Holistic Distribution Modernization Programs Require More Than Only Information Technology Upgrades

Electric utilities are realizing that distribution modernization programs, also referred to as grid modernization, can no longer be put off. Overhauling the electric distribution system will require upgrades to OT, as well as to the networks that allow IT and OT components to communicate to improve reliability. The benefits are clear: Grid operators need advanced sensors, communications and automation so they can see what’s happening in real time, which will lessen disruption while enhancing efficiency, reliability, security and safety.

More and more utilities also are looking into comprehensive programs that include efforts to deploy underground transmission lines and rehabilitate substations to further increase resilience. Managing distribution modernization efforts can be incredibly complicated, and survey results from the 2018 Strategic Directions: Smart Cities & Utilities Report reflect an industry still figuring out how technology and networks will work together in the modern grid.

Download the 2018 Smart Cities & Utilities Report

What’s Driving Distribution Modernization Investments?

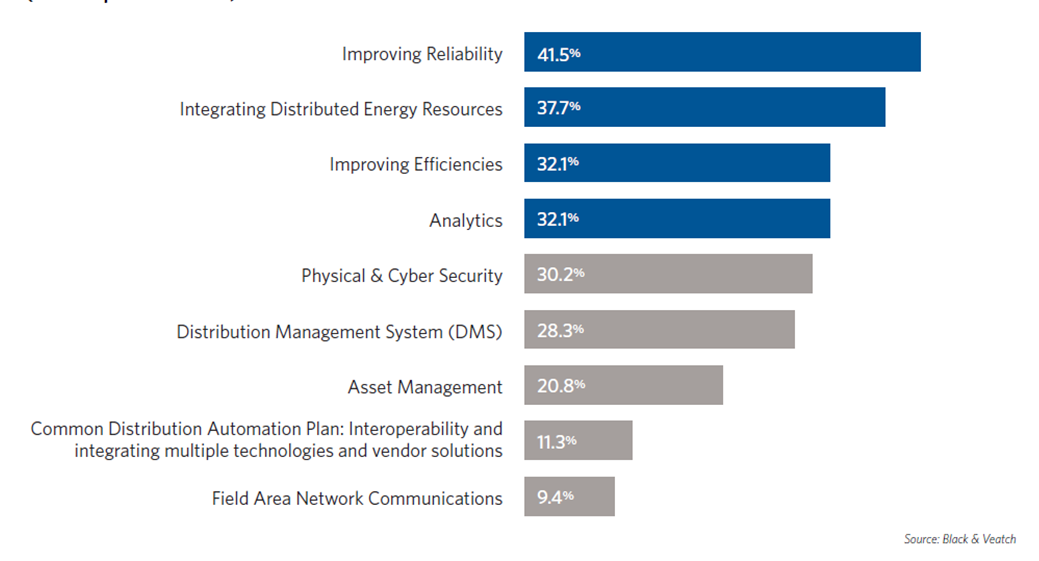

Today’s electric utilities are still focused on reliability, but nearly as important as maintaining a reliable grid will be integrating the growing number of DER being deployed. Improving reliability, integrating DER, improving efficiencies and analytics are the top four challenges facing distribution systems according to utilities, reinforcing the need for upgrades that will address those issues and more (Figure 1).

These large-scale changes, because of their reach and complexity, are often driven by policy, with many local regulators pushing statewide efforts. Regulators are becoming increasingly more involved in distribution modernization initiatives, while also wanting to accomplish more strategic environmental, cost-savings and fuel diversity goals.

With investments in the range of $100 million and up, state officials are working to better understand grid modernization dimensions and work more closely with utilities on planning. Black & Veatch has worked with several clients to host workshops where technology integrators, local authorities and utilities can discuss and collaborate about what is entailed in proposed or ongoing grid modernization programs.

Intelligent DER Integration Requires Regulatory Support

Many utilities see distribution modernization as built on a platform that can offer capabilities to improve customer experience and integrate DER. To meet DER deployment goals, organizations are adapting integrated system plans to identify ideal DER locations. Twenty-four percent of utilities forecast expected DER participation on a system-wide basis, while 19 percent integrate large-scale DER participation only into their ISP, and 11 percent forecast expected DER participation on a circuit basis.

The largest pool of respondents indicated that they are not adapting plans at this time. This surprisingly high percentage could point to utilities’ apprehension to collaborate with regulators until they have well-developed DER plans in place.

