Sustainability Ratings - Driven by Number of Sources?

As previously seen on the CSRHub blog.

By Bahar Gidwani

Some sustainability experts have speculated that the consensus ratings for an entity are driven partly by how many sources rate it. In other words, the more that an entity reveals, shares, and collaborates with those who judge its sustainability, the more positively these sources will rate the entity.

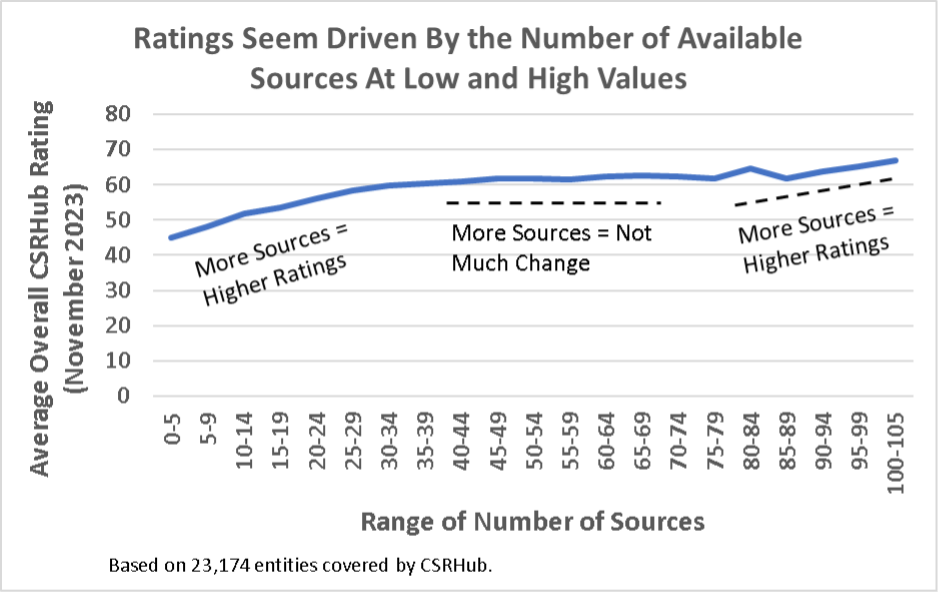

This theory seems reasonable. As you can see below, CSRHub’s consensus ratings data broadly support this theory.

See graph measuring ratings by number of sources at low and high values.

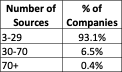

The chart shows a positive connection for entities that have between 1 and around 30 sources. Then, there seems to be little additional benefit until we reach 70+ sources. There are relatively few entities that have 30 or more sources. So, the connection between ratings and source number is valid for the more than 90% of the entities we track that have fewer than 30 sources.

See table measuring number of sources and percentage of companies.

Why would there be a flat zone above 30 sources? We suspect it is because companies with many sources are well enough known and studied that adding more information doesn’t change how they are viewed. Why is there a further rise above 70 sources? There may be a few “premier” names who get excess attention—everyone wants to track and follow them.

