The Future of Energy

“New energy” is here, built on sustainability, clean energy tech, grid innovation

The concept of “new energy” has ushered in a global movement dedicated to cost-effective sustainability, clean energy technology and grid innovation. Today more than ever, we’re seeing stakeholders and industry giants from all sectors — finance, manufacturing, retail, utilities, technology, even academia — come together in combined efforts.

As recently as a few years ago, renewable energy, distributed energy resources (DER) and battery storage were considered little more than glorified science projects. But today, these former buzzwords are top of mind from both infrastructure and commercial investment perspectives.

We are seeing three trends gain momentum in driving the movement: the swiftly falling cost of wind and solar technology, improvements in battery storage from both a technological and economic perspective, and rampant growth of electrification, driven by the proliferation of electric vehicles (EVs).

So what does the future hold for the future of energy, specifically, for the next-generation power market?

A Changing Customer Base

Two major evolutions in customer demand will shape the future of energy going forward.

First, the traditional utility customer is changing. Utilities no longer are sitting on the sidelines hoping customers will just be happy that their bill is predictable and the air conditioning is operational. Instead, utilities proactively are investing in technology to enable unique programs and services that will allow them to better understand and serve their customers, as well as meet their obligation to maintain and modernize the grid.

At the same time, both municipal and investorowned utilities are coming to terms with the impact DERs will have on their traditional business models and the ability to operate a reliable grid given the added complexity of DER. For example, utility powerhouse Duke Energy submitted $7.8 billion to modernize grid infrastructure by upgrading traditional transmission and distribution to improve reliability and resilience and also to pilot emerging technologies that could play an integral role in what the grid of the future may look like.

Second, the overall customer base is changing, literally becoming a different ecosystem. Customers are now potential competitors, and the concept of accessible, distributed energy is bringing new entrants into the market. Large financial, commercial and industrial (C&I) customers now see energy as a viable business, and they are looking at renewables, DER and storage from a deeper angle than just corporate social responsibility.

C&I customers are actively targeting market share, in addition to their own capacity needs. They are looking at critical questions such as the following: How can we add sustainable resources? Better manage bills? Improve reliability and sustainability at our sites? Offer additional products and services to our customers outside of our core business? Today, it is more than just buying green power purchase agreements; the focus is on discovering new ways to drive profitability to a multidimensional bottom line. This is the new reality.

Facing Down the Death Spiral

Perhaps the largest issue disrupting utility leaders’ sleep is the foreboding “utility death spiral” — the ugly Catch-22 that occurs when more and more customers switch to self-generation and drop from the traditional grid, except for the need of a provider of last resort. Which, in turn, makes power more expensive for remaining customers (unless fixed infrastructure costs can be equitably recovered), thus making selfgeneration even more attractive.

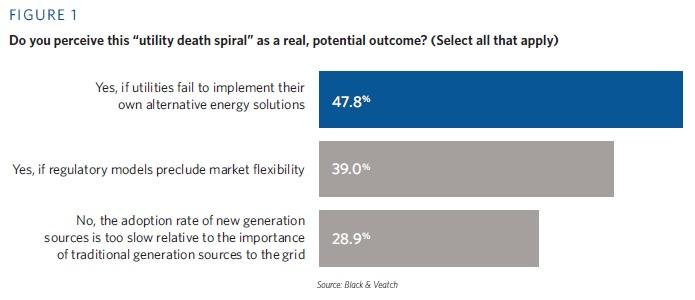

Nearly three-quarters (71 percent) of utilities see the death spiral as a real, potential outcome. According to results from the 2018 Strategic Directions: Electric Report survey, such a situation would occur if utilities fail to implement their own alternative energy solutions, or if regulatory models preclude market flexibility (Figure 1).

Although utilities can fully intend to work with their customers (both mass market and C&I) to deliver more reliable service while reducing costs, the reality is that utilities still bear significant fixed costs. A real market need still exists for conventional generation because renewables are intermittent, not to scale in many cases and not quite to grid parity on marginal cost.

