AllianceBernstein: Office Space: Looking Past the Doom and Gloom

By Peter J. Gordon

Will Americans return to the office? It may depend on where it is and what it offers.

The office market is widely viewed as the problem child in commercial real estate. There’s no doubt the sector has been disrupted and is in transition. But does this mean that working in an office is a thing of the past? We don’t think so. The current environment, which began with a pandemic and was followed by higher interest rates, has simply shined a brighter light on problems that have been building for decades—and what it may take to solve them.

A lot has happened in the last few years to change the way people work and what they want from their workplaces. Remote work arrangements have lifted office vacancy rates while high borrowing costs are depressing property prices and making it harder to refinance loans. A large share of commercial real estate debt in general—and office space debt in particular—will mature in coming years and likely need to be repriced at lower levels.

US Offices: More (Modern) Space Needed

In the US, the issue is often framed solely as a problem of tenant demand. Or, perhaps more precisely, a lack of demand from some employees who are clinging to hybrid or remote work arrangements that were normalized during the pandemic.

These changes in demand patterns are still evolving. But we also think the US is grappling with insufficient supply. There are too few recently built, environmentally friendly buildings near transit and with amenities that appeal to employees and can entice them back to the office. There are also too many older ones with inflexible super-structures, environmentally unfriendly systems and floor plates that can’t easily—or cost-effectively—be adapted to suit tenants’ current needs.

The Regional Mall Storyline Redux?

In some ways, the supply-demand mismatch echoes one that shook up regional American malls a decade ago. Many malls didn’t survive the transformational shifts that e-commerce triggered in the retail sector. But those that were well located and owned by landlords willing to commit capital to support the changing needs of the customers in their area evolved—and are stronger for it today.

US office space, with some regional variations, appears to be facing a similar “adapt or die” situation. Data shows that the top-tier office buildings, which tend to be newer and more adaptable to changing needs, account for a disproportionate share of leasing activity.

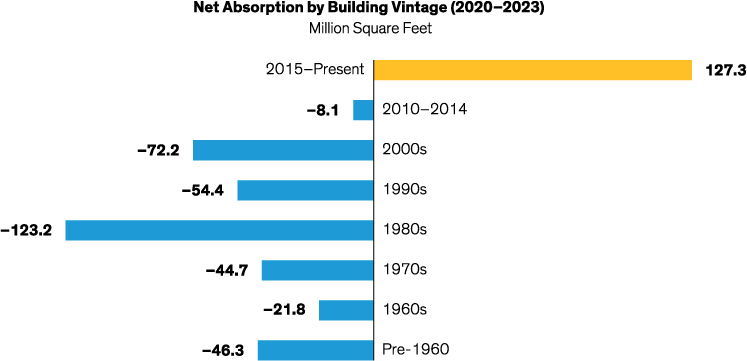

And the pandemic didn’t change tenant preference for newer office space. Since the first quarter of 2020, when the World Health Organization declared the COVID-19 outbreak a pandemic, there have been more than 127 million square feet of positive net absorption—the total amount of space leased minus the amount of space vacated—in US office buildings that were built or completely renovated in the last 10 years (Display).

Older buildings—spaces built more than 10 years ago—had negative net absorption over the same period to the tune of 236 million square feet. In other words, tenants vacated more space than they occupied. In our view, finding an alternative use for some of these buildings, which won’t be easy for many buildings and in many jurisdictions, might nonetheless be the most promising solution.

Even among the newer buildings, there has been dispersion. Fourth-quarter vacancy rates last year were lower in the newest, most modern properties than in just slightly more dated ones.

These top-tier offices are attractive to tenants who need their employees to be physically back at work on a full-time basis. They are typically aesthetically pleasing buildings with floor plate designs that allow for collaborative work and include plenty of meeting rooms, quiet rooms and social areas. They also offer best-in-class technology and audio-visual infrastructure; sustainable, energy-efficient heating and cooling systems; and proximity to transit, retail and a range of restaurants, from takeout to fine dining.

We expect the allure of these centrally located buildings with modern amenities to help companies not only draw workers back to the office but also retain their best employees.

Focusing on Growth

The “return to the office” push might explain why the number of tenants looking for office space increased nearly 6% in the first quarter of 2024 and is up more than 28% since the start of 2023, according to Jones Lang LaSalle (JLL), a global real estate services company. The focus for many employers will be on US metropolitan areas with a favorable ratio of high-quality office inventory, population growth, high education levels, low living and business costs, and concentration of office-using industries.

Major urban and suburban areas that cracked the top 20 in a recent research report by JLL scored highly on all of those metrics. Most locations were in the southern and western United States, dominated by tech-centric industries that have come to expect modern offices with premium amenities.

Again, though, the problem is one of demand exceeding supply: JLL reports that direct available space in offices less than 10 years old has fallen by more than 14% since the end of 2022.

Shades of Green: Sustainability Matters

We believe that sustainability considerations are also starting to influence office decisions, though the lack of a uniform federal mandate for environmental, social and governance (ESG) reporting can complicate the issue.

Even so, lack of ESG qualifications could hasten the demise of older US buildings that can’t or won’t adopt greener technology. For many commercial real estate investors, a thorough examination of local and regional climate-hazard risks and potential future regulations is already part of their required diligence.

Punching In…to Opportunity

The way the US office market works has changed—and will continue to evolve. We think it’s time for investors to start looking through the doom and gloom that enveloped the office sector after the pandemic. In reality, office dynamics vary. The challenges facing a Class B office building in Manhattan won’t necessarily tell us much about modern workspaces in Dallas.

The road ahead won’t be smooth, particularly for borrowers and lenders who face upcoming loan maturities. The cash-flow and occupancy challenges many offices face are real, and navigating the landscape requires regional knowledge and underwriting expertise. But a changing landscape begets opportunity, and for investors who have turned away from office, it may be time to punch back in.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Learn more about AB’s approach to responsibility here.