For Utilities, the Road Map to Resilience Must Be Focused, Holistic

With greater technological dependency comes greater responsibiilty

As climate change continues to flex its catastrophic muscle, a storm is brewing for U.S. utilities. The scourge of extreme weather events — prolonged droughts, pounding hurricanes and deluges blamed for unprecedented flooding — are joining wildfires as challenges that have utilities scrambling to harden their assets to provide the resilience that consumers and regulators demand. Unrelenting threats of cyberattacks and the rising number of technologies that increase the load and strain on infrastructure assets add to the complexity.

Download the ReportThese calls to prepare for climate change and build resilience against extreme weather events and the multitude of other daily events in today’s utility world are stretching already thin budgets. But utility industry leaders in the U.S. and abroad are innovating at an unprecedented pace, reinventing how technology is used to solve the challenges.

Power and water providers increasingly are dedicating themselves to rooting out their assets’ biggest vulnerabilities, embracing

their data’s immense value by mining and translating it, strategically using third-party communications carriers and strengthening assets with moves that ultimately make operations more cost-effective and sustainable. They’re also doing it because it’s simply good for business, assuring ratepayers that they can count on their utilities to serve as diligent stewards of the responsibilities placed upon them – and who respond in economically, environmentally and socially responsible ways.

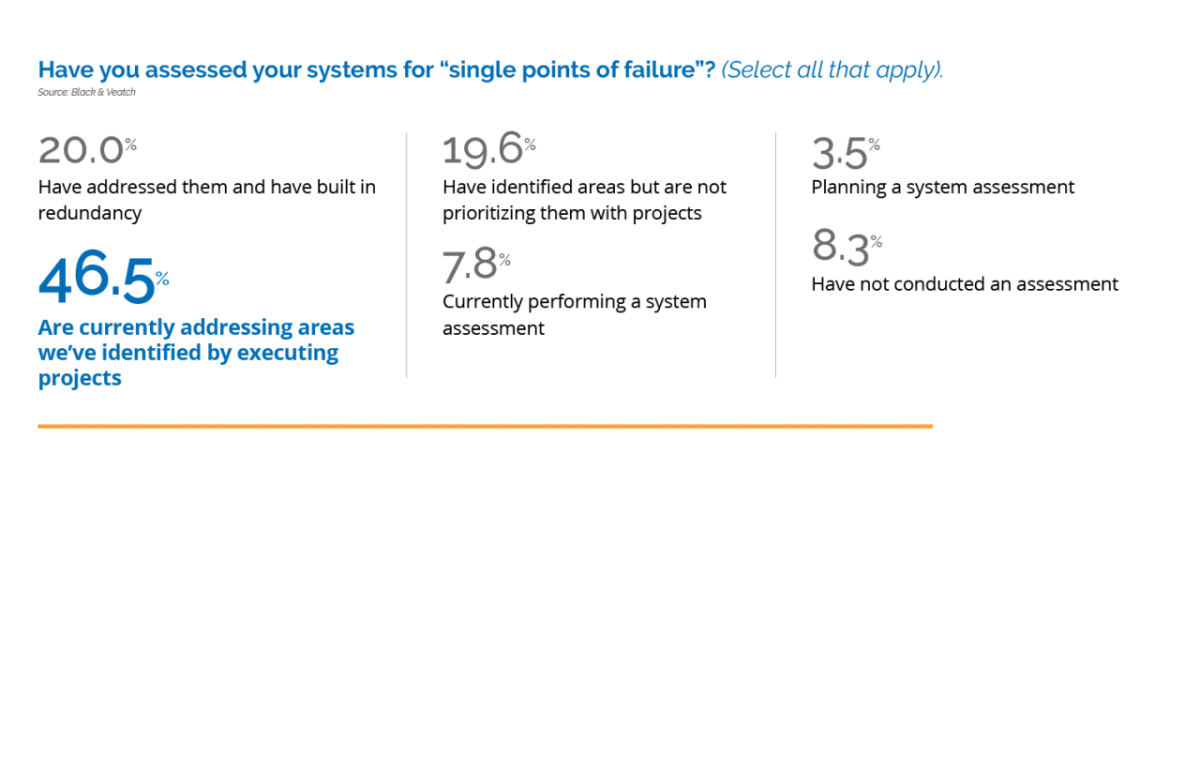

Data from Black & Veatch’s 2020 Strategic Directions: Smart Utilities Report survey shows that stakeholders are doing the necessary self-assessments despite their reputations for being slow-moving and conservative, scoping out potential “single points of failure” that could trigger cascading events. Nearly half (47 percent) of respondents say they are addressing issues they’ve identified, while an additional 20 percent say they’ve already mitigated those concerns and built-in redundancies.

Still, sleuthing problematic vulnerabilities — methods such as hiring experts to test a system’s defenses — should be part of a holistic examination of operations, including consultation with infrastructure experts. Utilities always must be mindful that the greater the technological dependency, the more incumbent it is upon operators to know both how to scuttle trouble and to respond properly when those bad things happen.

