Metlife 2018 Global Impact Report: Investing in Society

Read the MetLife 2018 Global Impact Report here

For more than 150 years, we have worked to build a more protected world by providing services and products that help our customers meet their financial needs and live fuller, more secure lives. Through other direct and indirect economic activities, including investments, job creation, benefit payouts and tax payments, MetLife also positively impacts millions of individuals and helps grow local economies.

Putting our customers first means making sure we can deliver on our promises several decades into the future. We therefore seek out diverse, stable and secure investments that offer competitive, risk-adjusted returns — a strategy that exemplifies our responsible approach to managing our entire business. Our global reach, financial strength, sizable investment portfolio and research-based approach combine to enable our customers and company to thrive. We employ a robust risk management culture, and within MIM, we carefully assess the risks and benefits presented by each investment, including relevant Environmental, Social and Governance (ESG) risks and opportunities.

The nature of our business creates far-reaching social value.

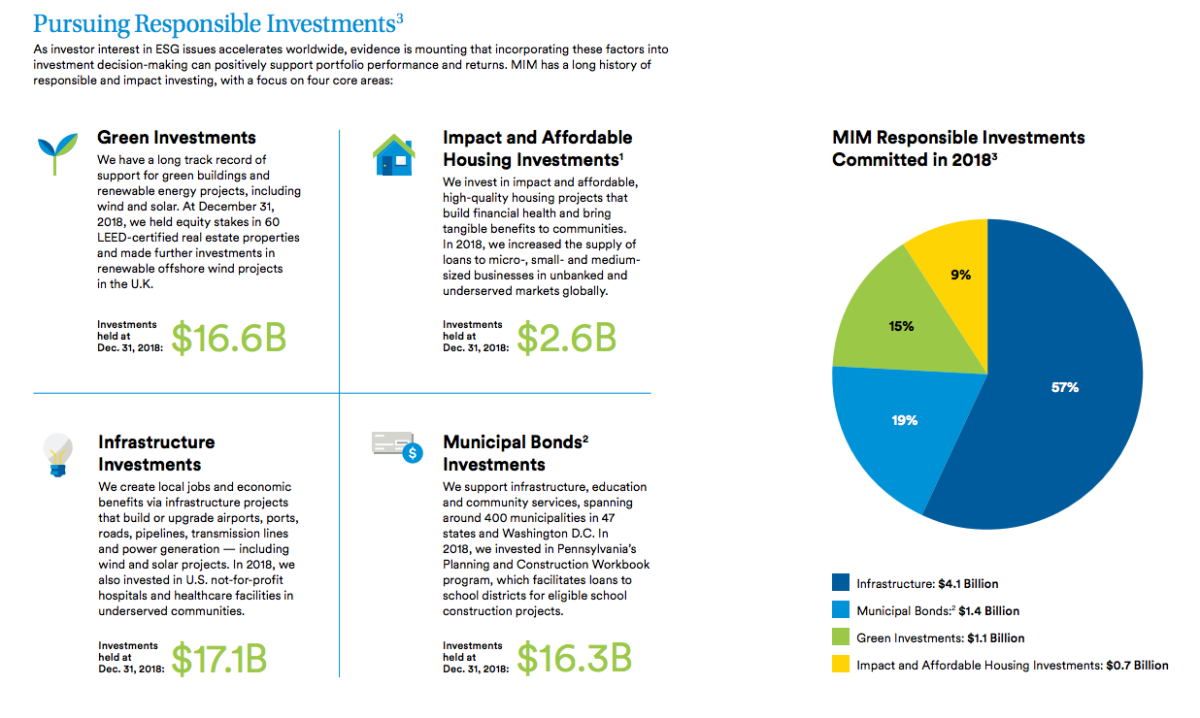

In 2018, MIM invested more than $7 billion to help finance projects that multiply our contribution to social and environmental benefits.

Investing Responsibly Through ESG Integration

We pursue investment practices that support a better world, reflecting our values and those of our stakeholders. Our responsible investment strategy incorporates a full picture of both relevant ESG risks and opportunities into decision making across our portfolio. This enables us to invest in ways that support sustainable long-term returns while contributing to social and environmental benefits.

Reducing ESG Risk

We apply an ESG lens across the MIM-managed portfolio in order to invest in companies whose practices reflect our values. MIM’s

investment methodology is based on a disciplined in-house research and underwriting process that leverages the expertise of our seasoned investment teams. Our new Sustainable Investments Strategies group will strengthen MIM’s ESG platform and build support for a deeper understanding and consideration of ESG principles across MIM.

Sharing Insights: Ride Sharing and the Future of Real Estate

In 2018, MIM published a groundbreaking report that explores how advances in transportation — including ridesharing services, self-driving cars, and electric vehicles — shape public transportation behavior and real estate building choices. Developed with MetLife’s Global Technology & Operations data analytics team, the report, On The Road Again, provides data-rich insights on real estate investment risks and opportunities.

MetLife Code of Conduct

MetLife’s Code of Conduct defines our expectations for appropriate business conduct, legal compliance and ethical decision-making by our people. Available in 21 languages, the Code applies worldwide and includes specific ethical guidance for personnel engaged in financial management. Each year, all employees must pledge that they commit to and comply with its provisions. Our Directors are also required to follow MetLife’s Code of Conduct. MetLife empowers employees to report ethical concerns and misconduct confidentially via multiple channels. Code violations may result in disciplinary action.