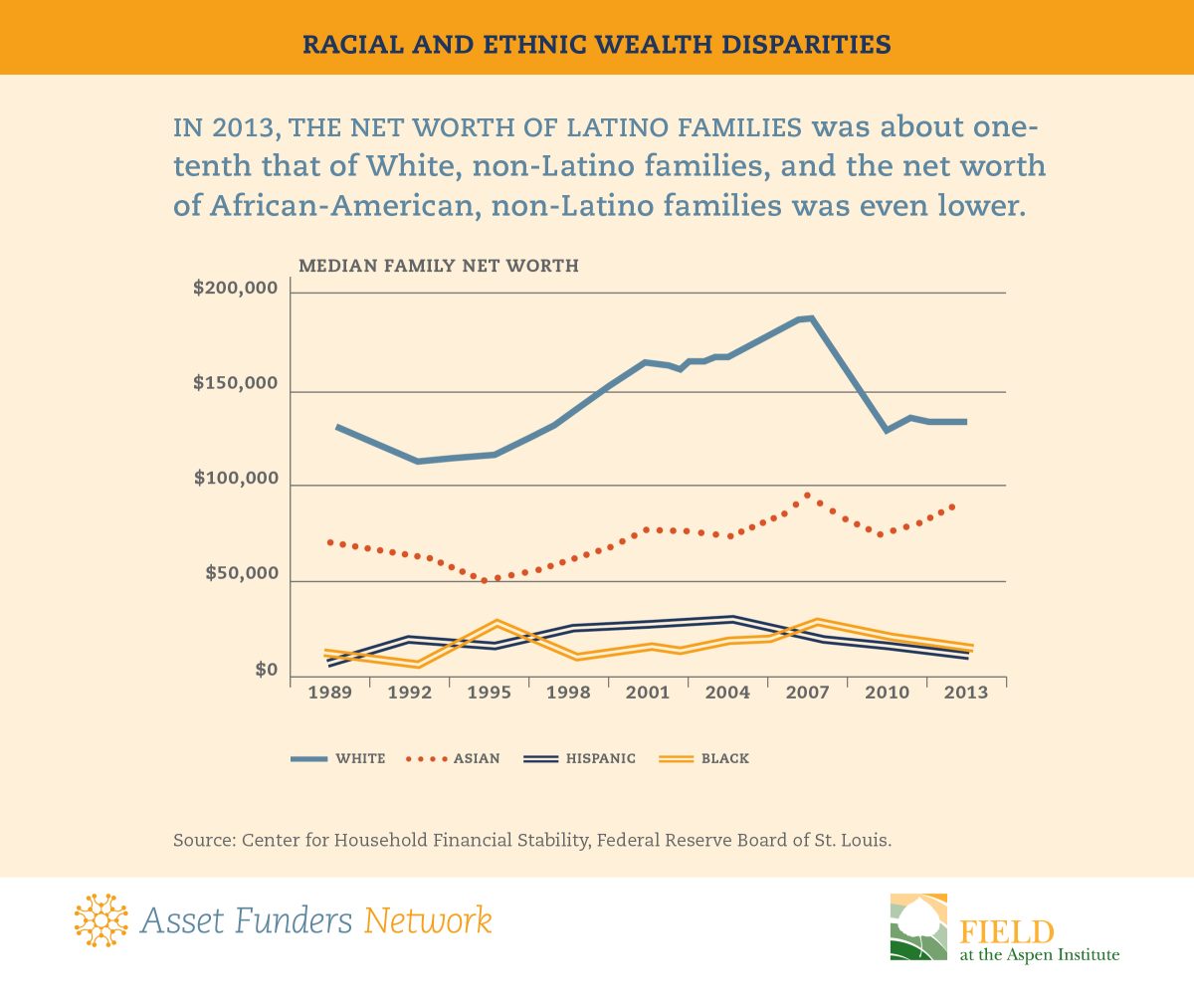

Data in the brief indicates that in 2013, the net worth of Latino families was about one-tenth that of White, non-Latino families, and the net worth of African-Americans was even lower. One of the reasons for the gap in household wealth was that African-American and Latino families have lower rates of investment in financial and business assets.

