The Green Bond Opportunity

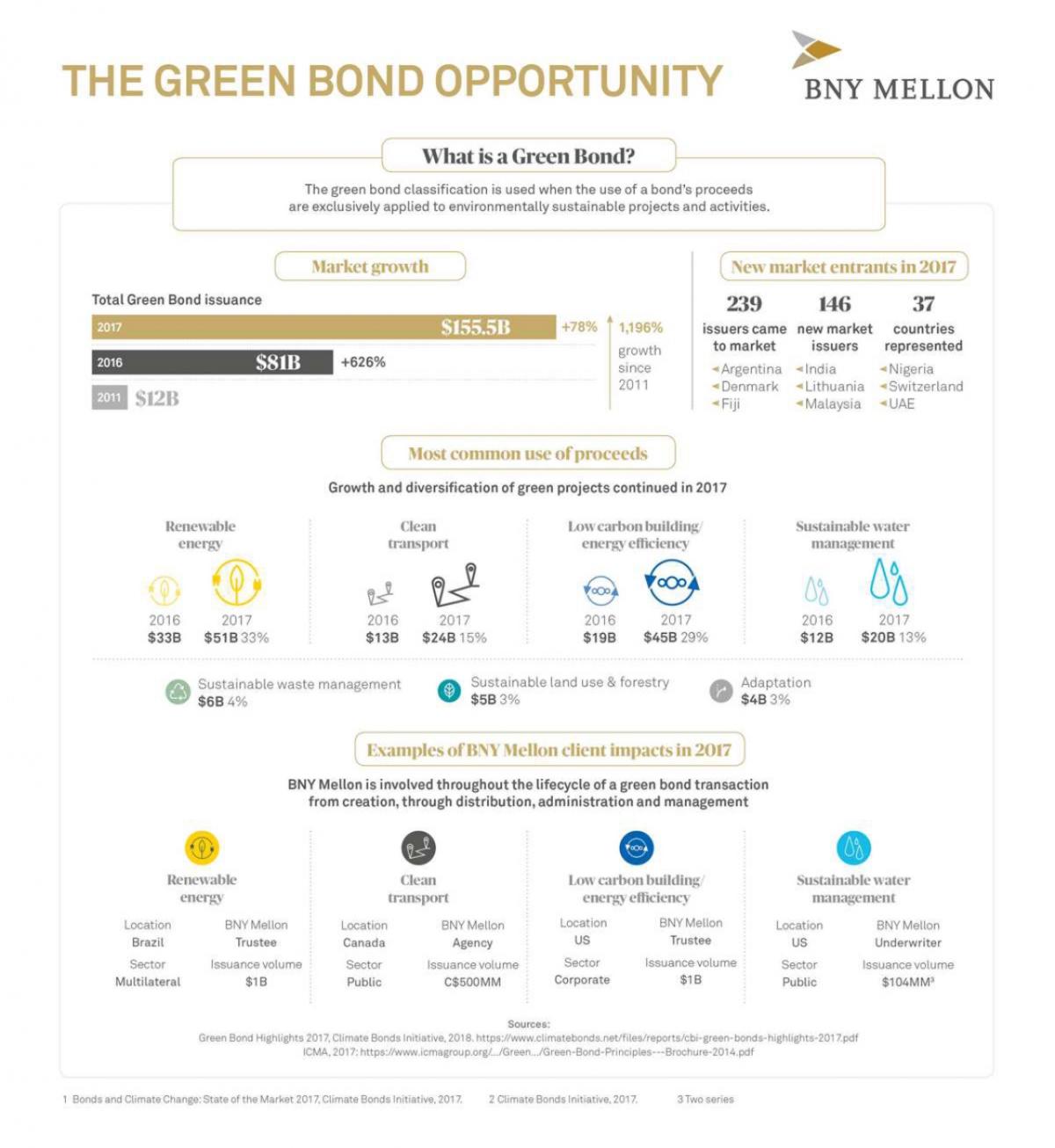

As the global green bond market continues to see significant growth, it is also attracting a larger and wider issuer base. This growth reflects $155.5 billion in labeled green bonds, incorporated into a larger $895 billion universe of climate-aligned bonds that contribute to a low-carbon economy.

Use of green bond proceeds shows how issuers are raising capital to conserve energy and resources, transform transportation systems and protect water, land and forests.

These investments also offer the opportunity for investors to support society’s transition to a more sustainable future while generating financial value. However, no single agreed definition of ‘green’ yet exists, creating a market challenge.

BNY Mellon is committed to fostering the integrity and strength of the market to help clients mobilize investment capital toward their sustainable financial objectives. Download the complete infographic and learn more in the 2017 Corporate Social Responsibility Report.