New Report: Water and Climate Risks Are a Growing Threat to U.S. Corn Production

Growing number of food, livestock and retail companies are responding with push for more sustainable growing practices

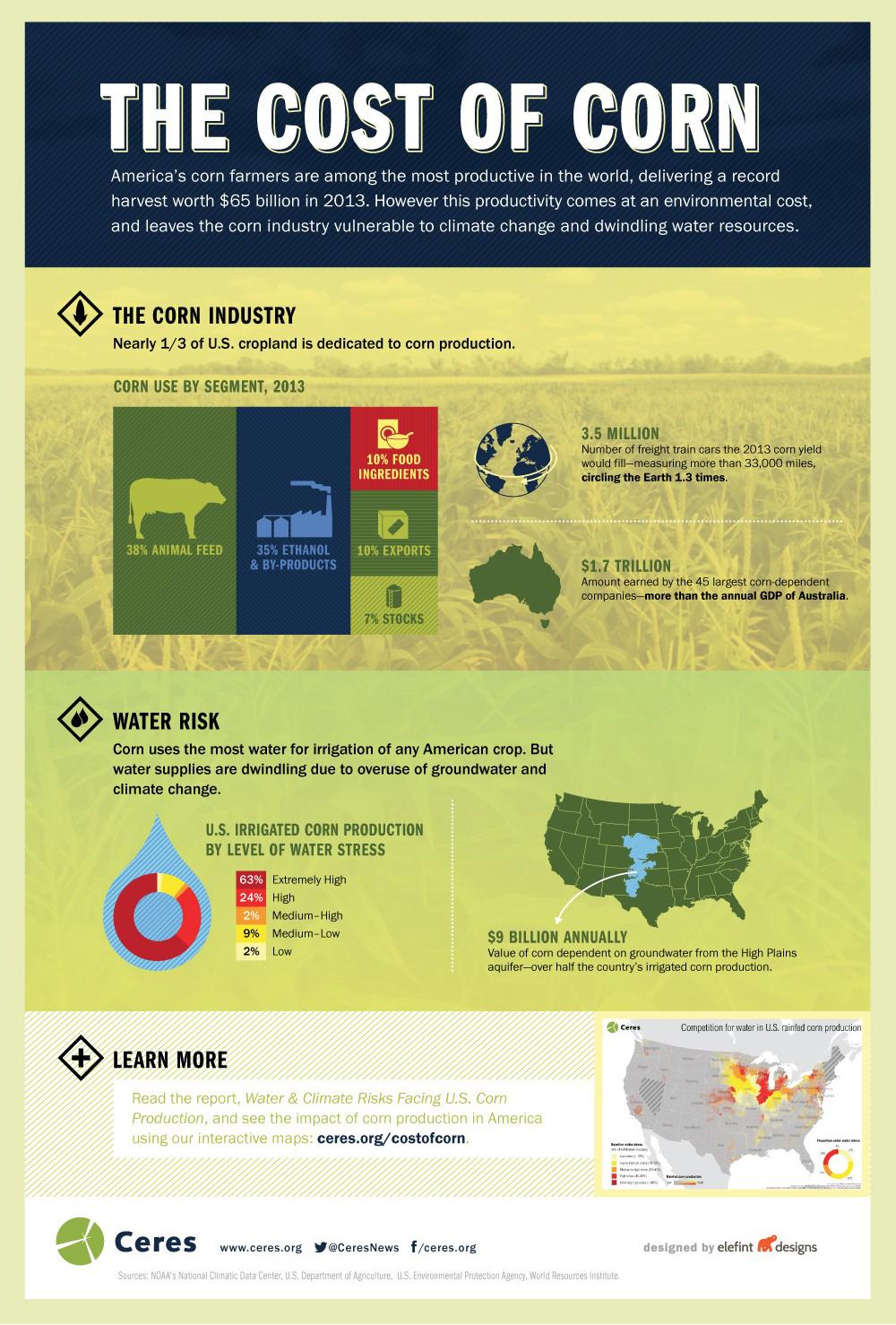

BOSTON, MA, June 11, 2014 /3BL Media/ – A new Ceres report released today shows that water and climate change risks are rising in the $67 billion U.S. corn sector, contributing to production and price volatility and growing concern by corn buyers that the nation’s largest crop needs to be grown more sustainably.

