New Report on Sustainable Investment Assets and Leading Trends

In its 15th edition, US SIF Foundation’s Report on US Sustainable Investing Trends identified climate action as the number one sustainable investing priority over the long- and short-term. The report, release in December 2024, documents $6.5 trillion in total US sustainable investment assets under management at the beginning of 2024. This represents 12 percent of the total US assets under professional management.

The 2024 US SIF Trends Report provides data on the US asset management firms and institutional asset owners using sustainable investment strategies and examines the environmental, social and corporate governance issues they consider in managing their portfolios. The report details the size of the US sustainable investment market, the Trends Survey findings, and emerging trends in the industry.

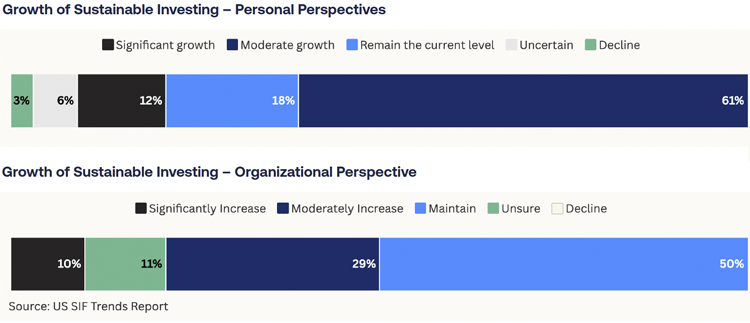

In addition to using advanced data analytics and AI tools, US SIF surveyed more than 250 — doubling responses to the 2022 survey — and found that addressing climate change and the clean energy transition were top priorities for respondents. Additionally, 73% of respondents expect the sustainable investment market to grow over the next one to two years, while only 39% of respondents expect their own organizations to increase sustainable investing, indicating that this growth is anticipated to come from broader market participants.

Read the full article here - https://greenmoney.com/us-sif-trends-report-documents-sustainable-investment-assets/

=====