AllianceBernstein: What You Didn’t Know About European Offices

Clark Coffee| Chief Investment Officer and Head—European Commercial Real Estate Debt

Are European offices broken? We don’t think so. They’re just different.

Make no mistake: office properties face challenges on both sides of the Atlantic, including higher-for-longer interest rates and lower valuations that, in some cases, will create refinancing challenges. But we believe certain factors make European offices less volatile than those in the US.

This doesn’t mean now is the time to focus on office space. In fact, we think the opportunity set is more attractive in other commercial real estate sectors. But we expect demand for the right type of European office property to remain high, and investors who understand the differences between Europe and the US may have a better chance of tapping Europe’s potential in the future.

Office Supply: Europe May Have Less

So, what is it that makes Europe different?

Let’s start with supply. Remote and hybrid work arrangements have had far-reaching effects on the value and utility of office space everywhere. European gateway cities, however, tend to have less office stock per capita than US ones. This may be because most cities in Europe lack US-style “midtowns” and the glass office towers that dot so many US skylines (the La Défense financial and business district of Paris is an exception).

That’s an important distinction, because when those towers become obsolete, they’re notoriously difficult to convert into residential housing. Many are inflexible super-structures that come with environmentally unfriendly systems and floor plates that can’t easily or cost-effectively be adapted to suit tenant needs. Carving them into dwellings with plumbing and access to natural light is a challenge.

Based on our analysis of office space per capita, the US is the world’s most oversupplied office market, with considerably more space than major European markets, including the UK, France and Germany.

What’s more, the oversupply in many US gateway cities is dominated by outdated space that’s poorly suited to what employers and employees want out of offices today: aesthetically pleasing, environmentally friendly designs, with proximity to transit and open spaces that promote collaborative work environments.

