Commercial, Industrial Manufacturers Press for Sustainability, Rethink Energy Options

Commercial, industrial manufacturers press for sustainability, rethink energy o…

By Jason Abiecunas, Director of Distributed Energy Resources; Daniel Chang, Market Development Services Lead for Distributed Energy Resources; and Randal Kaufman, Sales Director for Black & Veatch’s Transformative Technologies business

The changing energy landscape is prodding businesses to rethink how they use and manage electricity, and 3M Co.’s aggressive shift to renewable energy illustrates that thirst for sustainability.

The industrial conglomerate best known for its Post-it notes and Scotch tape called it “flipping the switch” when it converted its 12,000-employee, 409-acre campus at its global headquarters in Minnesota to renewables – the first step in its commitment to make its operations in more than 70 countries entirely powered by green sources of power. For now, in partnership with the regional utility, 3M aspires to get at least half of its electricity from wind and solar sources by 2025, with the rest of the makeover coming after that.

“We are continuing to step up our leadership toward a more sustainable future – in our own operations, and in solutions for our customers,” Mike Roman, 3M’s chief executive, said in unveiling the company’s quest to improve its environmental footprint and “accelerate global climate solutions.”

In manufacturing, it’s a dynamic time. Companies often have Environmental, Social and Governance (ESG) mandates – some foisted upon them by respective governments – when it comes to making their plants run efficiently, including sustainability goals tied to emissions reductions and bottom-line savings. Technology is rapidly evolving, with new, clean energy technology – notably renewable solar energy and battery energy storage – taking deepening root. Internet of Things (IoT) technology also is giving operators new tools to better understand and manage energy use. And stakeholders are taking heightened interest in their energy challenges, increasingly thinking long-term and investing in power independence and flexibility for the future.

According to the Black & Veatch 2019 Strategic Directions: Commercial & Industrial Report survey, most businesses in the commercial and industrial space – roughly two-thirds – have environmental sustainability goals and associated performance metrics, while one-quarter of respondents say they’re developing such roadmaps. Overwhelmingly, those sustainability objectives correlate to the respondents’ energy and water usage.

Perhaps unsurprisingly, larger companies – those with at least 5,000 employees – are setting the pace, with scant exception already having planned and adopted often sophisticated, comprehensive sustainability goals and related performance metrics. That status drops incrementally as the business’ workforce size gets smaller, to a little more than half among businesses with 500 to 1,000 workers. One explanation: Bigger enterprises may be better able to absorb the cost, for example, of committing and turning to onsite renewables such as solar energy.

Some of that transition to environmentally-conscious protocols may be attributed to certification best practices such as the ISO 14000 family of industry standards meant to give commercial and industrial interests practical tools to operationally be better stewards. While voluntary, such guidelines can assure companies, their workers and outside stakeholders that their environmental impact is being reduced by doing everything from lessening energy waste to designing and using packaging that’s biodegradable. Thinking outside the box, if you will.

Others are getting greener to literally make the grade, intent on getting a score they can show to a citizenry increasingly clamoring for better environmental practices by commerce and industry. The nonprofit CDP – formerly the Carbon Disclosure Project – tracks environmental impact, awarding scores ranging from A to D- according to how effectively greenhouse gas emissions are managed, measured and reduced. Although the group’s comprehensive, global collection of environmental data is self-reported, a high score can give the recipient bragging rights to publicize and market. Not only that, a better score may lead to a competitive advantage when peer companies are jostling for a contract award.