The report provides new data and interactive maps (www.ceres.org/cornmaps) on wide-ranging threats to U.S. corn production, including extreme weather events, groundwater depletion in regions with heavy irrigation demand, and contamination of waterways from inefficient fertilizer use. Among other statistics, the report finds that 87 percent of irrigated corn production is grown in water-stressed regions, and that corn growers in the Mississippi River Basin lost nearly half a billion dollars-worth of fertilizer in 2013 due to agricultural run-off into the Gulf of Mexico’s “dead zone.”

In response to these risks, a growing number of food and retail companies that rely on corn are developing supply chain initiatives to encourage more resilient and sustainable agricultural production in the sector, which has nearly doubled in size in the past two decades.

“Escalating corn production for our food, livestock and energy industries has put the corn sector on an unsustainable path, especially in regard to water quality and water use impacts and the growing ripples from climate change,” said report author Brooke Barton, Water Program Director at Ceres, a nonprofit sustainability advocacy group that works with companies and investors. “Corn buyers have an important role in recognizing this challenge and it’s encouraging that some are already trying to influence agricultural practices. Still, much more action is needed.”

Among the key findings and recommendations in the report, Water & Climate Risks Facing U.S. Corn Production: How Companies & Investors Can Cultivate Sustainability:

Groundwater Depletion and Irrigation Risks

Using GIS analysis, USDA and USGS data, as well as water stress maps from the World Resources Institute’s Aqueduct Water Risk Atlas, the report finds:

- Over half of the country’s irrigated corn production, worth nearly $9 billion annually, depends on groundwater from the over-exploited High Plains aquifer, which extends from South Dakota to Texas.

- 87 percent of irrigated corn is grown in regions with high or extremely high water stress, meaning there is limited additional water available for expansion of crop irrigation. Many of these same regions can also expect worsening water shortages due to climate change. Corn-growing areas in Nebraska, Kansas, California, Colorado and Texas are the most vulnerable.

- $2.5 billion of corn grain is grown in 20 counties over portions of the High Plains aquifer where groundwater levels are rapidly declining. Five counties in particular have over $150 million each in annual corn grain production at risk from groundwater depletion: Yuma County in Colorado, and York, Hamilton, Adams and Filmore counties in Nebraska.

- 36 ethanol refineries are located in and source corn irrigated with water from the High Plains aquifer. Of these, 12 refineries, with an ethanol production capacity worth nearly $1.7 billion a year, are in areas where aquifer water levels are dropping.

“No doubt, groundwater resources are being strained by corn production, especially in Kansas and my home state Texas, which face extraordinary groundwater depletion challenges,” said Bridget Scanlon, a groundwater specialist who leads the Sustainable Water Resources Program at the University of Texas. “The U.S. corn sector needs to greatly reduce its dependence on the High Plains aquifer. Failing to do so will have long-term negative consequences, including reduced agricultural productivity and less water for other uses.”

Climate Change Risks

Despite a bumper U.S. harvest in 2013 and lower corn prices in 2014, many of the drivers of high corn prices, price volatility and overall risk are likely to worsen, in large part due to climate change. Severe droughts, floods and heat waves at key moments in the corn-growing season are becoming increasingly common, causing dramatic year-to-year supply shocks. Among the recent examples: record high corn prices in the wake of extreme flooding in spring 2011 and the prolonged drought in 2012.

According to the latest National Climate Assessment released in May, the negative effects of climate change on agricultural production in the Midwest and Great Plains will outweigh any positive effects. Corn plants are particularly sensitive to high temperatures (which can reduce pollination and grain count) as well as to drought. Higher temperatures and increased water stress mean that increased irrigation for corn will be required. Given limited water availability in many parts of the High Plains, a northward shift in corn acreage is predicted. More frequent and intense precipitation events in the Midwest are also expected to negatively affect farmers’ ability to plant and increase run-off and erosion.

