New Ceres Guidance Helps Financial Institutions Find and Execute Sustainable Finance Opportunities

November 14, 2023 /3BL/ - Ceres today published strategic guidance to help U.S. banks and credit unions generate revenue while seizing on financing opportunities presented by the transition to a low carbon economy.

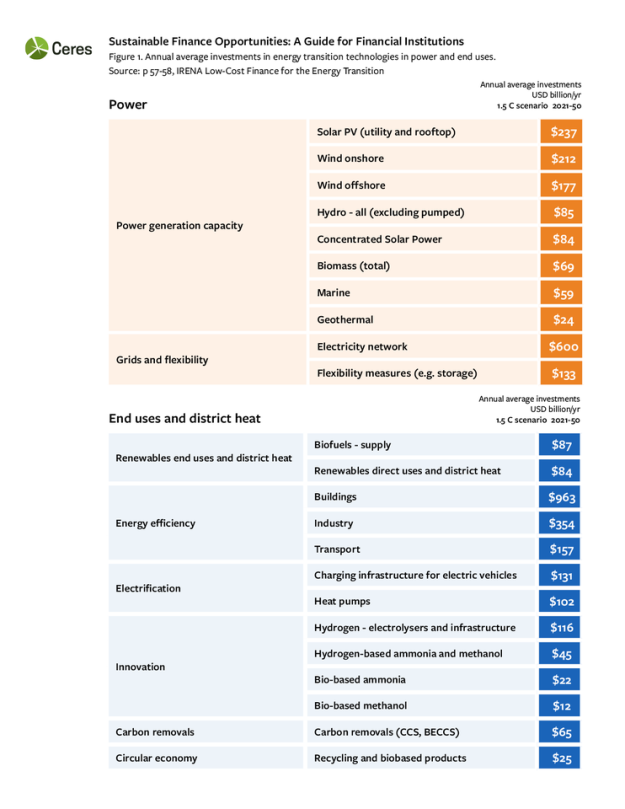

Sustainable Finance Opportunities: A Guide for Financial Institutions provides step-by-step instructions and helpful practitioner case studies on how financial institutions of all sizes can position themselves to engage existing borrowers, onboard new clients, and drive revenue growth by capitalizing on sustainable finance opportunities.

“By better positioning themselves for the transition to a low-carbon economy, banks have a unique opportunity to help their borrowers adopt more sustainable business models, while also driving long-term shareholder value,” said Jim Scott, CFA, Senior Advisor to the Ceres Accelerator for Sustainable Capital Markets. “The financial institutions that work their way up the sustainable finance opportunity ladder will not only thrive, but will have a unique first mover advantage."

Sustainable Finance Opportunities specifically outlines how financial institutions can:

- Engage borrowers with new sustainable finance products and services – including those that take full advantage of legislation like the Inflation Reduction Act,

- Drive new revenue opportunities through transition finance,

- Optimize their institution by deploying new profitability models like a return on carbon metric.

"To secure their future, banks must get ready to compete in the new energy economy,” said Blair Bateson, CFA, Director of the Ceres Company Network. “Financial institutions willing to act decisively position themselves as leaders in the global transition and as preferred banking partners for the corporate leaders of today and tomorrow.”

Ceres is a nonprofit organization working with the most influential capital market leaders to solve the world’s greatest sustainability challenges. The Ceres Accelerator for Sustainable Capital Markets is a center of excellence within Ceres that aims to transform the practices and policies that govern capital markets to reduce the worst financial impacts of the climate crisis. It spurs action on climate change as a systemic financial risk—driving the large-scale behavior and systems change needed to achieve a net zero emissions economy through key financial actors including investors, banks, and insurers. The Ceres Accelerator also works with corporate boards of directors on improving governance of climate change and other sustainability issues. For more information, visit ceres.org and ceres.org/accelerator and follow @CeresNews.

Media Contact: Diane May, dmay@ceres.org