Water Utilities Urged to Exploit Data, Use Less Guesswork

Data is driving the discussion in the water industry

In the water industry, data is driving the discussion. To understand what this means requires a story about motor oil.

For decades, car manufacturers recommended that vehicles have their engine oil changed at least every 3,000 miles without fail. This was never proven practical, given that such decisions should be based on individual driving style, the conditions and climate – even the type of oil used. But these real-world conditions don't tend to factor into the carmaker's original guidelines.

Download the full 2019 Water Report

Similarly, data is changing the game in the infrastructure space, giving operators better oversight of their assets without needing to religiously follow the manufacturer's maintenance bible. Digital information, exchange at staggering rates, often is actionable and predictive, foretelling when to replace or rehab equipment even well before the manual suggested.

in the water industry, data is taking on an ever more muscular role as what The Economist has called "the world's most valuable resource." This resource, among so many other things, helps utilities validate investments and demonstrate return on investment.

This also raises the question: Is data being prized as it should, as something abundant and valuable, but all too often relegated to silos? The industry, for the most part, believes it is. Wireless sensors continue to improve and become more affordable, and they can be placed anywhere to measure virtually anything. Budgets have grown tighter, squeezing operators to get the most out of equipment and system that often have surpassed or are nearing their life expectancies.

There's still more work to be done on optimizing digitization. And that begins with the need for an asset management blueprint.

Asset Management Programs Grab Attention

More than half the respondents to Black & Veatch's annual survey of water industry leaders say they have adopted an asset management program (AMP), while a little more than one-third say they're in the process of doing so. But the devil is in those details. Are utilities that report having an AMP saying they have a document that lists how assets are viewed from a financial standpoint? Or is it duly comprehensive, collecting all available information about the history, longevity and the value of each asset? More about data, less about process and procedure?

Fifty-seven percent of respondents said their data management strategy is strong and getting better, though it's still not fully integrated, making it difficult to understand what's occurring collectively across systems. One-third said their data still is siloed and unintegrated.

At the same time, the quality of data collected remains largely favorable. More than half of respondents cast their asset data as good, meaning most of what's collected is correct. One-third declares its data very good, almost always spot on. Only 3 percent trust that all its data is right.

More Data, Less Guesswork or "Tribal Knowledge"

When it comes to helping decide when to replace assets, nine of every 10 respondents say they employ a risk-based approach at different levels. More than 40 percent say they use factors such as the likelihood or consequence of failure to plan investment in new equipment. Twenty-eight percent said they defer to the skill and experiences of operators and technicians, suggesting more of a "tribal knowledge" approach rather than a decision that is based on technology.

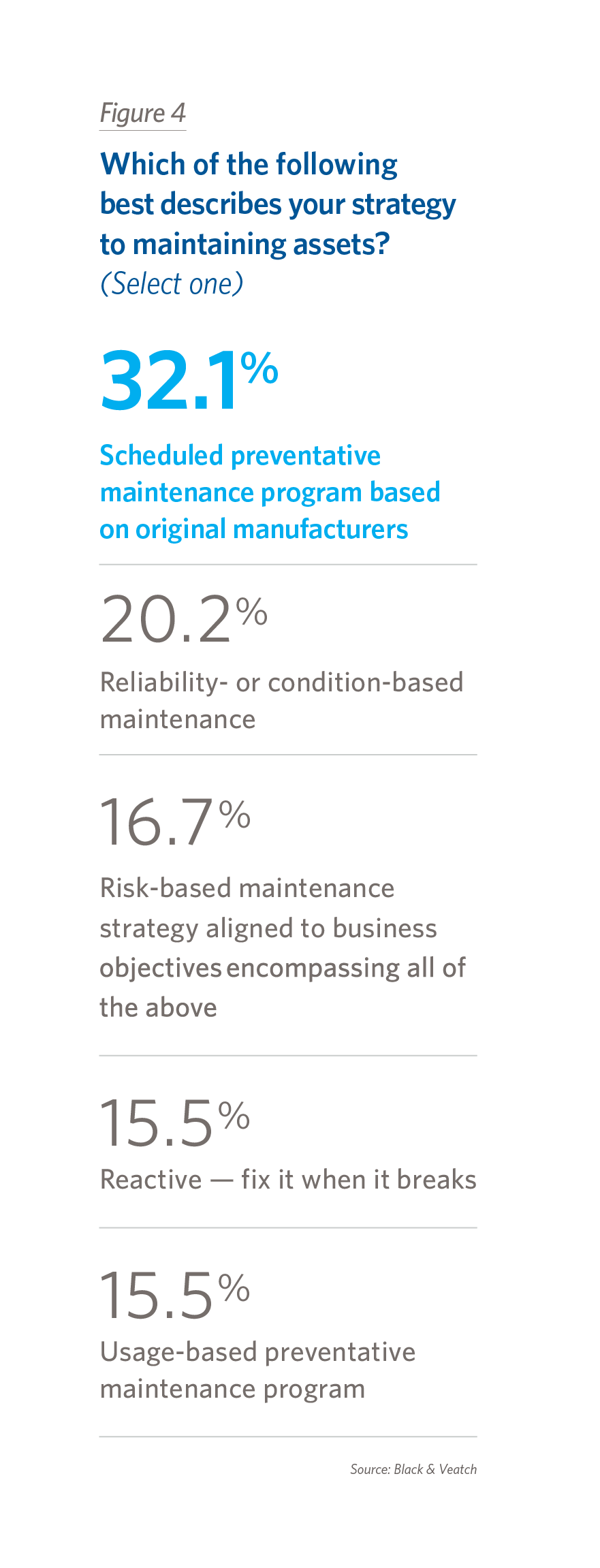

On the maintenance front, the oil-change analogy and the owner's manuals come back into play. Roughly one-third of respondents scheduled preventive maintenance according to the original manufacturer's recommendations, or "doing it by the book." One of every five respondents lean on reliability or condition-based maintenance. Thirty percent follow the status quo, reactively fixing equipment when it breaks or repairing it based on usage.

Suggested upkeep of assets is based on how they were designed, built and tested, often in perfect conditions: 70 degrees, 50 percent relative humidity and a spotless, dust-free environment. Contrast that with pumps, boilers and other assets operating in real-world conditions, with data spitting out instantaneous details about how each is behaving. If the performance changes, sensors alert the operator, helping predict failure or over-extension.

Helping the cause is Asset360®, a cloud-based analytics platform by Black & Veatch subsidiary Atonix Digital. The tool gives clients a one-stop solution that employs analytics to help manage risk, plan capital and monitor system health. As the adage goes, you can't manage what you don't measure.