Principal Financial Group 2023 Sustainability Report: Protecting the Environment

Managing climate impact

Originally published in Principal Financial Group 2023 Sustainability Report

Protecting the environment

Managing climate impact

To create a more secure world, we pledge to be responsible stewards and mitigate our impact on the planet. Our long-term climate goals and plans are aligned with science- based targets to address climate change and support the transition to a low-carbon economy.

Our approach

Managing our greenhouse gas (GHG) emissions is the primary focus of our broader environmental strategy. Across the company, we’re working to understand GHG emission sources to enable accurate measurement of scope 1, 2, and 3 GHG emissions and formulate reduction strategies.

Our goal

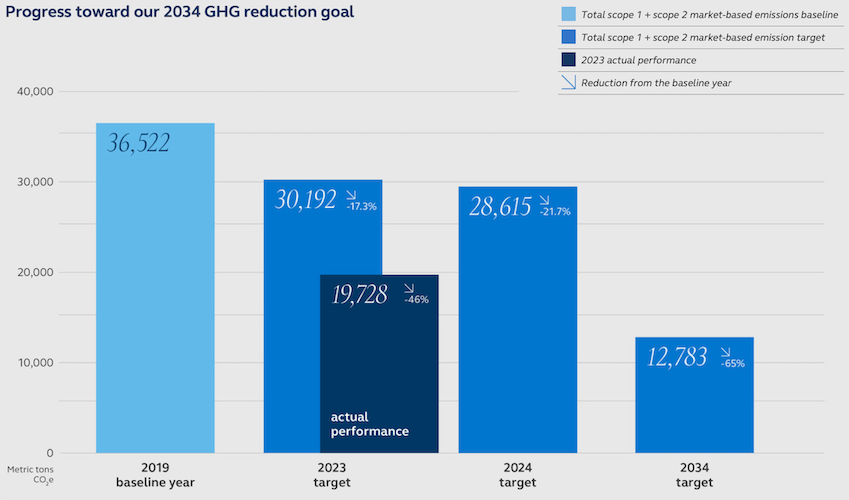

Starting from a 2019 baseline, we aim to achieve a 65% reduction in our global scope 1 and scope 2 market-based GHG emissions by 2034 and achieve net zero GHG emissions by 2050. Our 65% reduction target over a 15-year period aligns with the Science Based Target initiative’s (SBTi) 1.5°C scenario. On average, our annual glide path goal is to achieve a 4.3% reduction in global scope 1 and scope 2 market-based GHG emissions. Based on current and available data, we are confident we can achieve our goal, and we monitor progress annually to ensure we’re on track.

Our actions and performance in 2023

Scope 1 and scope 2 GHG emissions1

We have been measuring and reporting our U.S. GHG emissions since 2010. In 2022, we began collecting and reporting global emissions for locations we either own or control. Out of our global scope 1 and scope 2 market-based emissions, our U.S. emissions represent nearly 76%.

We saw meaningful decreases in our emissions both in the U.S. and globally in 2023. Our U.S. GHG scope 1 and scope 2 market-based emissions decreased by 13.9% from 2022 to 2023, and our global scope 1 and scope 2 market-based GHG emissions decreased by 14.6% over that same period.

Our emissions decreased as a result of changes to leased office spaces and favorable weather, among other factors. We closed a data center in March and moved those services to a leased location, which reallocates our electricity usage to a downstream asset.

In our leased office spaces, we downsized one building and closed another. One other building became unoccupied between 2022 and 2023, resulting in reductions in our electricity usage. We also made improvements to our lighting fixtures in our parking ramps, which resulted in a decrease of energy use this year.

Warmer temperatures in Des Moines, Iowa (our headquarters) over the winter also contributed to less electricity and natural gas use.

On average, since 2019 we’ve reduced global GHG emissions 11.5% each year, exceeding the annual reduction glide path target of 4.3%.

We exceeded our 2023 target of a 17.3% reduction against our 2019 baseline with a 46% reduction in scope 1 and scope 2 market-based emissions.

46% reduction in scope 1 and scope 2 market-based emissions since 2019

Principal maintained “Management” status for environmental stewardship from CDP, after receiving a B rating on our 2023 CDP Climate Change Questionnaire, based on 2022 data. CDP classifies “Management” status as taking coordinated action on climate issues.

Our B rating is higher than the global average (C), North American regional average (C), and consistent with the Financial Services sector average (B). We plan to complete the 2024 CDP Climate Change Questionnaire for 2023 data in Q3 2024.

Scope 3 GHG emissions2

We measure and report our scope 3 GHG emissions from purchased goods and services, fuel and energy-related activities (not included in scope 1 or 2), waste generated in operations, business travel, employee commuting, upstream leased assets, and downstream leased assets.

Our climate action plans require the involvement of all our global operations. In 2023, we initiated our search for a new tool to advance our capabilities and gain information from our suppliers on their environmental performance. Across the organization, these improvements will help us better understand our scope 3 emissions. While there are still gaps in the data available to us, we are proud of the progress we have made.

What’s next

In 2024, we remain focused on gaining more transparency into our scope 3 emissions as more data becomes available. This will enable improved strategic planning and reporting and allow us to continue to mature our climate transition strategy. Specifically, we are focusing on specific scope 3 categories including our purchased goods and services, business travel, employee commuting, leased assets, and investments.

To learn more, read the Principal Financial Group 2023 Sustainability Report.

12023 data will be verified in Q3 2024, and final figures disclosed in the 2024 CDP. MTCO2e are rounded to the nearest whole number.

2Scope 3 GHG emissions data for FY2022 can be found in the 2023 CDP. 2023 values will be verified in Q2 2024, and final figures will be disclosed in the 2024 CDP.

Insurance products issued by Principal National Life Insurance Co (except in NY) and Principal Life Insurance Company®. Plan administrative services offered by Principal Life. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities offered through Principal Securities, Inc., member SIPC and/or independent broker/dealers. Referenced companies are members of the Principal Financial Group®, Des Moines, IA 50392.

3729265-082024