Bloomberg Survey Shows Chinese Firms Embedding ESG Into Investment Strategies

Originally published on bloomberg.com

- Nearly two thirds of respondents reported challenges with the extent and quality of company reported ESG data

- Drivers for ESG seen as multi-faceted, including client demand, internal risk processes, and regulatory requirements

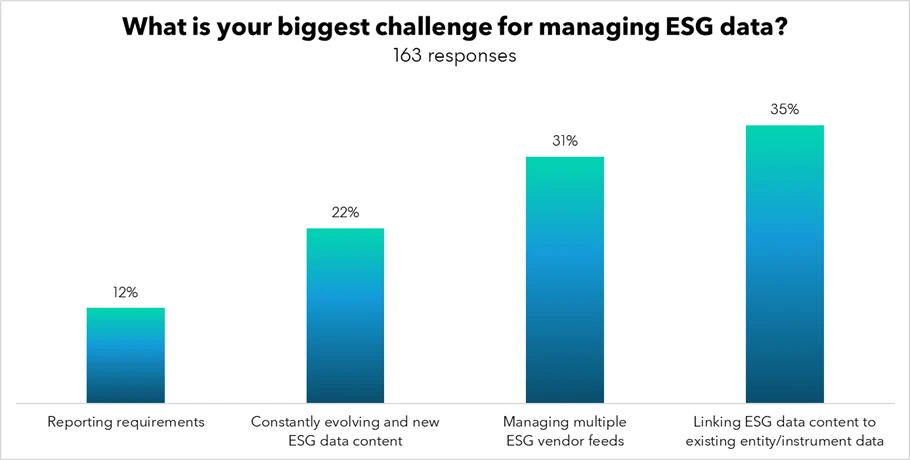

- Key data challenges include linking ESG data to existing entity and instrument data and managing multiple sources of data feeds

SHANGHAI, June 27, 2024 /3BL/ - A survey of over 150 responses from market participants in banking, insurance, securities, and technology who attended the Bloomberg Sustainable Finance Forum in Shanghai has revealed new drivers and challenges for embracing ESG data in China.

When it comes to adopting ESG data, responses were fairly evenly split across a range of categories. The leading reason for adopting ESG data within an organization was regulatory requirements (25%), followed by the demands of onshore clients (21%), offshore clients (21%), and internal risk management (22%). This survey follows Bloomberg’s European ESG Data Trends Survey announced earlier in the year where unsurprisingly, fulfilling regulatory requirements was a higher priority for European firms to access ESG data (35%).

Market participants in China are embedding ESG considerations into their decision-making in a variety of thoughtful ways. There was an even spread of use-cases including focusing on using third-party ratings, scores or related research (20%), focusing on impact investing (19%), and focusing on building quantitative strategies that utilize ESG data alongside other financial considerations (18%). Taking into account climate risks (16%) and biodiversity (9%) were also shown to be gaining traction among Chinese firms.

However, when respondents considered the challenges to greater use of ESG data, a clearer picture emerged. Nearly two thirds of respondents (62%) said their main ESG data challenge was related to issues with company reported data coverage and quality. Combining ESG with alternative data was the second biggest challenge faced by respondents (26%). These results align very closely with the European survey indicating there is still a way to go for standardized ESG data reporting by firms globally before financial market participants are fully comfortable with the results.

In terms of managing ESG data, nearly one-third (31%) of respondents indicated challenges with managing multiple ESG vendor feeds. This contrasts significantly from the European survey, where only 16% of respondents identified this as a key challenge. Respondents from the Chinese survey (35%) also found linking ESG data to existing entity/instrument data was a significant challenge.

Patricia Torres, Global Head of Sustainable Finance Solutions at Bloomberg, said that the findings were indicative of the significant appetite for high-quality ESG data and the changing role of sustainability in Chinese financial markets.

“There is a growing synergy between the demands of investors and regulatory drivers when it comes to the use of ESG data for Chinese market participants. Now, more than ever, the firms that are building capacity to incorporate and thoughtfully manage ESG data as part of their investment decision-making processes will have a positive point of difference. There is every indication that the role of ESG in China’s financial markets will continue to grow in importance over time.”

Bloomberg’s sustainable finance solutions span ESG data and analytics, indices, scores, regulatory solutions, sustainable debt, and climate risk. In addition, Bloomberg Terminal users also have access to ESG research from Bloomberg Intelligence and BloombergNEF. Clients can readily access ESG data on the Bloomberg Terminal via {ESGD <GO>} or across their enterprise via Data License at data.Bloomberg.com for use in proprietary or third-party applications in their cloud environment of choice. Through Data License Plus (DL+) ESG Manager, Bloomberg connects customers’ ESG data workflows to the full power of Bloomberg’s datasets as well as data from vendor partners, so clients can unlock maximum value with ease. For more information, visit Bloomberg Sustainable Finance Solutions.

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration.

For more information, visit Bloomberg.com/company or request a demo.

Media Contact

Irene Gu, igu3@bloomberg.net, +852-2977-2111

Tingyu Liu, tliu554@bloomberg.net, 86-10-8642-0337