Tight Budgets, Regulation Holds Back Broader Sustainability Efforts

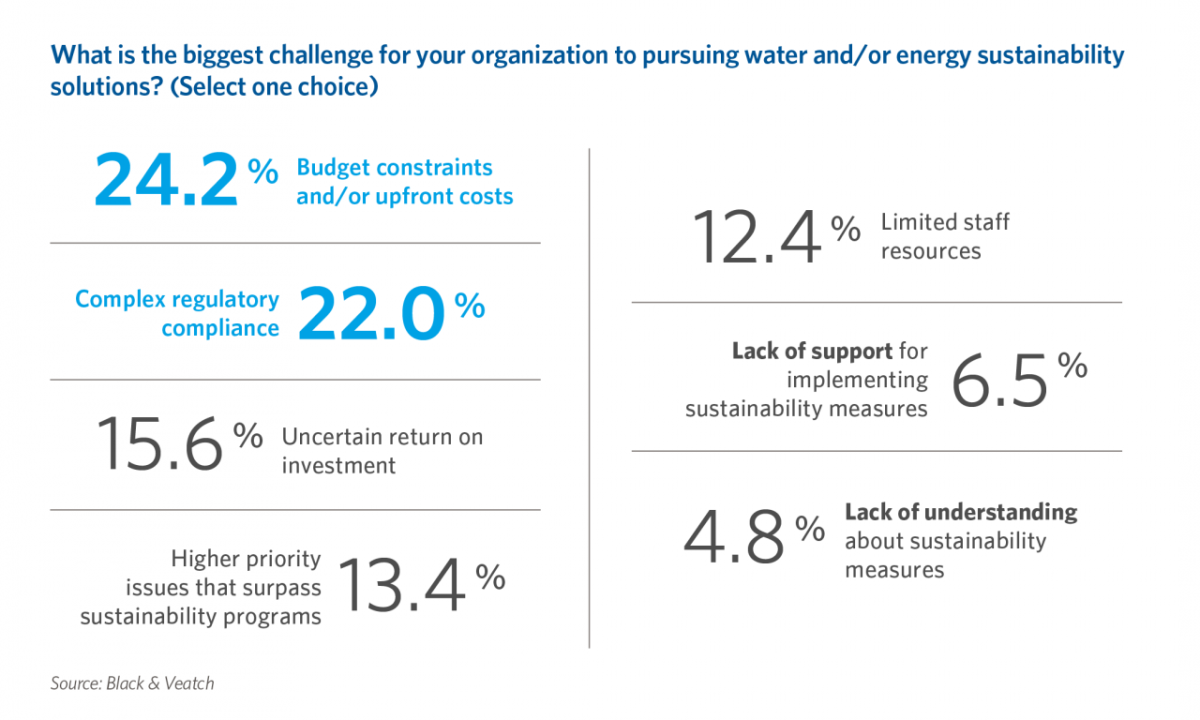

When it comes to barriers to broader adoption of sustainability solution, money still is proving to be the biggest obstacle. Black & Veatch’s survey found that roughly one of every four respondents cited budget constraints and upfront costs as being their biggest challenge in meaningfully improving their sustainability. More than one in five said the complexities of regulatory compliance were to blame, followed by “uncertain returns on the investment” – though it’s unclear if a respondent’s check on that box means he or she finds the return simply too low – and their focus on issues they deem more important.

Money also drives the discussion in industry when evaluating energy projects or investments, with two-thirds of respondents citing economics as an important or most important factor, followed by the quality of the power (57 percent). The least essential consideration: sustainability. That doesn’t necessarily mean sustainability isn’t valued; it’s just that sustainability benefits are reaped along with an economic advantage gained from an investment in sustainable energy projects.

Still, this question – and the answers to it – may be masking a lot of nuance among commercial and industrial interests when it comes to how and from whom they get their energy. Renewables are gaining a broadening footprint as they achieve price parity with power from the local utility. While craving sustainability, companies are gravitating toward the cheapest form of renewables or a basket of green energy options that gets them a reasonable cost of power. The catalyst: Businesses have a deeper menu of ways to satisfy their appetite for power, and they may see renewable energy – notably solar – in alignment with their sustainability goals, along with an upgrade in terms of economics, quality of power and reliability.

While some large companies have said they’d power a portion of their operations with renewable energy, many others have insisted they are taking an all-or-nothing approach by installing their own solar arrays, wind farms, energy storage, microgrids and other resources. A “RE100” listing by The Climate Group and CDP (formerly the Carbon Disclosure Project) shows that more than 120 multinational companies — many in the commercial and industrial space, including General Motors, Kellogg’s, Johnson & Johnson, Hewlett-Packard and Iron Mountain — have announced plans for their power to come entirely from renewable sources as part of a global corporate leadership initiative. 3M joined that fray in early 2019, committing to entirely renewable power for its global operations in coming decades, with an interim goal of 50 percent by 2025.

Many of these companies are generating their own energy through rooftop solar and buying renewable-based power from offsite, grid-connected generators. In addition to citing the environmental benefits of switching to renewable energy, they insist the business case for creating roadmaps heavily reliant on green energy is strong. Sustainable energy is now more than environmental policy intended to shave a company’s carbon footprint by being emissions-free – a movement that resonates with the public at a time of growing appetite for clean energy and of worries about climate change. It’s also a competitive advantage, giving companies a liberating sense of greater control over their energy costs. Talent attraction and retention also can benefit from a movement towards being more sustainable.

In 3M’s case, Climate Group CEO Helen Clarkson has said, that company “is building sustainability into its business growth strategy and showing the two go hand-in-hand.”

“Seeing such a large manufacturer commit to ‘go all in’ on renewables to produce sustainable new products is an encouraging step forward,” she added. “Big brands like this can influence positive action from other companies and customers and accelerate the clean energy transition around the world.”

As survey responses reflect, many in the commercial and industrial sector are eager to forge their own energy destinies by at least exploring renewables. One-third of respondents report that they’ve considered distributed energy resources (DER) or microgrids for resiliency and revenue generation, both for their facilities and as a benefit to the community. Nearly four of every 10 respondents say that while they haven’t considered DERs, there’s interest in exploring them.

Other companies are going the route of Power Purchase Agreements (PPAs) — particularly beneficial in that while they don’t require massive upfront capital investments, they offer the prospect of lower energy costs.

Whatever the case, manufacturers continue to awaken to the increasingly favorable economics of alternative energy options and giving them fresh looks, in many cases staking their own course by making the investment. With the counsel of experts in power solutions, greater sustainability – free of carbon – awaits them.

About the Authors

Jason Abiecunas is the Director of Distributed Energy Resources at Black & Veatch. With more than 15 years of experience, Abiecunas leads a team that delivers sustainable, resilient and cost-effective distributed energy solutions to address a wide range of power issues and enable our clients to capture new business opportunities.

Randal Kaufman is Sales Director for Black & Veatch’s Transformative Technologies business. With more than 15 years of experience in the electrical power industry, Kaufman has expertise in electric vehicle charging infrastructure and complimentary energy delivery systems, data centers, distributed generation, energy management, power quality and backup systems. He also spent two years in the stationary fuel cell power generation business, with special focus on application engineering and product development. His previous work experience includes ABB, ClearEdge Power, and Schneider Electric.

Daniel Chang is the Market Development Services Lead for Distributed Energy Resources at Black & Veatch. Chang has been involved in several recent projects with electric utilities to identify and develop new products and services to increase revenue growth and improve electric utility customer retention.