KeyBank Provides $36.4 Million of Financing for New Affordable Housing in Toledo, Ohio

CLEVELAND, January 21, 2025 /3BL/ - KeyBank Community Development Lending and Investment (CDLI) provided a $15.5 million construction loan, a $3.18 million permanent loan and $17.7 million in low-income housing tax credit (LIHTC) to finance the new construction of The Grand and The Glen, a scattered two site workforce affordable housing project in Toledo, OH.

The Grand and Glen will introduce 70 affordable family units to a vacant city-owned parcel and an underutilized parking lot. The project will target families with income levels between 50%, 60%, and 70% AMI levels.

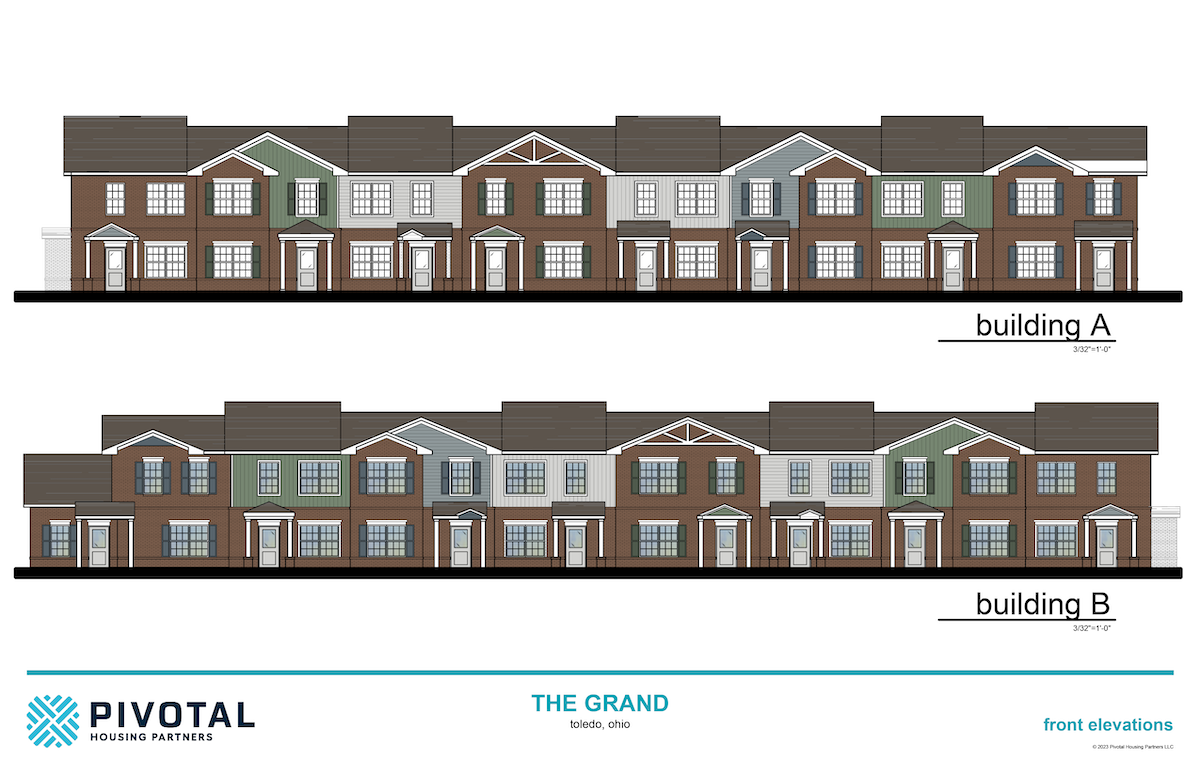

The Glen is a 50-unit four story building at the Southland Shopping Plaza. The Grand will be 20 townhomes at the corner of Detroit and Grand avenues. Both locations boast proximity to downtown Toledo, The University of Toledo Medical Center, and numerous major employers and sought-after amenities. The project will offer a mix of one- and two-bedroom apartments and three- and four-bedroom townhomes. All units prioritize thoughtful design, energy efficiency, and accessibility. Moreover, the development will encompass modern amenities, enabling residents to comfortably age in place. This scattered-site development aims to diversify housing options, rejuvenate vacant or underutilized parcels, and inject approximately $28 million of investment into the City of Toledo

The sponsor, Pivotal Housing Partners, is a top ranked Ohio-based multifamily developer and property management company with LIHTC properties operating in 16 states including Ohio, Indiana, Michigan, Illinois, Iowa, Missouri, Kansa, Oklahoma, Texas, Tennessee, Georgia, Kentucky, West Virginia, Pennsylvania, North Carolina, and most recently, New York.

Derek Reed and David Lacki of KeyBank CDLI structured the financing for the transaction.

About KeyBank Community Development Lending and Investment

KeyBank Community Development Lending and Investment (CDLI) finances projects that stabilize and revitalize communities across all 50 states. As one of the top affordable housing capital providers in the country, KeyBank’s platform brings together construction, acquisition, bridge-to-re-syndication, and preservation loans, as well as lines of credit, Agency and HUD permanent mortgage executions, and equity investments for low-income housing projects, especially Low-Income Housing Tax Credit (LIHTC) financing. KeyBank has earned 11 consecutive “Outstanding” ratings on the Community Reinvestment Act exam, from the Office of the Comptroller of the Currency, making it the first U.S. national bank among the 25 largest to do so since the Act’s passage in 1977.

About KeyCorp

KeyCorp's roots trace back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, Key is one of the nation’s largest bank-based financial services companies, with assets of approximately $190 billion at September 30, 2024. Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank Member FDIC.

###

CONTACT :

Laura Mimura

216-471-2883

Laura_J_Mimura@KeyBank.com

KEY MEDIA

NEWSROOM: Key.com/newsroom