T. Rowe Price: Parents Putting on a Financial Façade Are More Reluctant to Discuss Money With Their Kids

Twelfth annual Parents, Kids & Money Survey found that parents who try to “keep up with the Joneses” are more likely to use retirement savings to cover holiday spending

News

T. Rowe Price’s 12th annual Parents, Kids & Money Survey, which sampled more than 2,000 parents of 8- to 14-year-olds and their kids, revealed that families who try to “keep up with the Joneses” are more reluctant (62% vs. 30%) to have money conversations with their kids and more likely to have risky financial behaviors and habits. Overall, many parents reported having some reluctance discussing financial topics with their kids (41%).

“Discussing money with kids is particularly important in the midst of the coronavirus pandemic, when many families have been affected—from smaller consequences like a canceled vacation to a parent who has lost a job,” says Roger Young, CFP®, a senior financial planner at T. Rowe Price. “While parents may question their ability to teach money topics, they can take comfort that there are resources available to help them. Parents who put on a financial façade could especially benefit from these resources, as we see an increased reluctance among them to discuss money with their kids.”

To help parents discuss money with their kids, the firm created MoneyConfidentKids.com, which provides free online games for kids; tips for parents that are focused on financial concepts, such as goal setting, spending versus saving, inflation, asset allocation, and investment diversification; and classroom lessons for educators. The site also includes a newly created student workbook and teaching guide, in partnership with Scholastic, designed to make money concepts more accessible and relatable to life’s milestones.