Footprints Matter, Too

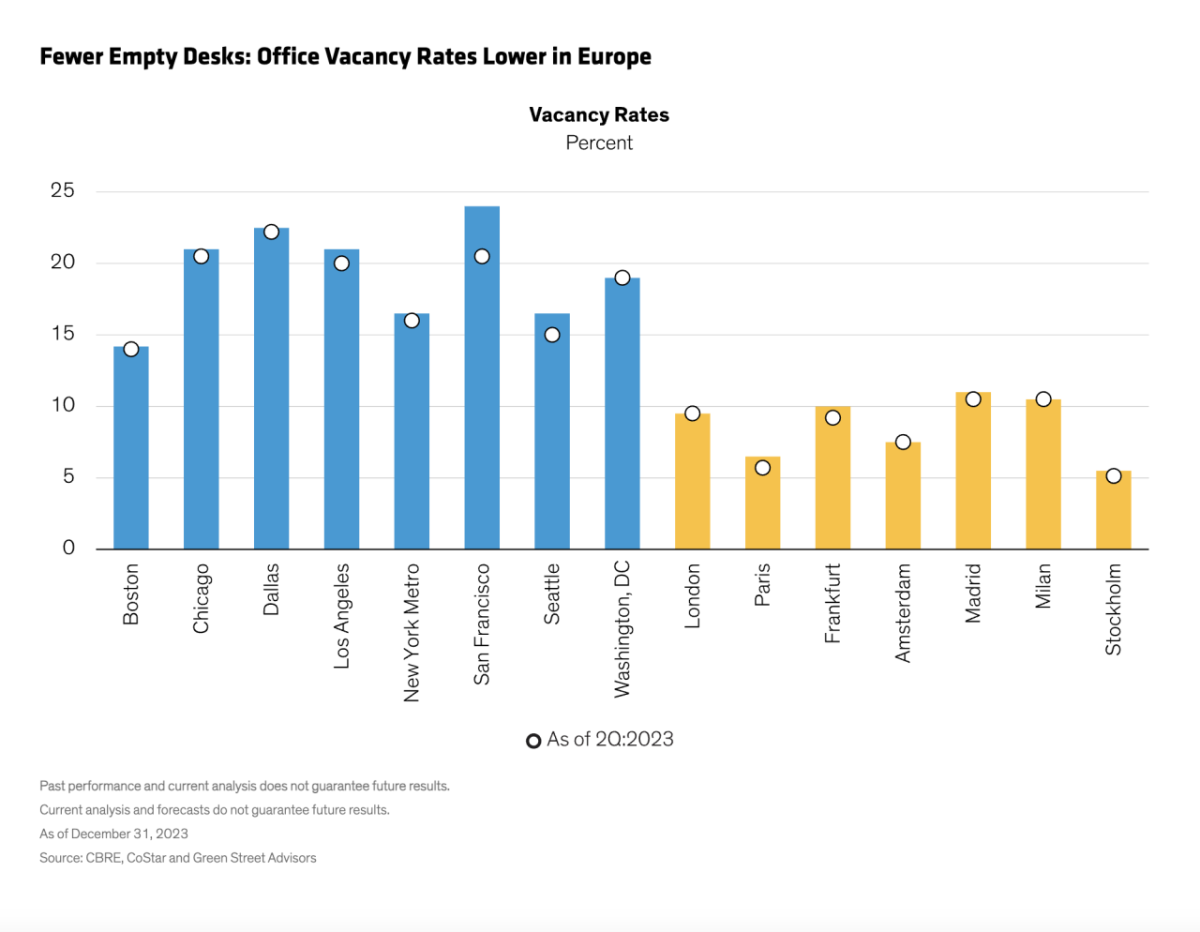

Europe may score better on supply issues because the smaller, narrower footprints of European buildings can be easier to repurpose. Between 2015 and 2022, for example, more than 73,000 residential units were created in the UK through the repurposing of outdated office stock, according to Savills, a global real estate services provider. This may help explain why office vacancy rates, which rose everywhere during the pandemic, are lower in major European cities (Display).

Change of Scenery: More Demand for Time in Office

There are differences on the demand side of the equation, too, that we think may shed more light on Europe’s lower vacancy rates in office space.

First, European homes tend to be smaller across most income levels, leaving little space for a home office. According to one study, homes in France, Germany, the Netherlands and the Nordic countries average two to three rooms per household member, compared with nearly four in the US.

Then there’s the comfort level of working remotely. European city dwellers are less likely to have air conditioning, so some may find working in an office more comfortable during the summer. In winter, the lack of double-glazed windows can make home offices too chilly.

European commute times are typically shorter, too. The reverse is increasingly true in the US, where drives to work are getting longer. Economists at Stanford University recently found that morning commutes between 50 and 74 miles rose 18% in the US between 2019 and 2024. Commutes of more than 75 miles rose by 32%. Some participants in the study said they could tolerate the longer commutes because hybrid work arrangements meant they only had to make them once or twice a week.

Greener Requirements Are Transforming Workspaces

European regulators are also influencing office supply and demand dynamics simply by requiring landlords to implement minimum energy performance standards before they can lease properties. As we see it, this does two things: it drives investment that will “future-proof” these properties while at the same time accelerating the obsolescence of properties that don’t make the grade.

