Non-Traditional Third-Party Clients Impact Energy Distribution

Driven by new tech and a growing commitment to sustainability, companies are managing more DER than in the past

Maturing technologies and a growing emphasis on energy efficiency and sustainability are leading organizations to manage more DER than in the past. Bolstered by more financial and mechanical flexibility behind the meter, companies are becoming increasingly energy independent and investing more in alternative generation, storage and energy efficiency.

Get the 2018 Strategic Directions: Electric Report

As a bonus, being able to sell the energy they create has also lowered power bills while opening up new streams of revenue. The success of DER applications depends heavily on the type of facility. According to responses to this year’s Strategic Directions: Electric Report survey, the industry sees large-scale facilities that require enormous amounts of power to be the best venues for DER. When asked to rank these facility types, more than half (54 percent) pointed to industrial parks/industrial facilities, followed by academic campuses and universities, military installations and government facilities, and hospital/healthcare facilities (Figure 1).

On the flip side, smaller facilities with less energy needs may not be the best candidates, appearing near the bottom of the list. Fifteen percent said DER has a place in residential, multi-family homes, 12 percent said single-family homes, and 4 percent said retail locations.

Although entry into DER can be prohibitive for many reasons (e.g., enormous upfront costs to invest and the technology’s notorious intermittency), these technologies still are being driven heavily by organizational commitments to sustainability. In fact, about half of survey respondents said it is their organization’s (or their customer’s organization) commitment to sustainability that is the main reason they are involved with DER or microgrids.

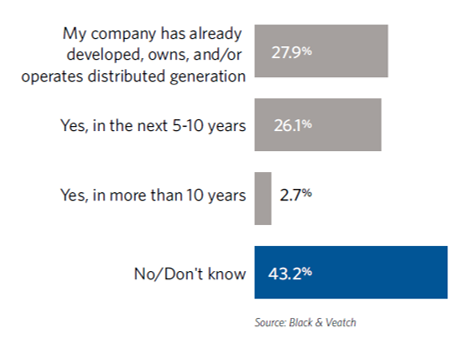

But the survey suggests that the industry faces a long road ahead before using DER becomes mainstream. When polled on their plans to develop, own or operate any DER (including microgrids), 43 percent said no or they do not know if it’s something they will invest in, 28 percent already are developing, own or operate distributed generation, while 26 percent plan to do in the next five to 10 years (Figure 2).

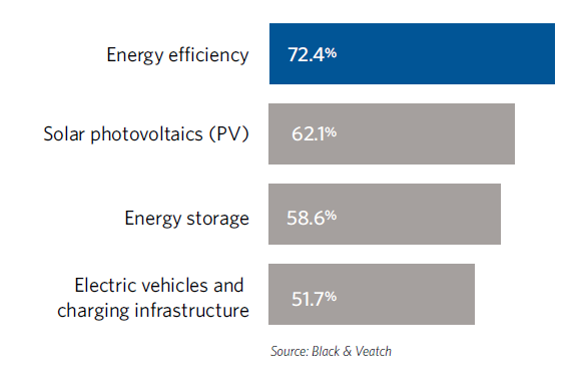

Of those organizations actively developing or promoting DER technologies, nearly threequarters (72 percent) said they are actively investing in energy-efficient measures such as efficient appliances, LED lightbulbs, smart thermostats, weatherization or new system technology that can help managers better manage their energy loads (Figure 3).

Making a significant mark in the results was “electric vehicles and charging infrastructure,” which 52 percent said is a technology in active use as the growth of energy storage and EV charging networks become more prominent in the electric market. Experts believe the solar industry has become more saturated but will continue to grow, but that energy storage and EV markets will continue to expand.

Just as change and innovation have taken place in hardware and software, the new frontier of DER has created new opportunities to buy and sell electricity, especially as the cost of making electricity now can be tracked minute by minute.

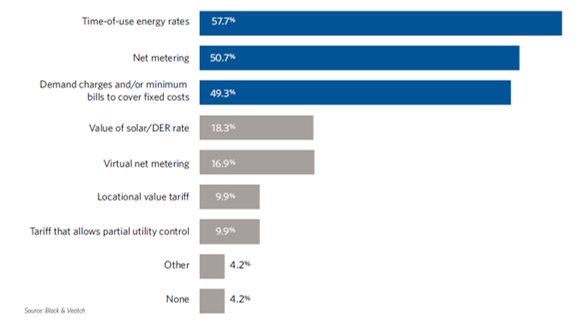

One of the trending DER-specific rate structures is “Time of Use,” which allows the utility to have less financial risk in the production of its power. Based on power availability and usage throughout the grid, the utility can calculate and set rates practically by the minute. The third party also gets the benefit because the technology makes them more educated and capable of planning their electrical use accordingly to keep costs down.

More than 57 percent of survey respondents said they would prefer to offer or take advantage of Time-of-Use energy rates, while just over half found net metering appealing (Figure 4). DER activity continues to take place primarily in the pilot or demonstration project arena, where subsidies have made financing possible while giving new technologies a venue to develop and fine tune. More than 40 percent of respondents described their DER investments as demonstration or test projects, while more than 20 percent said DER was no part of their investment plans.

The survey results also hint at the growing significance of behind-the-meter revenue sources, with three-quarters of respondents seeing revenue opportunity behind the meter. Only about 18 percent of respondents believe there is no opportunity for revenue behind the meter. Experts believe this shows that the attention going on behind the meter from a DER perspective is not trivial. The level of revenue anticipation among respondents is significant. Of the nonutility responders, there is more automation and attention to demand response while looking to create revenue for their companies.

On the utility side, these results validate that even with a monopoly on their customer base, they must find new revenue sources by pushing more products and services to their users. They must start thinking more like traditional businesses than traditional utilities and take more risk on products and services that are tied to a profit and loss statement rather than a rate base.

With organizations taking on a lot more energy functions with the increase of new technology and power generation hardware, the survey revealed a large gap between the amount of DER in play and the use of distributed energy resources management systems (DERMS) that help manage it via computer software. According to the survey, only 1 percent of respondents are actively using DERMS, with another 7 percent testing a portion of their system. However, more than 60 percent have no plans for installing a DERMS or don’t know if they ever will. Experts attribute the gap to many organizations deciding to start managing their DER in a piecemeal fashion or independently, which can be extremely difficult and overwhelming.

Before DER activity grows further, utilities must examine the barriers that continue to stand in the way of progress. Not surprisingly, funding and the cost of technologies remain the biggest obstacles blocking DER growth. More than half of respondents (56 percent) cited the “economics of DER,” while 55 percent named the price of DER technologies as their biggest barrier. Experts believe that to keep investment in DER healthy, financial subsidies will need to remain a key part of the financial equation. Otherwise, investment in DER and overall pace of the market could suffer.