Electrified Fleet Vehicles and Mass Transit Gaining Momentum

Transportation accounts for more than one-quarter of the nation’s greenhouse gas emissions, according to the U.S. Environmental Protection Agency. In a country with more than 70,000 transit vehicles — and with buses averaging roughly 34,000 miles of travel each year — electrification of the U.S. fleet and mass transportation spheres is becoming a top priority for city officials and utilities as they reimagine how people and goods move sustainably across urban landscapes. Removing fossil fuels from mass transit will go far in reducing that carbon footprint.

Download the 2018 Smart Cities & Utilities Report

As battery and vehicle technologies advance the solution of efficient, environment-friendly transportation, the preference for electric vehicles — from passenger cars to metro buses and enterprise fleets — is the latest sign that electrified mass transit is growing. For example, orders already are mounting for Tesla’s electric-powered semi-truck that can haul 80,000 pounds roughly 500 miles — at 20 percent less than the cost for diesel. For transit providers and the communities they serve, what resembles exponential growth in adoption presents new challenges, requiring them to proactively and creatively engage now.

Such a transition — from acquiring the buses to upgrading the distribution grid and charging infrastructure, along with developing financing models to pay for it all — doesn’t happen overnight.

Roughly 5,000 public transit buses are purchased each year in the U.S. With more than 60 agencies demonstrating or deploying electric buses — 850 already are on order, with active requests for proposals for hundreds more — the number of fossil-fueled vehicles is about to shrink dramatically. Given the technological strides of recent years in battery storage and electric drive, a community or transit provider that once passively viewed electric buses as novelties is now considering how they can move people in cleaner, greener ways as these options increasingly become the obvious choice. Dozens of additional agencies each year are putting electric buses into play, either by testing the waters or jumping straight to large deployments of vehicles that already are proven in the most demanding duty cycles.

Many agencies are committing to completely electric fleets. Earlier this decade, Los Angeles County’s transit authority, the nation’s second-largest, retired the last of its fleet’s diesel buses and turned fully to alternative fuels, including cleaner-burning compressed natural gas (CNG), to cut air pollution in one of the country’s smoggiest regions. The region’s governing transportation authority recently agreed to invest more than $138 million for 95 electric buses – the first step toward replacing its entire CNG fleet and eliminating emissions from its more than 2,300 buses by 2030.

China has led the way in output of electric buses, having sold 115,700 of them in 2016 and 94,260 the year before that. In 2013, Chinese manufacturers sold just 1,672. The U.S. government is doing its part to support the drive to zeroemissions transit. Each year, the competitive “No/Low-Emission” grants provide tens of millions in funding for vehicles and supporting infrastructure. In September 2017, $55 million in federal awards were announced for four dozen projects to replace aging internalcombustion buses with efficient, cleaner transportation.

Those funds help transit providers launch or accelerate their vehicle and infrastructure programs even in the face of budget constraints or competing interests. For transit providers and the communities they serve, what resembles exponential growth in adoption presents new challenges, requiring them to proactively and creatively engage now.

Market growth in zero-emissions technologies is fueled by growing public awareness of new options that include electric- and hydrogen-powered buses, which provide cleaner air, a better experience for passengers and drivers alike, and increasingly support the imperative to cut greenhouse gas emissions. Federal and numerous state-backed programs acknowledge that electrification is primed to move beyond the combustion vehicles that contribute heavily to transportation pollution in cities. Key to the equation, electric buses have lower maintenance costs than their diesel or hybrid counterparts.

Much of this is due to the benefits of electric drive’s regenerative breaking that virtually eliminates replacing brakes and electric motors that don’t require costly rebuilds of their diesel counterparts. Not so long ago electric buses that were priced at about $1 million apiece have declined to around $750,000, with upfront cost parity just a few years away through economies of scale as demand and production volume increases.

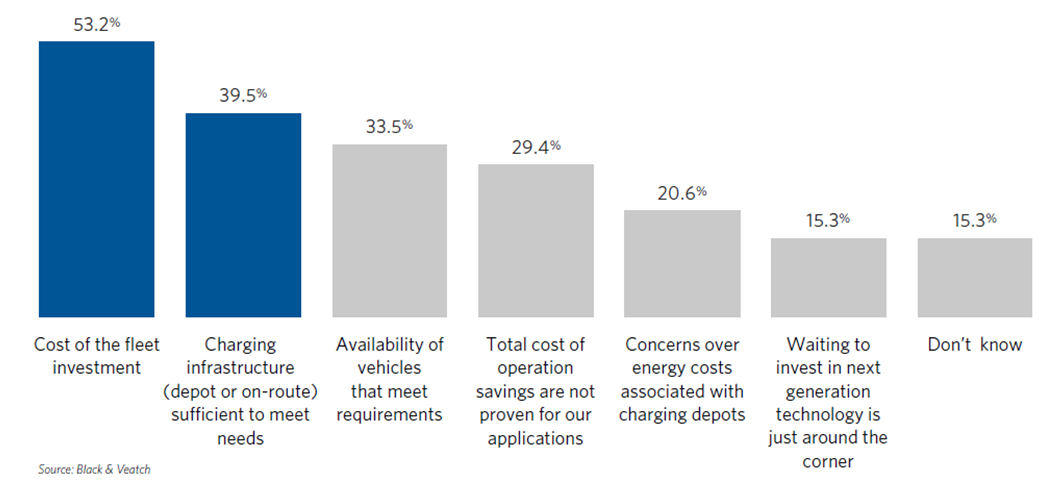

Still, cost considerations weigh on broader growth in the electric busing sector. More than half of survey respondents in the 2018 Strategic Directions: Smart Cities & Utilities Report listed the investment price as the biggest obstacle to adopting an electric fleet. Four in 10 respondents cited the sufficiency of a charging infrastructure, while one-third pointed to concerns about the availability of vehicles that meet requirements as an obstacle to electrifying a fleet (Figure 1).

When asked what is most important when considering electric fleets, 51 percent of respondents cited the total cost of operation and the return on investment from similar fleet applications, followed closely (48 percent) by the charging infrastructure needed. Electrified transit has broad applications well beyond metro busing. Shuttles at everything from airports to national and amusement parks and other tourist sites are poised for greater acceptance. Over-the-road coaches that can run 300 miles between charges are on the horizon.

Electric-powered school buses are picking up the pace, with a Daimler subsidiary, Blue Bird, and other manufacturers planning rollouts of new or enhanced all-electric models in 2018 or the following year.

Trucking isn’t being left out of the mix. Daimler is marketing its emissions-less eCanter, an allelectric, light-duty box truck designed, at least for now, just for around-town traffic, given battery limitations. In November, Tesla announced plans to hit the market in 2019 with an electrified, futuristic-looking truck tractor that can get 500 miles on each charge, even with an 80,000-pound payload. Tesla hasn’t yet revealed the sticker price.

Electrified mass transit has significant charging demands, and cities must determine how to scale charging infrastructure and manage increased electric loads. Enabling a robust EV charging infrastructure for vehicles requires industry, municipal and utility partnerships. Public transit agencies and utilities must develop infrastructure roadmaps to guide pilot studies and mass deployment for on-route and depot charging scenarios. The battery charging demands of large buses — and fleets of those buses — will create substantial loads for the grid that could necessitate distribution grid upgrades.

These capital-intensive upgrades require careful coordination with the host utility and have long lead times for engineering, permitting and construction. Utilities and cities should begin preparations now to design, finance and manage this new infrastructure.