G&A Institute’s New Research Shows Big Jump in Sustainability Reporting by Mid-Cap U.S. Public Companies in 2022

82% of Smallest Half of Russell 1000® Published ESG Reports; Record 98% of S&P 500® Companies and 90% of Total Russell 1000 Companies

NEW YORK, November 15, 2023 /3BL/ - Governance & Accountability Institute, Inc. (G&A), a leading consulting and research firm on corporate sustainability and ESG, today announced the findings of its 2023 Sustainability Reporting in Focus research on companies in the S&P 500® Index and the Russell 1000® Index. The research showed substantial increases in sustainability reporting for both large-cap and mid-cap U.S. public companies[1]. The largest companies in the S&P 500 are approaching 100% reporting, while mid-cap companies making up the smallest half of the Russell 1000 continue to close the gap with 82% publishing reports in 2022.

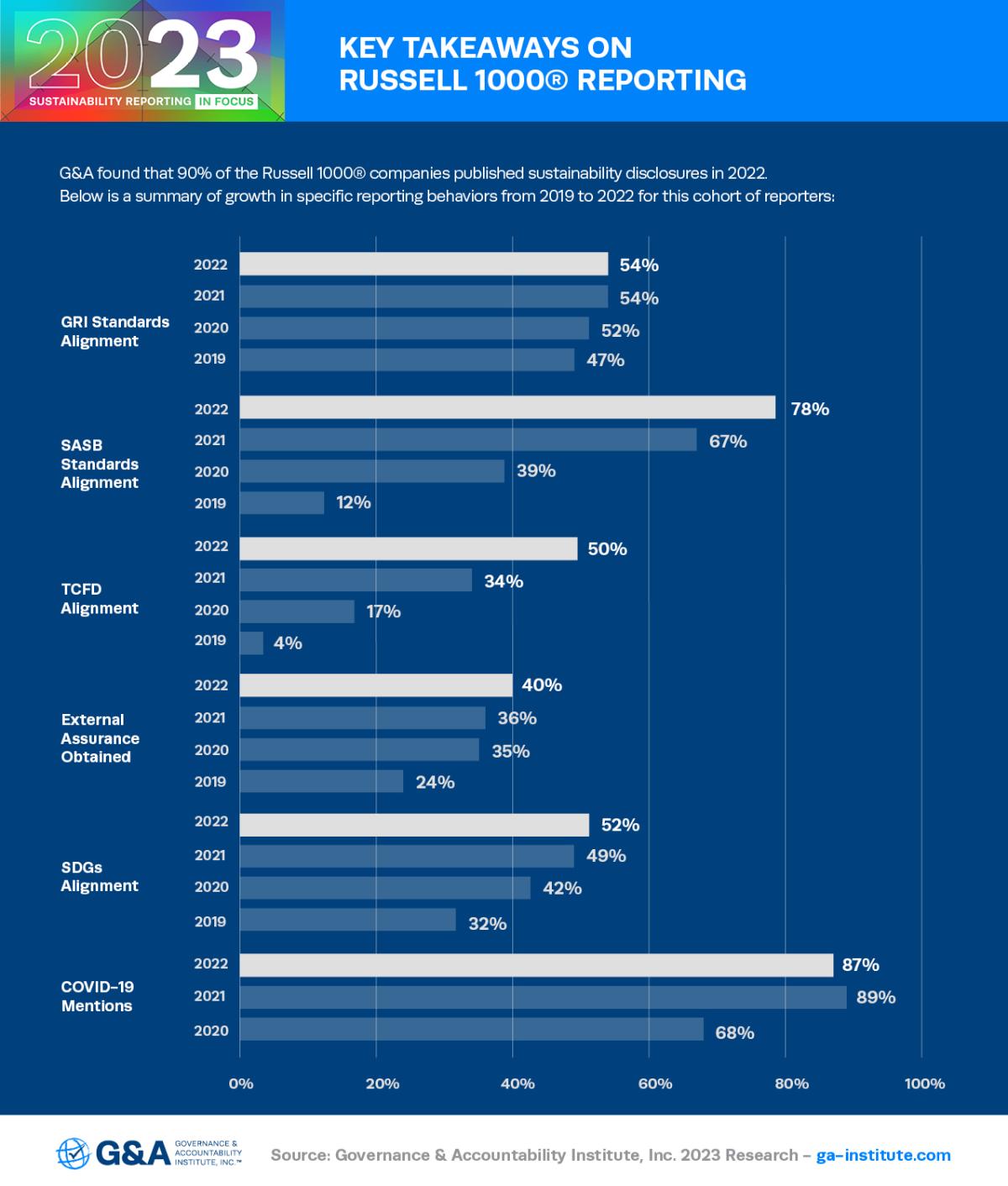

G&A’s 2023 Sustainability Reporting in Focus research analyzes ESG-related report content to provide detailed breakdowns of reporting frameworks and standards used – Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB), Task Force on Climate-Related Financial Disclosures (TCFD) -- as well as alignment with initiatives such as the UN Sustainable Development Goals (SDGs), trends in external assurance and CDP reporting, and breakdowns of non-reporters by sector. The latest edition of G&A’s research report is available here.

