New Ceres Analysis Reveals Strong Corporate Climate Action Resulting From Shareholder Proposals

July 24, 2024 /3BL/ - A new report released today shows a high volume of corporate climate commitments resulting from shareholder proposals that were filed and withdrawn or received a majority vote in the 2021 U.S. Proxy Season and that most of these commitments have been implemented by the companies. The results highlight a substantial level of follow-through by companies on their promises to address climate-related financial risks and opportunities and responsiveness by companies to the climate-related requests of their shareholders.

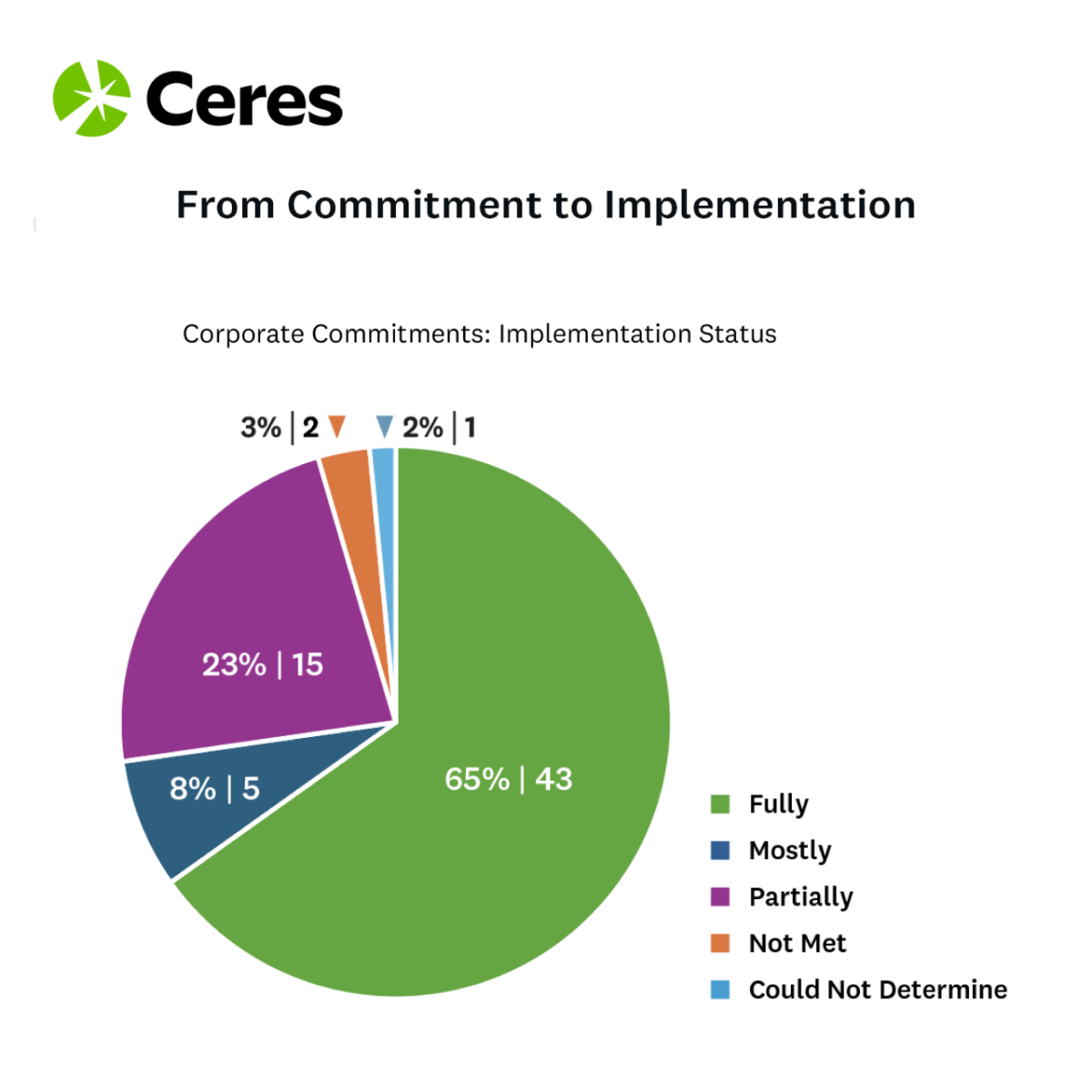

From Commitment to Implementation: An Analysis of Corporate Climate Actions from the 2021 Proxy Season examines the implementation of 66 corporate climate commitments following resolutions filed in 2021. Shareholders withdrew the resolutions in response to these commitments. By focusing on 2021, the report’s analysis gives companies a reasonable amount of time—three years—to act on commitments, including setting science-based greenhouse gas reduction targets and adopting global no-deforestation policies. The report also evaluates the high level of responsiveness to 18 proposals that received majority votes during that same proxy season. There is a widespread expectation among institutional investors and corporate governance experts that companies should implement the requests made in proposals supported by a shareholder majority.

“Our analysis shows that shareholder engagement on climate change continues to lead to actions that benefit investors, companies, and society,” said Rob Berridge, a senior director of shareholder engagement of the Ceres Investor Network at the sustainability nonprofit Ceres. “Shareholder proposals, along with constructive dialogue, result in a significant number of corporate commitments, and as our research reveals, most of those commitments are implemented.”

Investors file shareholder proposals to encourage companies to address important financial risks and opportunities. This process often leads to proposal withdrawals in exchange for company commitments to address shareholder concerns. In 2021, there were 70 withdrawals out of 151 climate-related proposals, resulting in a 46% commitment rate. (This report analyzes the 66 commitments where adequate information was available.) These commitments, which typically receive less public attention than proxy season votes, are the ultimate goal of the filers, who are seeking to strengthen long-term shareholder value. Since 2009, over a third of climate-related proposals filed with U.S. companies have been withdrawn due to such commitments, according to Ceres tracking.

Key findings from Ceres’ analysis include:

- 73% of corporate commitments made in response to the withdrawal of shareholder resolutions were fully or mostly implemented, highlighting a substantial level of follow-through by companies on their promises to address climate risks and opportunities.

- 94% of 18 majority votes were implemented in some capacity, with 61% fully or mostly implemented.

- 84% of implemented corporate commitments and 77% implemented majority votes were assessed as High or Medium quality by investors, indicating a strong level of satisfaction with the actions taken by companies.

Examples of companies acting are spotlighted in the report, from oil refiner Phillips 66 to food giant Kraft Heinz, underscoring the underreported story of investors and companies reaching agreements to address the business challenges and opportunities in the transition to a clean economy. The analysis also serves as an accountability mechanism, highlighting shareholder engagements that may require continued investor and corporate dialogue and follow-up to ensure companies take meaningful action.

Ceres’ analysis is primarily derived from assessments conducted by the shareholders who filed proposals, providing first-hand insights from investors ranging from pension funds to asset managers of all sizes, to faith-based institutional investors. This new analysis also reaffirms the findings of a previous Ceres report on the 2014 and 2015 proxy seasons, which showed similar positive results of companies implementing a high percentage of commitments they made to shareholders.

About Ceres

Ceres is a nonprofit advocacy organization working to accelerate the transition to a cleaner, more just, and sustainable world. United under a shared vision, our powerful networks of investors and companies are proving sustainability is the bottom line—changing markets and sectors from the inside out. For more information, visit ceres.org.

Media Contact: Vivian Melody, vmelody@ceres.org, 617-247-0700 ext. 353