The death spiral will be particularly worrisome for utilities with small service areas that have relatively high rates, especially as renewables continue to get less expensive and more prolific. There is immense value in connecting DER to the utility network, and it is a natural fit for utilities to deploy DER as part of their resource mix, but this won’t happen equally across the board; some will adapt easily, while others will not or cannot.

To survive, utilities must figure out whether they can offer their customers something compelling from an economic development standpoint.

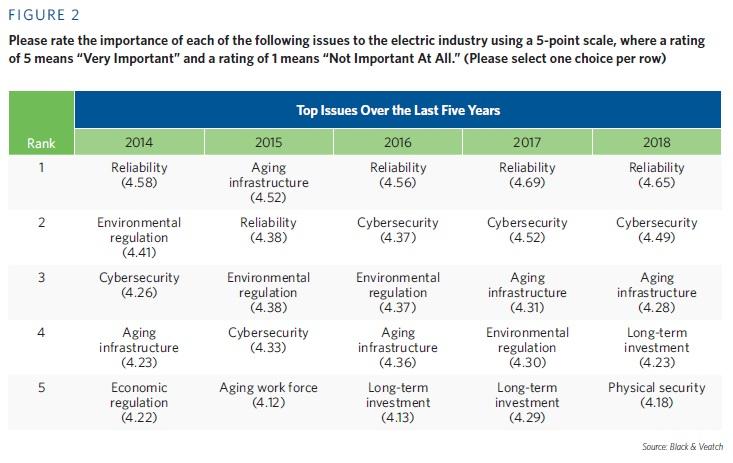

Survey results show that reliability is still key, followed by cybersecurity, aging infrastructure and long-term investment (Figure 2).

But second- and third-tier priorities are becoming more interesting. For example, what products and services are available to customers? What can utilities do to enhance reliability without incurring additional cost? Could a utility help a customer build a microgrid on-site that can be used for capacity, backup generation or demand response?

If utilities can prove that they are willing to serve customers in such a way, negotiating with and presenting a business case to regulators would be much easier. Enabling such unique offerings as performance-based rates, community solar and solar-plus-storage for all customer sizes can assist in shifting the utility model enough to slow down the proverbial downward spiral in earnings.

Building a marketplace for distributed energy will be a critical step.

Incredible opportunity is ahead — not only to embrace sustainable, green power but to save money and increase resilience across all operations.

Building a Marketplace

Developing a market mechanism where “transactional energy” can reside — and utilities can bid — would help ensure grid parity by getting ahead of critical issues such as intermittency.

The early energy storage marketplace offers a preview. The market was originally crowded with vendors, to the point that it was unsustainable; however, many vendors could not scale and ultimately fell out. Companies either will fall out because they can’t meet the demands of a broadbased and complex market, or those companies with great technology will get acquired. In addition, as large, global companies enter the market, we may see an enormous amount of consolidation in the next three to five years.

The marketplace concept is something the industry needs to address. But what would that market look like? How do we create it? What platform is it built on? In short, utilities would need to be incented to create an environment where more clean energy is used.

To make that happen, standardization will need to take hold, and this will be a fundamental change. Because everyone wants to be proprietary, a prevailing lack of standardization has hobbled the industry more than helped it. Standardized energy system infrastructure would allow for less custom engineering, and more plug-and-play designs — another big shift for all involved.

Creation of a marketplace will take time, but it is entering the conversation at a very high level with C&I customers and utilities. No matter the outcome, expect to see the truly sustainable, armed with technology that is fully automated and scalable, to rise to the top.

Looking Ahead

The conversation is changing, but chances are slim that the impact will be seen today. Billions of dollars won’t be spent on behind-the-meter batteries in 2018, and not in 2019 or 2020. At this point, the ripples of this new movement will be felt three, five, even 10 years down the road.

Even with that time line, however, incredible opportunity is ahead — not only to embrace sustainable, green power but to save money and increase resilience across all operations. Five years ago, the concept of new energy was an expensive proposition, asking utilities and customers to pay more for power than they would have otherwise, but today there is a business case AND a positive return on investment. That is a powerful statement.