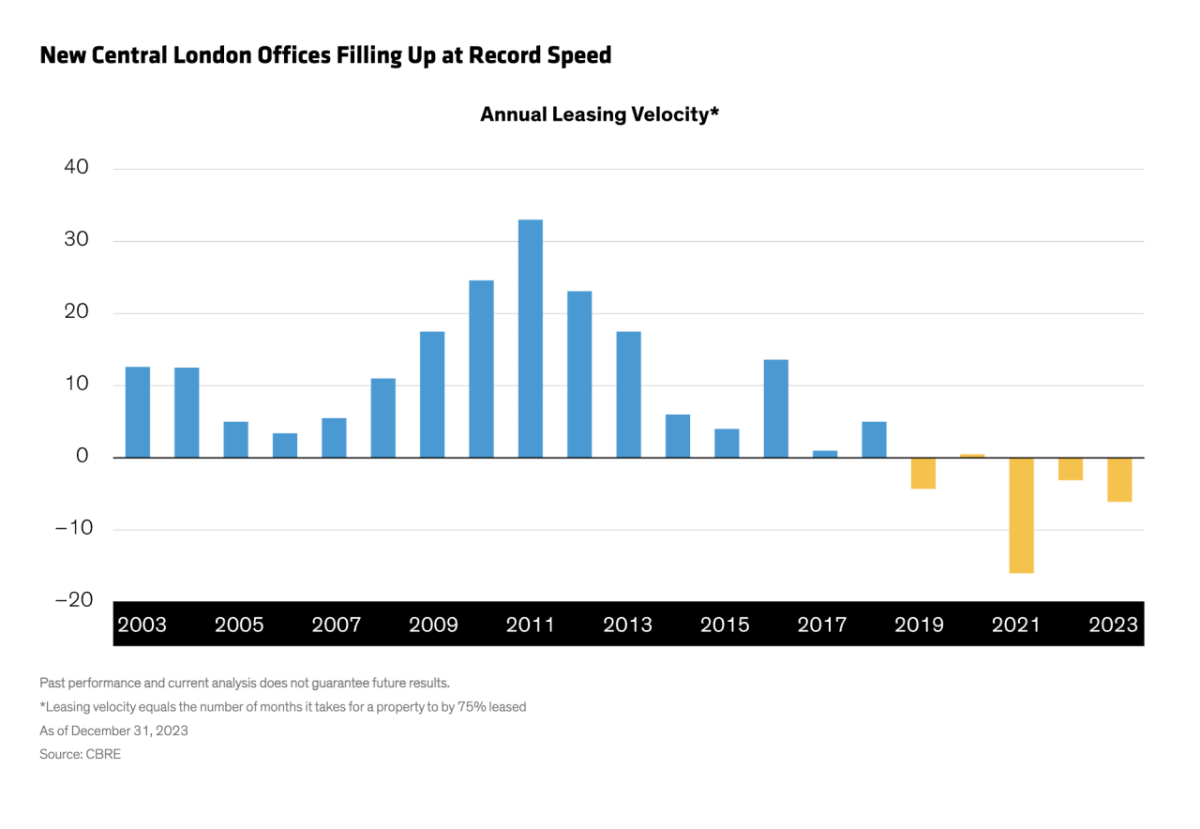

Leasing for “next generation” office space in London, for example, is near a 15-year high. This suggests that demand tends to be high for properties that tick the right boxes, which is visible in the declining length of time it takes them to reach a 75% leasing threshold (Display). In recent years, buildings have been 75% pre-leased (indicated by the negative bars) in an average of five months prior to completion.

We think this helps explain why prime office rents grew by an average of 4.9% across major European cities between the third quarter of 2022 and the third quarter of 2023.

Demand for “next generation” buildings is high in US cities, too, and we expect it to create opportunities for investors. But there’s a wrinkle: the US lacks a uniform federal mandate for environmental, social and governance (ESG) reporting, which can complicate development and leasing decisions. Opposition to ESG considerations in some areas of the country may also slow the process.

Don’t get us wrong: investors need to tread carefully when it comes to Europe’s office sector. For now, we think the most attractive commercial real estate investments can be found elsewhere. But those who avoid painting Europe and the US with the same brush may find it easier to capitalize on opportunities as they arise.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

About the Author

Clark Coffee is the Chief Investment Officer and Head of European Commercial Real Estate Debt. His previous business, Lacarne Capital, was acquired by AB in 2020 to establish the firm’s real estate debt business in Europe. Previously, Coffee was head of Tyndaris Real Estate, where he was responsible for building the business into a top-10 real estate debt fund in Europe. Prior to that, he co-headed origination for Deutsche Bank’s European commercial real estate credit business and oversaw the risk management and restructuring of more than €2 billion of troubled loans during the global financial crisis. Coffee holds a BA in economics from Lake Forest College and an MBA from the University of Michigan. Location: London/Frankfurt