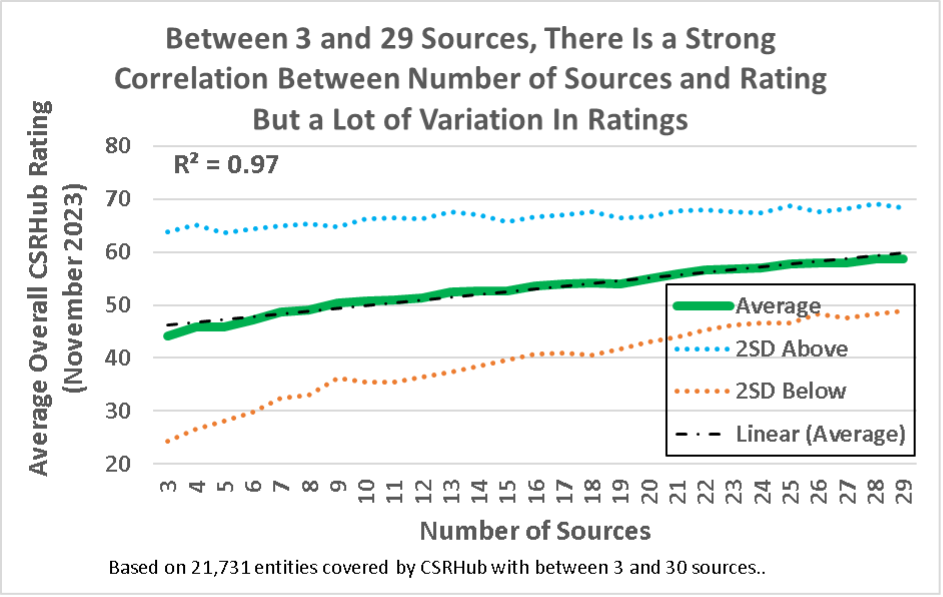

What about the core group with between 3 and 29 sources. Are their ratings driven by the number of sources who track them? When we focus on entities in this range, there is a strong correlation between average ratings and sources. However, there is also a huge variation in the possible rating that an entity may have. As you can see below, 95% of the ratings for an entity with 10 sources are between 35 and 65. 95% of those with 15 sources are between 40 and 65. Even at the top end of the number of source range, there are entities within two standard deviations of the average who are rated below 50 (below average).

See graph measuring correlation and variation between 3 and 29 sources.

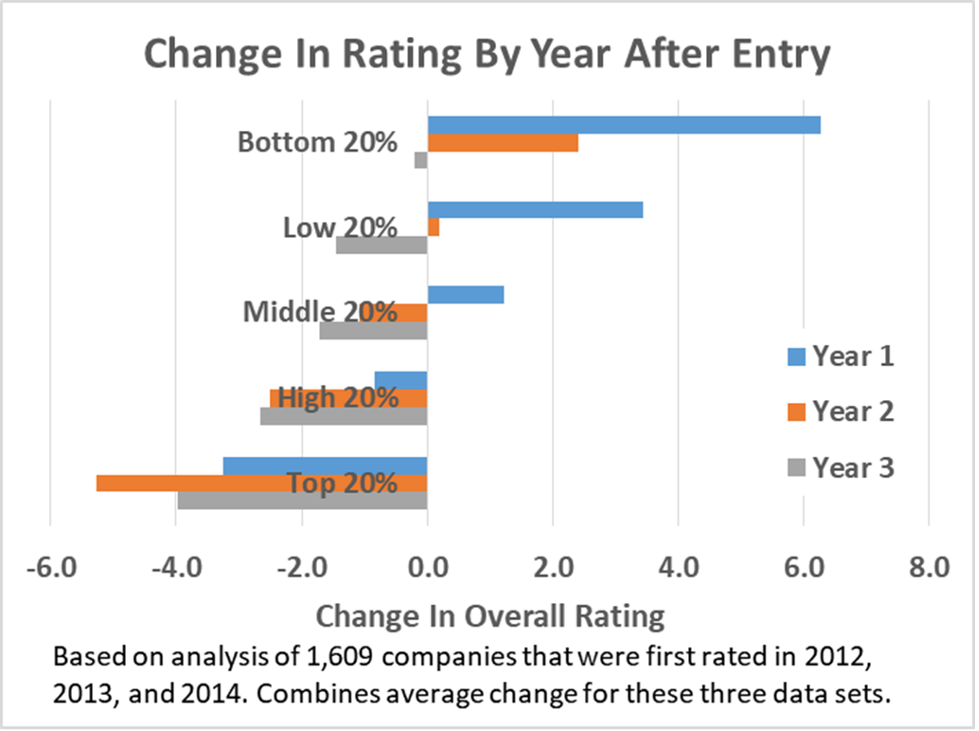

The general rise in ratings as an entity gains sources may not be driven by a true improvement in its performance. We previously showed (in a paper published in The Journal of Investing) that entities begin their rating journey with either high or low scores. After entering at the top or bottom of the ratings regime, their scores then “regress” towards the middle.

See graph measuring change in rating by year after entry.

Our explanation for this was that these new companies gained sources rapidly—in particular at the top. This table documents this phenomenon.

See table measuring increasing in number of company sources over time.

Those who rely on ratings (for benchmarking, supply chain, marketing, regulatory, or investment purposes) need to understand that there are systemic issues that may drive them up or down over time. How many sources are interested in an entity and when it began its ratings journey are two of these drivers. The true performance (and changes in performance) of an entity are another driver. We will continue looking for other non-performance-related factors as we seek to improve understanding of ESG ratings and how they change.

Bahar Gidwani is CTO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

About CSRHub

CSRHub offers the most comprehensive global set of Consensus ESG (Environmental, Social, and Governance) ratings, information, and tools. CSRHub’s business intelligence system measures the ESG business impact that drives corporate and investor sustainability decisions. Founded in 2007, CSRHub covers 55,000 public and private companies, and provides ESG performance scores on over 35,000 companies from 135 industries in 210 countries. Our Big Data platform uses algorithms to aggregate, normalize and weight ESG metrics from 933 sources to produce a strong consensus signal on corporate sustainability performance.