Fertilizer Use and Nutrient Pollution

Corn is fertilizer-intensive and every year millions of tons of nitrogen and phosphate fertilizer leach into groundwater and run off cornfields into waterways. Corn fertilizer run-off is the single largest source of nitrogen pollution to the Gulf of Mexico’s hypoxic “dead zone,” an area the size of Connecticut that is devoid of aquatic life.

Mapping county-level USDA corn production data and data on nitrogen loading from the USGS, the report finds:

- Inefficient fertilizer use in 2013 cost growers $420 million from run-off into the Mississippi River, and eventually the Gulf of Mexico. (Nitrate pollution due to fertilizer use by agriculture also costs water utilities $1.7 billion a year according to the USDA.)

- 60 corn ethanol refineries with $8.8 billion in annual production capacity are sourcing corn from watersheds with high local nitrogen pollution from agriculture.

Corn Buyers’ Response

Ceres’ report finds that 16 separate sectors from fast food companies to fertilizer manufacturers to grocery retailers depend on U.S. corn as a key ingredient for their products, or as a market for their inputs and services. In 2013, the top 45 companies in the corn value chain earned $1.7 trillion in revenue, which is more than the annual GDP of Australia.

A growing number of food & beverage companies and grocery retailers are increasing demand for more sustainable products, are setting public goals to source more sustainable ingredients, and are participating in new supply chain initiatives to help farmers address the risks profitably. Among these encouraging efforts:

- Walmart recently announced a goal for U.S. farmers in its supply chain to increase efficiency of their fertilizer use by 30 percent on 10 million acres of corn, wheat and soybeans by 2020.

- Coca-Cola announced in July 2013 a goal to sustainably source all of its key agricultural ingredients by 2020, including the corn that goes into its high fructose corn syrup.

- Field to Market – a multi-stakeholder initiative involving major growers associations, agribusinesses, food companies, retailers and other groups – has developed sustainability metrics and an online calculator for farmers of U.S. row crops, including corn, to promote continuous improvement and data reporting in the supply chain.

"A critical factor for improving the environmental performance of production agriculture is to get the individuals managing the land, the farmers themselves, to see that environmental stewardship enhances profitability and is crucial to the long term viability of modern agriculture," said Paul Helgeson, Sustainability Manager at GNP Company, a Minnesota-based poultry company.

Recommendations

Despite these efforts, many companies that depend on U.S. corn are not yet taking steps to address these risks. The report recommends how corn-buying companies and their investors can incentivize farmers to reduce risks, enhance yields and protect water resources. Recommendations for companies include:

- Setting a corporate policy with time-bound goals for sourcing agricultural ingredients (including corn) that are grown more sustainably.

- Integrating requirements for more sustainable agricultural production into supplier codes and procurement contracts.

- Supporting corn growers to adjust farming practices by providing direct agronomic assistance, performance guarantees and credit, as well as financial support to local and regional organizations that assist farmers.

- Supporting federal and state government policies that address climate change and encourage risk-reducing, environmentally beneficial farming practices and water stewardship.

Maps and Infographics

The report includes four interactive maps and infographics showing corn production and ethanol plants relative to regions of water stress, groundwater depletion and nitrogen pollution: www.ceres.org/cornmaps.

About Ceres

Ceres is an advocate for sustainability leadership. Ceres mobilizes a powerful coalition of investors, companies and public interest groups to accelerate and expand the adoption of sustainable business practices and solutions to build a healthy global economy. Ceres directs the Investor Network on Climate Risk (INCR), a network of over 100 institutional investors with collective assets totaling more than $12 trillion. Ceres also directs Business for Innovative Climate and Energy Policy (BICEP), an advocacy coalition of nearly 30 businesses committed to working with policy makers to pass meaningful energy and climate legislation. For more information, visit www.ceres.org or follow on Twitter @CeresNews.