The need for increased regulatory support, however, was highlighted in survey results as a key to standardizing DER implementation. For example, some utilities must first determine the expected customer support level. Some utilities do not have a lot of headroom to raise rates, so they will need to explore cost recovery mechanisms that have to be approved by local government.

Many organizations require changes in the regulatory structure to encourage DER implementation; 61 percent indicated the need to de-link energy consumption from distribution rates. This change would likely be the easiest way to fund distribution modernization efforts. Updated connection charges (26 percent) and increases in fixed rate elements (26 percent) were other leading amendments suggested by survey respondents.

The focus on regulatory involvement signals a shift in the industry. Utilities are beginning to move past initial technology concerns and are realizing that technology, infrastructure, business models and regulations must all be taken into consideration for a holistic distribution modernization program.

Enhanced Monitoring To Advance Capital Planning

Many survey respondents still seem unsure of how all the elements will play together. For example, many utilities already have enhanced monitoring in place but are not using it to its full potential. When OT systems are fully integrated with business systems, data from enhanced monitoring can be used to make informed business decisions. However, only 39 percent of survey respondents are currently using smart monitoring to provide input into assessments of asset condition and their likelihood of failure.

For distribution modernization programs to be successful and scale, capital planning approaches need to evolve. Leading utilities are implementing integrated resource planning for their smart grid investments. Integrated resource planning takes into account how a utility and/or state is looking to the future using conventional resources, DER, energy efficiency goals, electric vehicle programs and more to meet the needs of its customers for the long term. Program management expertise in both smart metering and telecommunications networks can help leverage existing assets and optimize capital for infrastructure upgrades.

Assessing Distribution Automation Communications Options

Utilities are widely adopting advanced metering infrastructure in earnest, but the next step in distribution modernization is in automation. Automation will enable DER to support the grid without jeopardizing reliability. Regardless of DER deployment goals, distribution automation (DA) will be a foundational technology, but the electric industry may be underestimating costs.

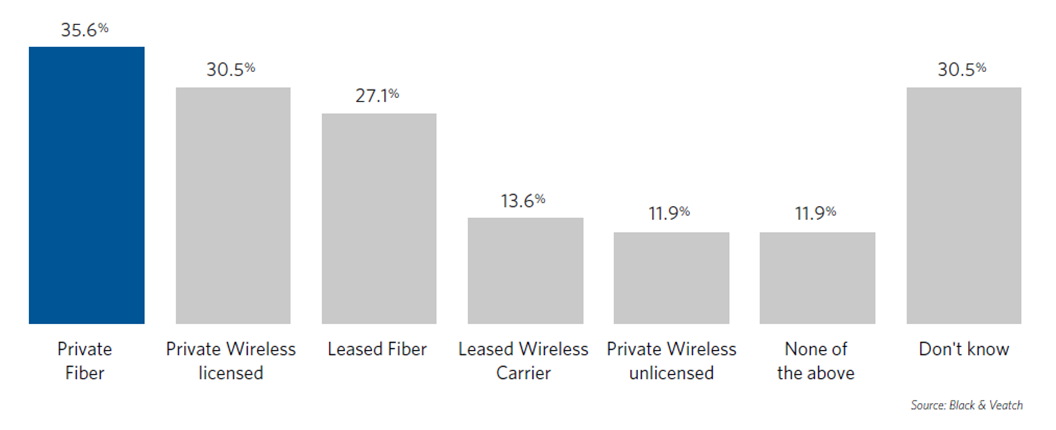

Just over a third of survey respondents (34 percent) are only planning to invest less than $10 million over the next three years in DA, which will rely heavily on suitable communication solutions. Private fiber is currently the most popular network option, chosen by 36 percent of utilities (Figure 2). This is unsurprising because one of the main drivers for DA is higher bandwidth, and private fiber-optic networks can accommodate the most capacity.

This is a point of contention in the telecommunications space because adequate broadband private wireless solutions are limited. Without a clear industry standard, Black & Veatch is investigating private long-term evolution options for utility clients that will allow those organizations to utilize licensed spectrum for optimal operations.

Most telecommunications networks require updates to support DA and enhanced transmission substation operations. While funding will continue to be a challenge, end-to-end planning, design and implementation expertise can play a critical role in selecting optimal technology and network solutions on the basis of system requirements. Collaborating with engineers, equipment vendors, regulators and utilities can ensure that technology solutions and advanced communications networks are configured to deliver a return on investment.