Putting Up a Financial Façade

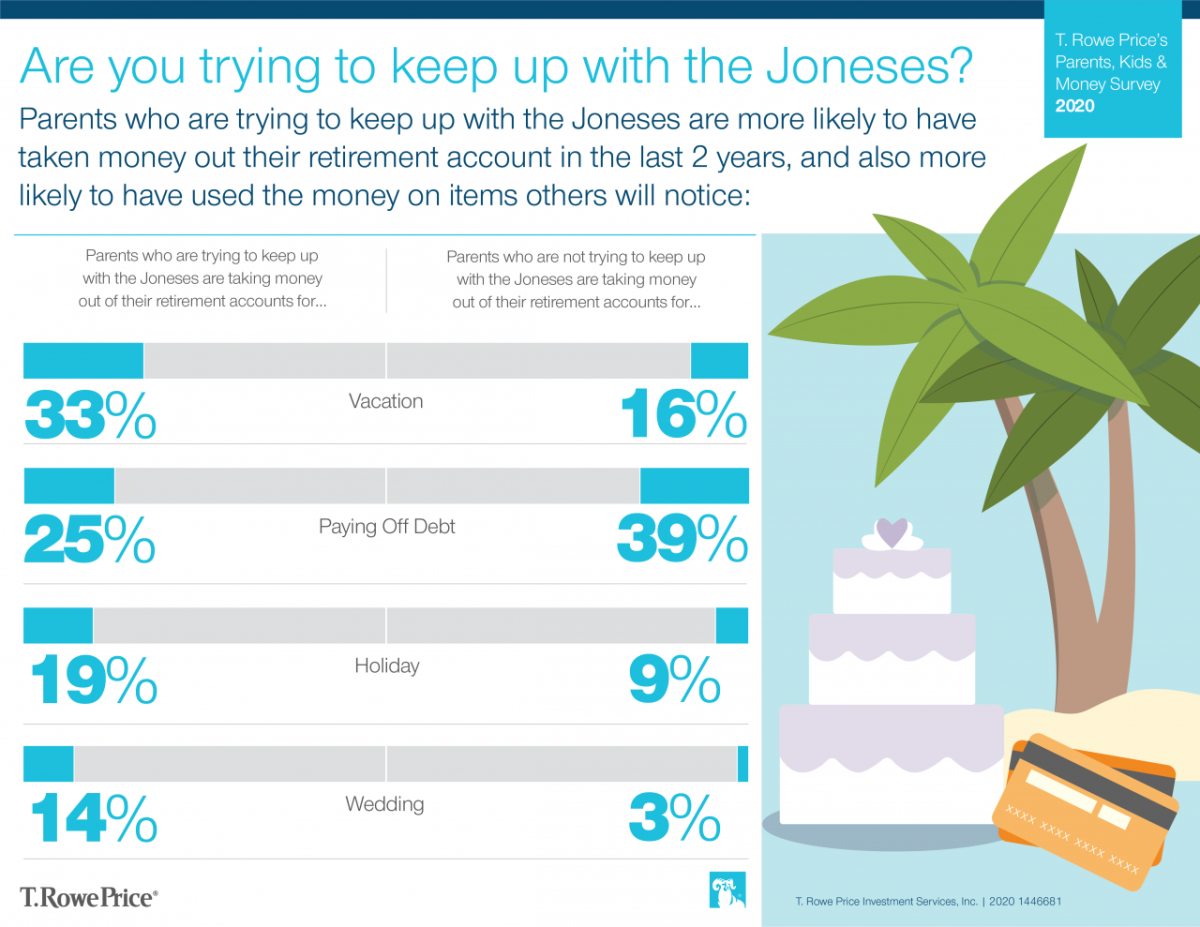

- Keeping up with the Joneses: Thirty-five percent of parents surveyed said they are always trying to “keep up with the Joneses.” Of those, 53% said they hide purchases from their spouses, 60% have a budget but rarely follow it, 59% rely on credit cards to cover monthly expenses, and 72% live paycheck to paycheck.

- More likely to pull from retirement and college savings: Those who try to keep up with the Joneses were three times more likely to have taken money from their retirement savings at least twice during the past two years. They are also five times as likely to have taken money out of their college savings for noneducational purposes at least twice in the past two years.

- Holiday spending more likely to prompt retirement savings withdrawals: Those who try to keep up with the Joneses were twice as likely to cite holiday spending as their reason for withdrawing money from their retirement savings (19% vs. 9%).

- Twice as likely to think about or declare bankruptcy: Parents who try to keep up with the Joneses were two times as likely to consider (16%) or declare (22%) bankruptcy compared with parents who don’t want to keep up with the Joneses (8% and 11%, respectively).

- They are more concerned about financial security: Those who try to keep up with the Joneses were more worried about financial security than their counterparts due to educational costs (54% vs. 44%), health care costs (47% vs. 36%), the political environment (44% vs. 32%), natural disasters (42% vs. 23%), and lack of financial knowledge (40% vs. 20%).

- More reluctant to discuss money matters with their kids: More parents who try to keep up with the Joneses are at least somewhat more reluctant than their counterparts (62% vs. 30%) to discuss financial topics with their kids.

- Kids follow their parents’ spending examples: Seventy-one percent of parents who try to keep up with the Joneses said their kids usually spend most of their allowance right away compared with 40% of their counterparts.

- Kids and credit cards: A minority of parents of 8- to 14-year-olds indicated that their kids have credit cards (9%). Parents who try to keep up with the Joneses are more than four times as likely to have kids with credit cards than their counterparts (27% vs. 6%).

Conversations with Kids

- Parents see the value of money conversations but have some reluctance to discuss money: Although the majority of parents surveyed agree that it’s important to have discussions with their kids about saving money and spending money (85%), setting financial goals (80%), and family finances (50%) and they agree that such discussions make a difference (60%), many respondents (41%) said they have some reluctance to discuss money matters, and only 22% of parents follow T. Rowe Price’s recommendation to discuss money matters at least weekly.

- Some parents aren’t confident or comfortable talking to their kids: Fifty-three percent of parents expect their kids to bring up the topic of money if they have questions or want to learn. Forty percent of parents said they don’t always know the best way to talk to their kids about financial topics, and 38% agreed that they have a hard time making their kids understand the value of a dollar.

- Teaching kids about money is the number one reason parents give them credit cards: Of the 9% of parents who have given their kids a credit card, 52% of them say it’s to help their kids learn about money, 50% say they prefer that their kids carry credit cards over cash, 46% say it’s because their friends have them, and 18% say it’s for emergency situations only.

- Parents think schools should play a role: Forty percent of parents agreed that they would rather have their child take a finance class versus teaching them themselves. Sixty-six percent of parents said they wished they had received more financial education in school.

MONEY CONFIDENT KIDS is a registered trademark of T. Rowe Price Group, Inc.

About the Survey

The 12th annual T. Rowe Price Parents, Kids & Money Survey, conducted by Dynata, aimed to understand the basic financial knowledge, attitudes, and behaviors of both parents of kids ages 8 to 14 and their kids ages 8 to 14. The survey was fielded from January 6, 2020, through January 20, 2020, with a sample size of 2,030 parents and 2,030 kids ages 8 to 14. The margin of error is +/-2.1 percentage points. All statistical testing done among subgroups is conducted at the 95% confidence level. Reporting includes only findings that are statistically significant at this level.

About T. Rowe Price

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. (NASDAQ-GS: TROW), is a global investment management organization with $1.42 trillion in assets under management as of November 30, 2020. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price’s disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com or our Twitter, YouTube, LinkedIn, Instagram, and Facebook sites.

Contact Us

Heather McDonold

T. Rowe Price

443-834-4132

heather_mcdonold@troweprice.com

Monique Bosco

T. Rowe Price

410-345-5740

Monique.Bosco@troweprice.com