New Study From FSG Examines the Essential Link Between ESG Targets and Financial Performance

BOSTON, September 15, 2022 /3BL Media/ - ESG (environmental, social, and governance) funds are projected to reach $53 trillion by 2025. So it’s no surprise that leading companies are setting ambitious ESG targets. But despite years of effort to integrate ESG and financial performance in business, strategic decisions continue to be made in ways that lead to social and environmental damage.

The problem is that too many companies position “sustainability” as an afterthought, a retroactive risk management remedy for the consequences of strategic and capital allocation decisions made only with a financial lens.

Such companies are going to miss their opportunity to win in the emerging green and just economic transition.

In The Essential Link Between ESG Targets and Financial Performance in Harvard Business Review, FSG’s cofounder Mark Kramer and managing director Marc Pfitzer describe why doing the math on the “impact intensity of profit” is necessary to meet both financial and ESG targets and thus open the way to exploring business model and ecosystem transformation that will outcompete in today’s economy.

“Companies that don’t link the social and environmental consequences of their businesses directly to their business models and strategic choices will never fully deliver on their ESG commitments,” the authors warn in their article.

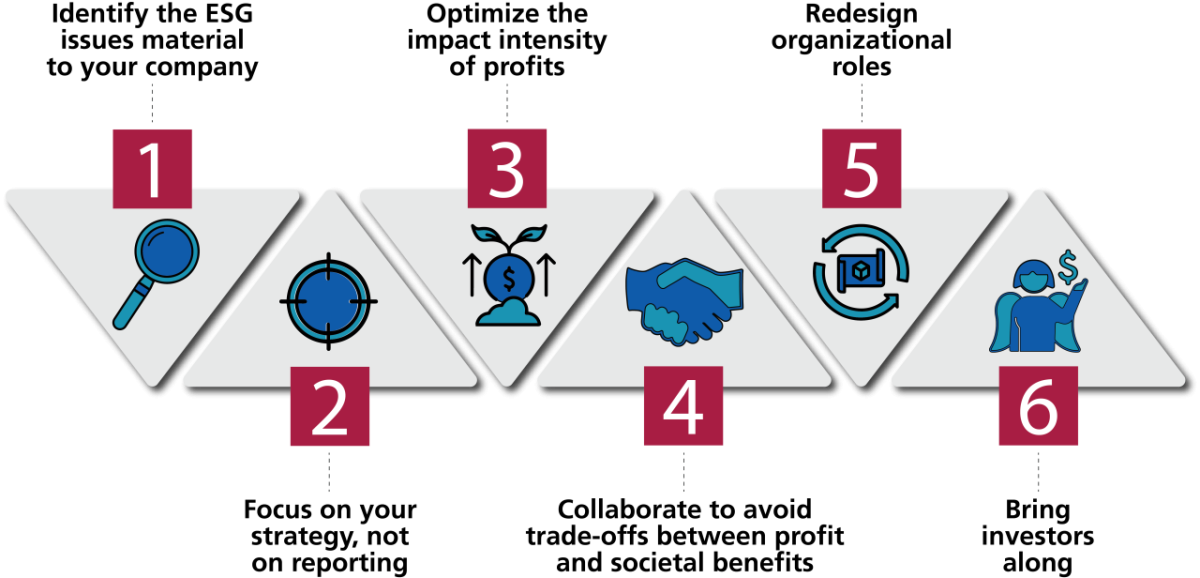

They propose a six-step process that companies can use to fully integrate ESG performance into their core business models. One of the keys to success will be collaboration with other stakeholders—companies, governments, and NGOs—requiring a new degree of cross-sector trust and collaboration.

“We cannot continue the path we are on today, where companies’ social and environmental actions are after-the-fact interventions disconnected from strategy and decision-making. Focusing on shared value and the economics of impact will lead companies to make fundamental changes to their business models, capital investments, and operations, generating meaningful opportunities for differentiation and competitive advantage. In doing so, they will create an economy that truly works to close social inequities and restore natural ecosystems,” the authors conclude.

Read The Essential Link Between ESG Targets and Financial Performance in Harvard Business Review.

About FSG

FSG is a global, mission-driven consulting firm that partners with foundations and corporations to create equitable systems change. Through customized consulting services, innovative thought leadership, and learning communities, we’re working to create a world where everyone can live up to their full potential.

We believe real change requires an expert understanding of systems. As advisors and facilitators who blend rigorous data analysis with empathy, we are comfortable working in complex environments with clients, partners, and community members. We share the insights from our work on topics that range from equity and shaping markets to strategy, learning, and evaluation. With our partners, we develop initiatives and grant-funded programs to put some of those insights into practice. These efforts include Talent Rewire (engaging employers for equitable economic mobility), GLOW (empowering women in India), PIPE (supporting activity-based learning in India), the Shared Value Initiative, and the Collective Impact Forum.

Learn more at www.FSG.org.