Business ownership is an important means to build wealth in the U.S. economy. Yet lower rates of business growth and survival among Latino-owned and African-America-owned firms remain a challenge in terms of wealth creation. The brief identifies three core causes for lower growth and a lack of success amongst African-American and Latino-owned businesses:

- Financing;

- Lower levels of education and business experience; and

- Lack of market access.

“It is important that as we seek to address rising inequality in the US, we focus on wealth as well as income equality,” said author Joyce Klein. “The hope is that this brief provides funders with insights that will increase their understanding of the role that business ownership can and should play in addressing growing wealth and income inequality.”

Strategies for Supporting Business Ownership Amongst People of Color:

- Microenterprise Development Programs (MDOs): MDOs have traditionally focused on serving non-white clients and addressed the very issues that have been identified as contributing to the lower growth and success rates of African-American and Latino-owned firms. They have focused on helping entrepreneurs to secure financing, strengthen their business knowledge and skills, and access markets.

Research conducted by FIELD found the following outcomes for non-White individuals working who received assistance from MDOs:

- 95% business survival rate.

- 64% business start rate.

- Workers were paid a median hourly wage of $15.16.

- Median business revenues were $45,000.

- Business revenues increased by $12,777.

- Worker Cooperatives: As businesses owned and managed by the employees, worker cooperatives tend to serve low-income communities, invest locally, and on average, provide higher wages, better job stability, and more benefits than traditional businesses. While worker cooperatives are not widespread, they have a long history within the African-American community. At the end of the Civil War, free African Americans pooled resources to buy operating farms in order to own land and support themselves financially. Today working cooperatives are gaining increasing traction as a business model in community development circles, in part due to the emergence of a growing support infrastructure that includes nonprofits providing technical and financial support to cooperatives, and due to local policy and government efforts.

Investment Recommendations that Can Help Close the Gap

The funder’s brief validates the critical role grantmakers play in the research, programs, and policies that can allow communities of color realize the wealth-building potential of becoming business owners. The guide outlines investment recommendations that include:

- Invest in mission-based lenders that provide capital to firms and worker-owned cooperatives owned by African-Americans and Latinos.

- Invest directly in cooperatives.

- Support services that develop the business ownership skills of African-American and Latino entrepreneurs, and expand their ability to access broader markets.

- Invest in incubators and co-working spaces for African-American and Latino entrepreneurs.

- Fund research aimed at gaining a deeper understanding about the role of business ownership in building assets among people of color.

- Support the development of models that promote savings and build credit for potential entrepreneurs.

“Capital One sees microbusiness as an increasingly more important and relevant asset building strategy that can help bridge the growing racial wealth gap and promote financial well-being,” said Daniel Delehanty, Senior Vice President of Community Development responsible for community development activities in the field of economic and small business development.

The Asset Funders Network is a community of national, regional and community-based foundations and grantmakers using philanthropy to make more effective and strategic funding decisions that allow each dollar invested to have greater impact in bringing economic opportunity and financial security to low- and moderate-income Americans.

FIELD's mission is to identify, develop, and disseminate best practices in the microenterprise field, and to educate funders, policy makers and others about microenterprise as an anti-poverty strategy. FIELD is one of three main initiatives of the Economic Opportunities Program (EOP), a policy program at the Aspen Institute in Washington, DC. EOP focuses on advancing strategies that connect the poor and underemployed to the mainstream economy. For more information about FIELD and its work, please visit www.fieldus.org.

The Aspen Institute is an educational and policy studies organization based in Washington, DC. Its mission is to foster leadership based on enduring values and to provide a nonpartisan venue for dealing with critical issues. The Institute is based in Washington, DC; Aspen, Colorado; and on the Wye River on Maryland's Eastern Shore. It also has offices in New York City and an international network of partners. For more information, visit www.aspeninstitute.org.