Final Regulations Released for the IRA Section 45X Tax Credit

Final regulations revise previous guidance and provide clarity on 45X credit compliance

Authored by Baker Tilly’s Jiyoon Choi and Selene Cullen

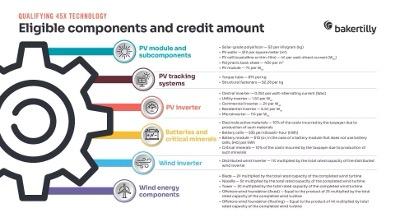

On Oct. 24, 2024, the Treasury released final regulations, subsequently published on Oct. 28, 2024, regarding the IRA section 45X advanced manufacturing tax credit established through the Inflation Reduction Act (IRA). The section 45X production tax credit provides an incentive for manufacturers to produce certain qualifying energy production components in the US. These final regulations will affect taxpayers intending to claim a section 45X tax credit on any eligible component they produce. The rules will become effective on Dec. 27, 2024 (60 days after publication in the Federal Register).

The Treasury and IRS officially finalized the proposed regulations published on Dec. 15, 2023, except for the regulations on section 1.45X-4(b)(1), which provides the requirements for aluminum to be considered an applicable critical mineral for the purposes of section 45X. The final regulations for section 1.45X-4(b)(1) will be released at a later date.

Updates and reiterations addressed in the final rule

The final regulations are generally consistent with the proposed regulations proposed on Dec. 15, 2023. Some updates or reiterations are addressed in the final regulations, such as:

- Clarifications to the definition of “produced by the taxpayer,” including confirmation that taxpayers may produce eligible components using recycled materials, and that eligible components produced by assembling other eligible components are still eligible for the 45X tax credit.

- Reiteration of the special rule for the production of certain eligible components, stating that the act of extraction alone does not produce an eligible component.

- Confirmation that subcomponents, constituent elements and materials used to make an eligible component are not subject to domestic content requirements.

- Confirmation that the 45X credit does not require domestic sale of the eligible components.

- Clarification on the sale of integrated components. A taxpayer will be deemed to have sold an eligible component if the taxpayer produced such a component and subsequently integrated, incorporated, or assembled it into another eligible component that is then sold to an unrelated person.

- Clarifications on the interactions between 45X and 48C, including confirmation that the physical proximity of facilities does not matter as long as each facility operates independently, and a revision to the regulations to remove the term “production unit” to avoid unnecessary complexity. The final regulations also clarify that eligible components can include subcomponents, constituent elements, or materials that were produced at a 48C facility.

- Revisions to the acceptable methods taxpayers can use to determine the specifications of eligible components (e.g., measuring the capacity of a solar module).

- Clarification that repowering equipment can be considered a form of on-site manufacturing and, in certain cases, can qualify for a 45X tax credit.

- Clarification on the credit’s anti-abuse rule. The 45X credit will not be available to a taxpayer if the primary purpose of the production and sale of an eligible component is to claim the 45X tax credit in a manner that is wasteful, such as discarding, disposing of, or destroying such a component without putting it to productive use.

- Revisions to allow taxpayers to include the cost of extraction and direct and indirect materials costs when determining the 45X credit amount for applicable critical minerals and electrode active materials. The extraction of materials must have taken place in the U.S. or a U.S. territory, and extraction costs can only be included if such costs were incurred by the taxpayer claiming the 45X credit. Direct and indirect materials costs can only be included if the acquired material is not an eligible component at the time of acquisition, to avoid crediting the same components twice.

Get started

The complexity of the 45X tax credit shouldn’t hold you back. Baker Tilly’s specialists can help eligible taxpayers fully leverage the 45X tax credit to maximize IRA credits. Contact a specialist today!