Key takeaways from G&A’s most recent research include:

- 90% of Russell 1000 companies published a sustainability report in 2022 - an increase from 81% in 2021.

- The smallest half by market cap of the Russell 1000 (mid-cap companies with approximately $2 billion-$4 billion in market cap) had the largest increase in reporting, jumping to 82% publishing a report in 2022 compared to 68% in 2021.

- Companies within the largest half by market cap of the Russell 1000 (i.e., the S&P 500) are nearing 100% reporters with 98% publishing a report in 2022 - an increase from 96% in 2021.

- Alignment with the TCFD recommendations continued to grow rapidly - now utilized by half of Russell 1000 reporters in 2022 - compared to 34% in 2021, 17% in 2020, and just 4% in 2019.

- Alignment with the GRI Standards remained consistent among Russell 1000 companies at 54% in 2022 when compared to the prior year.

- SASB remained the most-widely used sustainability standard among the Russell 1000 for the second year in a row - now utilized by over three-quarters of reporters (78%) in 2022.

- Discussions tied to COVID-19 remained high in 2022, with 87% of Russell 1000 reporters discussing the pandemic - compared to 89% in 2021.

Click here to view a graphical representation of the data noted above.

Louis Coppola, G&A’s Executive Vice President and Co-Founder, commented, “G&A’s annual Trends research has shown the progression of sustainability reporting to be unmistakably vigorous over the past decade. We stand at a pivotal inflection point today, with sustainability reporting shifting from voluntary to mandatory reporting. The increasing complexity of ESG disclosure, while challenging, presents immense opportunities for innovation and leadership within corporate America. We urge companies to embrace new ESG reporting standards and disclosure regulations as an opportunity to provide greater transparency and accountability to investors and all stakeholders. This is a chance for companies to redefine their legacy and set precedents that will define the future of our society and our one and only planet Earth.”

Hank Boerner, G&A’s Chairman, Chief Strategist and Co-Founder, added, “When G&A began analyzing sustainability reporting trends, there was a sense that U.S. companies were lagging behind European issuers in releasing important non-financial information, such as for ESG factors, sustainability, ethics, corporate citizenship, and the like. No more! Sustainability reporting best practices are now firmly established and being widely adopted not just by the largest companies but also by mid-cap companies. As a result, U.S. companies are better positioned than ever before for expected new regulations on climate reporting.”

ABOUT G&A’s 2023 SUSTAINABILITY REPORTING IN FOCUS

This new report marks the 12th annual edition in G&A’s annual research series tracking the publication of sustainability reports in 2022 by the largest U.S. publicly-traded companies. In 2012, G&A published its first annual research on 2011 sustainability reporting trends of the S&P 500 companies, which at the time showed just 20% of these companies could be considered sustainability reporters. In 2019, G&A expanded this research to include all companies in the Russell 1000 Index, finding that 60% of Russell 1000 companies and only 34% of the smallest half of the Index published sustainability reports in 2018.

G&A proudly recognizes our research team of talented analysts who made significant contributions to this study:

G&A Research Supervisor: Elizabeth Peterson, Vice President of Sustainability Consulting

G&A Team Leader: Natali Alsunna, Sustainability Analyst

G&A Honor Roll - Intern Analysts:

- Emma Haynes

- Grace Cusack

- Francesca Edralin

For more information on our team of research analysts please click here.

ABOUT G&A INSTITUTE, INC.

Founded in 2006, Governance & Accountability Institute, Inc. (G&A) is a sustainability consulting and research firm headquartered in New York City. G&A helps corporate and investor clients recognize, understand, and develop winning strategies for sustainability and ESG issues to address stakeholder and shareholder concerns. G&A’s proprietary, comprehensive full-suite process for sustainability reporting is designed to help organizations achieve sustainability leadership in their industry and sector and maximize return on investment for sustainability initiatives.

Since 2011, G&A has been building and expanding a comprehensive database of corporate sustainability reporting data based on analysis of thousands of ESG and sustainability reports to help steer strategy for our clients and improve their disclosure and reporting.

More information is available on our website at ga-institute.com.

ABOUT THE S&P 500®

The S&P 500 is widely regarded as one of the best gauges of large-cap U.S. equity market performance, measuring the stock performance of approximately 500 large-cap companies covering approximately 80% of the total U.S. equity market capitalization. In 2022, S&P Dow Jones Indices estimated that US$11.4 trillion in assets was indexed or benchmarked to the index. More information is available here.

ABOUT THE RUSSELL 1000®

The Russell U.S. indices are market-weighted indices that serve as leading benchmarks for institutional investors to track current and historical market performance by specific market segment (large/mid/small/micro-cap) or investment style (growth/value/defensive/dynamic). The Russell 1000 Index includes the largest publicly-traded U.S. companies by market cap, which make up approximately 93% of the total U.S. equity market capitalization. The indices/benchmarks are provided by FTSE Russell, a wholly-owned subsidiary of the London Stock Exchange Group (LSEG). More information is available here.

CONTACT:

Louis D. Coppola, Executive Vice President & Co-Founder

Governance & Accountability Institute, Inc.

Tel 646.430.8230 ext 14

Email: lcoppola@ga-institute.com

[1] Definitions of market cap sizes: https://www.finra.org/investors/insights/market-cap