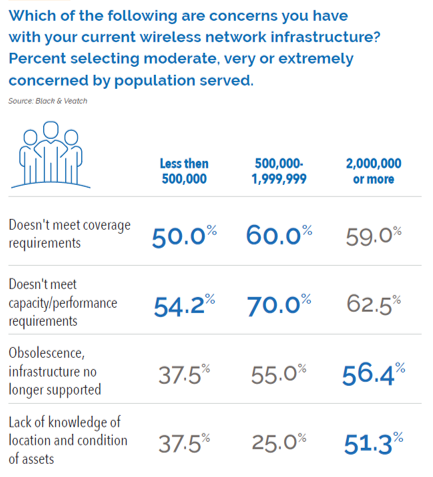

The key is to keep current with technology and to get over the mindset that if it isn’t broke, don’t fix it. This is increasingly important as microprocessor-based technology is widely deployed in infrastructure, bringing a pace of technological change evolving at light speed in comparison to incumbent systems that had been state of the art since the evolution of critical infrastructure. The survey makes clear that utilities have serious worries about shortcomings with their wireless technology. Even as the dawn of 5G approaches — and utilities and enterprises alike ponder ways to maximize that — roughly four of every 10 respondents cast themselves as extremely or very concerned about or performance. One-quarter offered similar assessments over whether their wireless systems meet their coverage requirements.

Still, the majority deems itself in a spectrum from moderately concerned to not concerned, perhaps reflecting their comfort with 3G or even 4G technology. Results were similar according to population served. The trouble lies when that technology fades away, and investments are needed to ramp up to 5G.

With the cavalcade of data mined by utilities — and increasingly used to inform their decisions — it makes sense that they welcome outside help to warehouse it, confidently relying on the cloud to spare the expense of buying enough servers as repositories. Put more simply, it just makes it all more manageable.

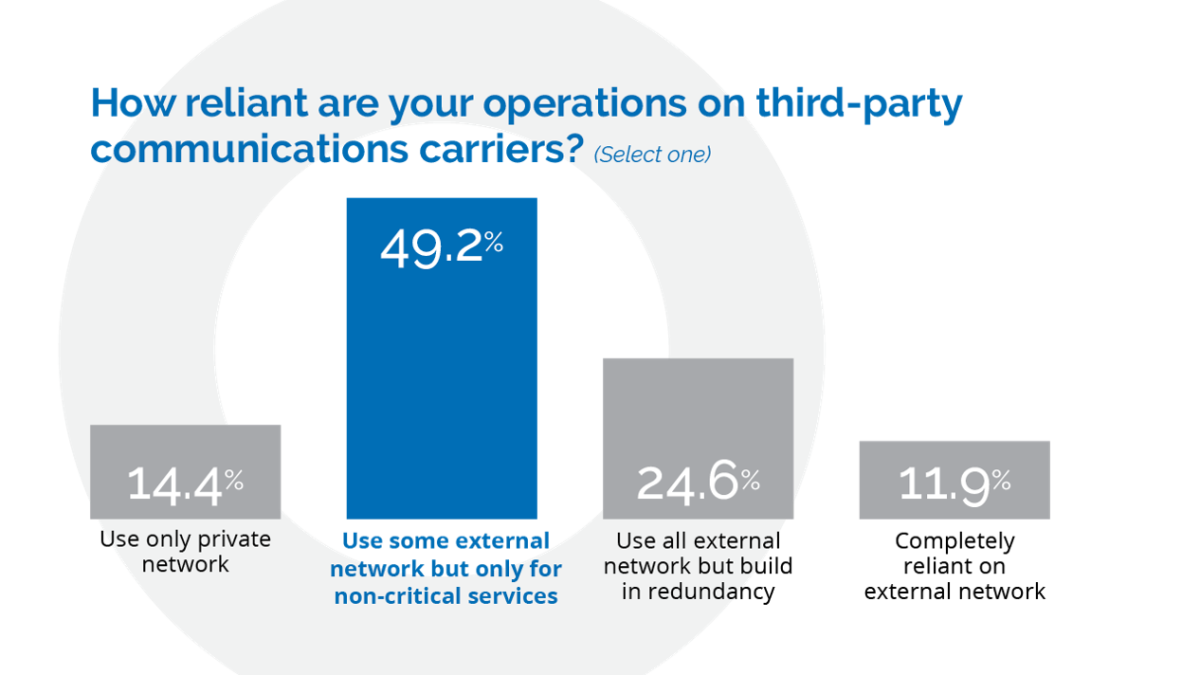

Utilities are being strategic with how much they lean on third-party communications carriers. Just half of the survey’s respondents report that they only use an external network for non-critical services, while one-quarter use them but have redundancies.

Offloading things onto third-party carriers isn’t a trend likely to fade out any time soon for non-critical data. For critical applications, however, utilities continue to see advantages to managing a private network to ensure security and to eliminate prohibitive costs with leasing communication infrastructure to support critical business elements. This infrastructure choice may evolve as communication needs to be extended further into the distribution infrastructure as smart grid applications penetrate the marketplace.